The fundamentals on crude are still rather bearish and should make $100 a barrel nothing but a pipe dream (if you’ll excuse the pun). But there is a potential for an upside trade on crude oil in the short term as a falling wedge suggests a bullish breakout may be on the cards.

There is still plenty of oil sloshing around the markets which is no secret, there is plenty of data to look at that will tell you this. The latest API figures show an inventory build at Cushing of 1.3m barrels, versus the expected -1.2m. Oil pushed to the lower end of the wedge as a result.

Further adding bearish pressure were US rig count figures which showed a drop of just a single rig. The recent rise in oil prices may have taken some pressure off producers on the borderline of closing. As always, watch for the Energy Information Administration crude inventory figures due later today as they will no doubt add volatility to the commodity.

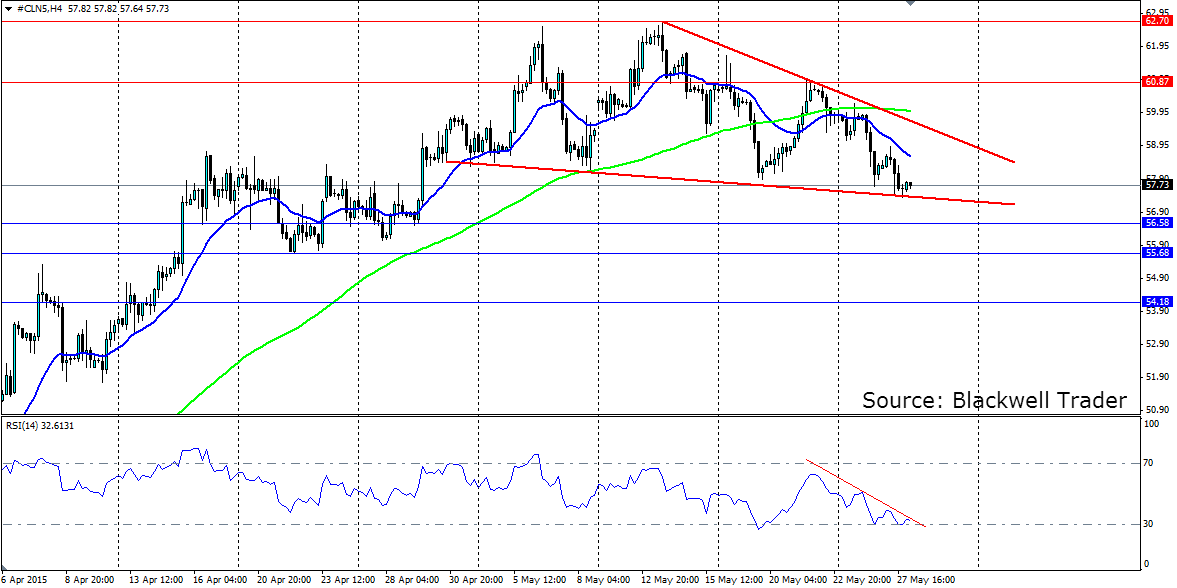

To technicals and we can see a squeeze occurring in the price of June WTI futures contracts, from the highs seen in Mid may, to the low found yesterday. The text book case of a falling or descending wedge during an uptrend is for a bullish breakout and a continuation of the uptrend. The RSI appears to support an upside push as it consolidates just above oversold.

If we take a bullish bias, look for a strong bounce off the bottom line of the wedge and further consolidation within it before a breakout upwards. A bullish breakout will see a continuation of the recent bullish trend which will certainly put the highs at $62.70 under pressure and could even stretch over the $64 a barrel mark, i.e. the width of the wedge. Firm resistance will be found at $60.87, the highs at $62.70 and further out at $65.98

Conversely, if fundamentals hold, we could see a bearish breakout that will invalidate the recent bullish trend. The recent double top pattern and the moving averages turning downwards would support a bearish bias. Support will be found at $56.58, $55.68 and $54.18.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.