The markets have recently been enthralled with the fall of Gold and Silver as the metals seek to make lower lows. However, Silver is facing a squeeze play as a small double bottom forms on the 4-hourly chart that keen eyes are watching closely.

The Silver breakdown started in May and has been vicious for traders with a bullish bias, as prices are currently down over $3.00 an ounce. However, in comparison to Gold, the metal has provided some positive signs of late as a small double bottom and wedge pattern are seemingly forming. There is subsequently potential for a base to form at the $14.790 level that could yield some interesting trading opportunities.

Silver and Gold both exhibit very different fundamentals as Silver is correlated with industrial demand, and to a lesser extent, the equity markets. Silver is a key component of circuitry and, in particular, is heavily used in smart phone production. Subsequently, the metal retains a strong fundamental case for its industrial demand.

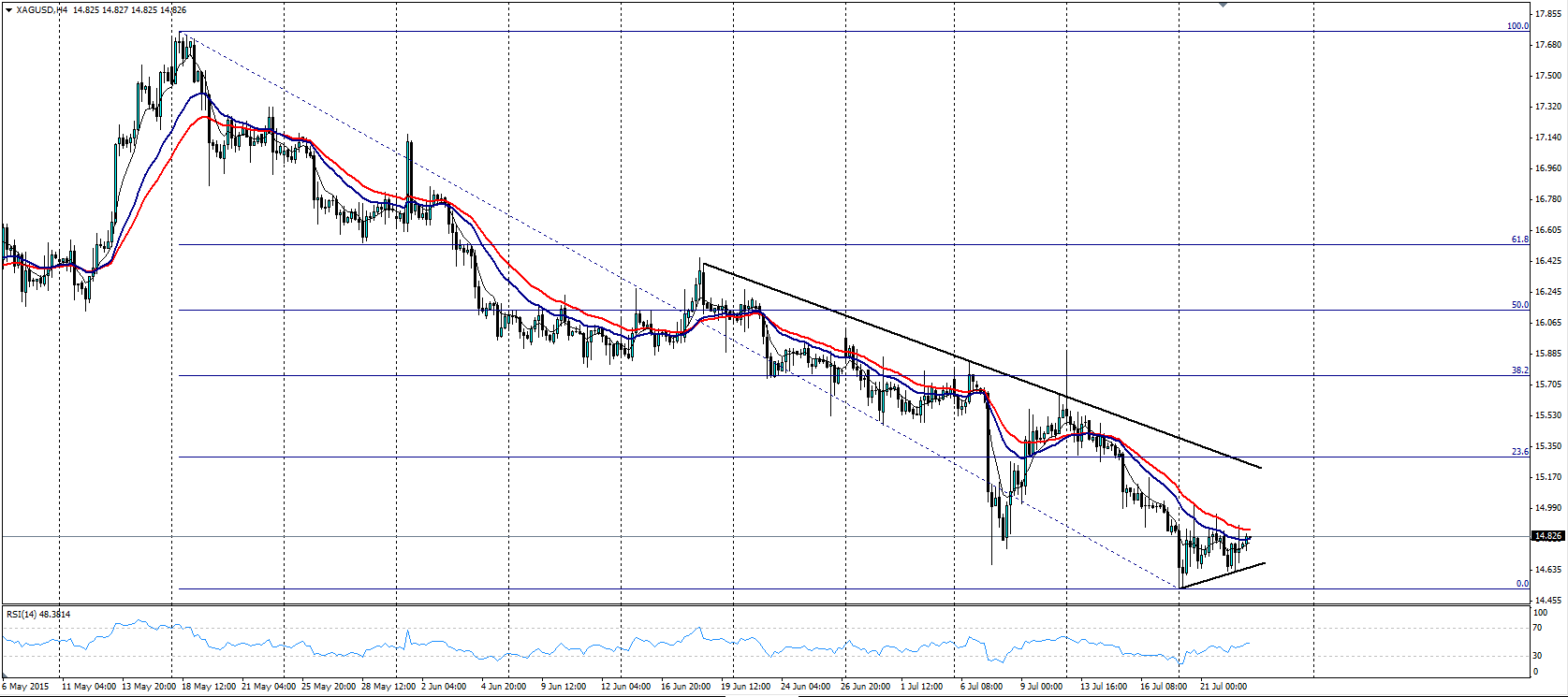

Taking a look at the technical aspects of Silver provides an interesting case for a retracement from its current depressed level. The 4-Hourly chart shows that a small double bottom has formed around the $14.60 level. Currently, the lows are becoming higher as a small wedge pattern has appeared from the months low. If this pattern holds, it is probable that a retracement back towards $15.20 will occur.

There has also been some divergence occurring on Silver’s chart as RSI trends higher, away from oversold territory, whilst price remains relatively flat. This gives some credence to the case for a short run retracement back towards the top of the bearish trend line. Along with the RSI oscillator, the moving averages are also turning as the 6EMA trends higher towards the 30EMA.

Overall, wedge patterns and divergence can be difficult to predict, ever more so when it is a counter trend position. However, given Silver’s recent strong falls and the underlying industrial demand for the metal, a long side bias towards $15.20 seems probable. Having said that, like everything in life keep your stops tight and your options open!

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.