It would appear that the past few weeks have been a gentle hibernation period for the gold bears. It generally isn’t until the season warms up that they pop out from their hiding places, to steal a few picnic baskets, and possibly bite Ranger Smith. Just like the cartoon character, Yogi Bear, real life gold bears are awakening from their slumber and looking for their next picnic basket haul to plunder.

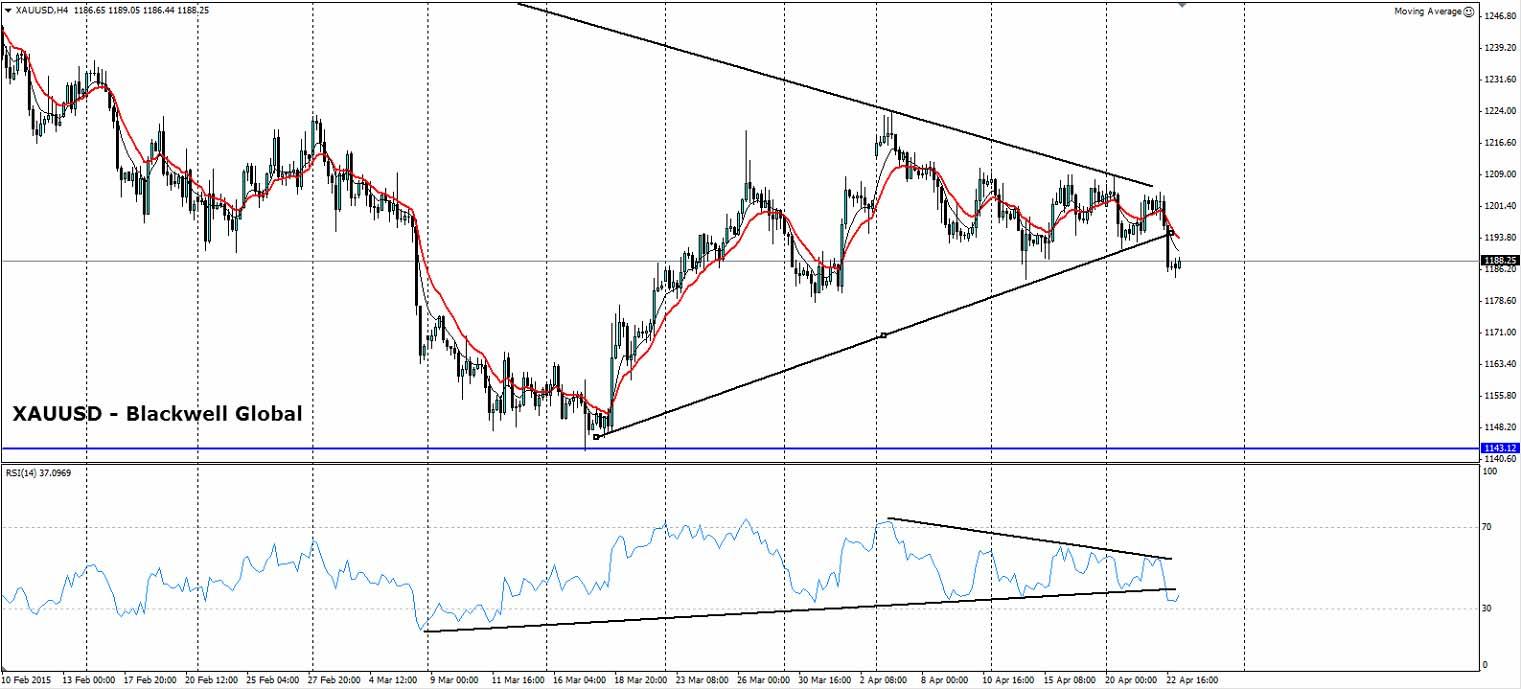

Gold has been consolidating over the past ten days with its price action constrained by a wedge pattern that is strongly evident on the H4 chart. Despite increased economic uncertainty, and geopolitical risk in Yemen, gold really hasn’t benefited from much in the way of a strong trend and continues to languish sideways looking for the break out point that is sure to come.

Just like a picnic basket that is full of scrumptious snacks that a bear can feast on, gold’s wedge pattern is just waiting to have its lid lifted and the contents gorged upon. The pressure is building and a downside break for gold is a real possibility as gold bears realise that little exists in the way of support until the $1,143.00 range.

Today represents gold’s first real test, on the downside, for over two weeks as price responded to bearish pressure and fell to $1,188.55. The moving averages tell the story with the 6EMA crossing over the 12EMA and both lines heading lower, as price found some support at $1,188.55. RSI remains in neutral territory despite breaking through its wedge pattern, but reveals a bearish trend. MACD reveals further bearish sentiment as it crosses below its signal and “0” line, indicating further downside action may be in play.

Ultimately, wedge breakouts are difficult to predict but the evidence suggests that gold is likely to be under bearish pressure in the coming days. The unknown variable is likely to be Greece in the coming weeks and whether the risk of a sovereign default causes capital to seek a safe harbour.

Finally, it leaves us with the question of whether you are Yogi Bear, seeking your next picnic basket caper, or the venerable Ranger Smith protecting vulnerable picnic goers. I know which camp I fall into…

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.