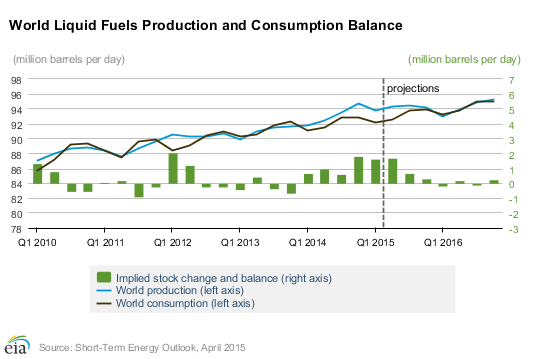

In a decision that is likely to strongly impact the U.S Shale Oil Industry, OPEC has decided to maintain their current level of crude oil production which will further strain the current supply imbalance. The move, primarily led by Saudi Arabia, is likely to put additional pressure on the fledging shale oil industry at a time when the sector has experienced substantial growth.

OPEC’s decision to maintain production despite a global decline in oil prices is a strategy aimed directly at the heart of growing US output. The current US oil shale boom was predicated on prices remaining above the key $65.00 level, but as prices have declined domestic producers have found their marginal revenue falling. Subsequently, there have been further rig stand-downs in the Permian and Bakken shale plays leading some to question whether the shale boom is effectively over.

However, increased efficiency and innovation within the industry is starting to see costs fall, with some sources reporting a 30% improvement in their costs/revenue/funding mix that is likely to see more efficient production. If WTI prices can base around the $60.00 a barrel level then we might just see production ramp up in a sign that the battle isn’t over just yet.

OPEC’s strategy has clearly been to encourage the significant supply imbalance in an attempt to damage the US domestic industry which explains the lack of production cuts over the past six months. However, any game theorist will tell you the law of unintended consequence rules when considering strategy and in this case, instead of encouraging a massive shuttering of production, it has led to additional investment in efficiency and lowering cost structures.

So it therefore begs the question…just how far is OPEC prepared to let the price decline, over the long term, before cutting production. The answer likely involves a question of political and financial will versus accepting a growing U.S domestic industry and at this stage OPEC is demonstrating plenty of will to continue the pain.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.