Oil has been jumping up and down on the charts, but has had a slightly bullish bias to it lately. The reason for that has been somewhat confusing for investors at present as there has been a surplus in the market, but not as much as some people had originally feared when it comes to the American market.

Last weeks 8.43M surplus for crude oil inventories was an increase on the previous month, but oil quickly bounced back within its range. The reason for this is the market is looking for larger surpluses at present to justify further drops. What we have seen regarding oil is that the surplus is stable and unlikely to increase, which in turn has led the market to rally back up to the 50 dollar mark in the short term.

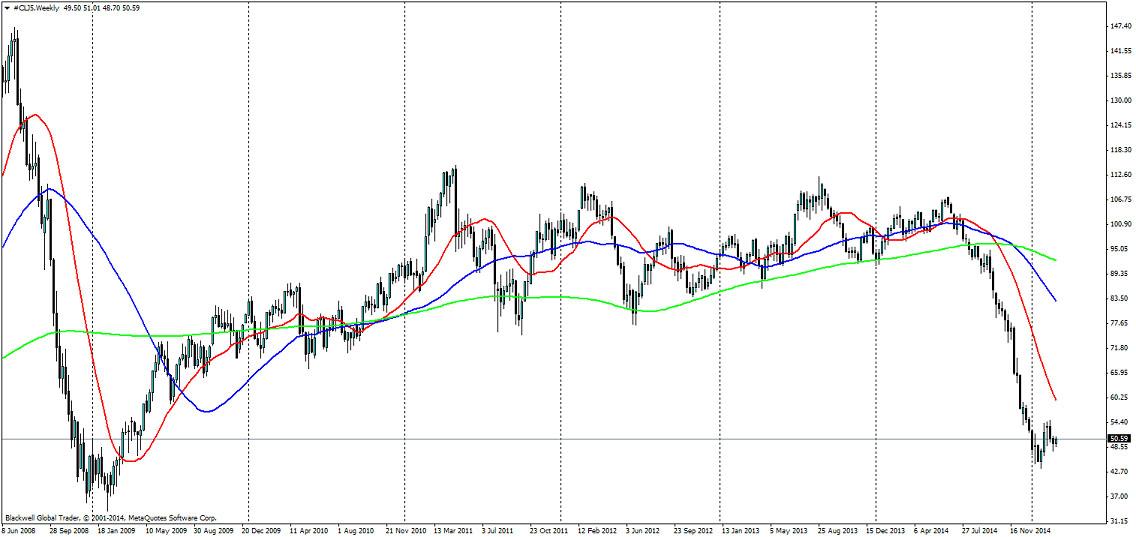

The market has thus far been looking for some sort of correction and it’s unlikely to get exactly that. What is more realistic after a sudden supply shock/demand drop is not a rush back to the norm, but a slow persistent grind back up the chart for oil prices in the long run.

As can be seen here we saw a sharp sell off in 2008 followed by strong buying over the course of the following year. This is what I feel is the most realistic scenario given the drop in capital expenditure in the oil market, which will reign in future supply in the medium to long term.

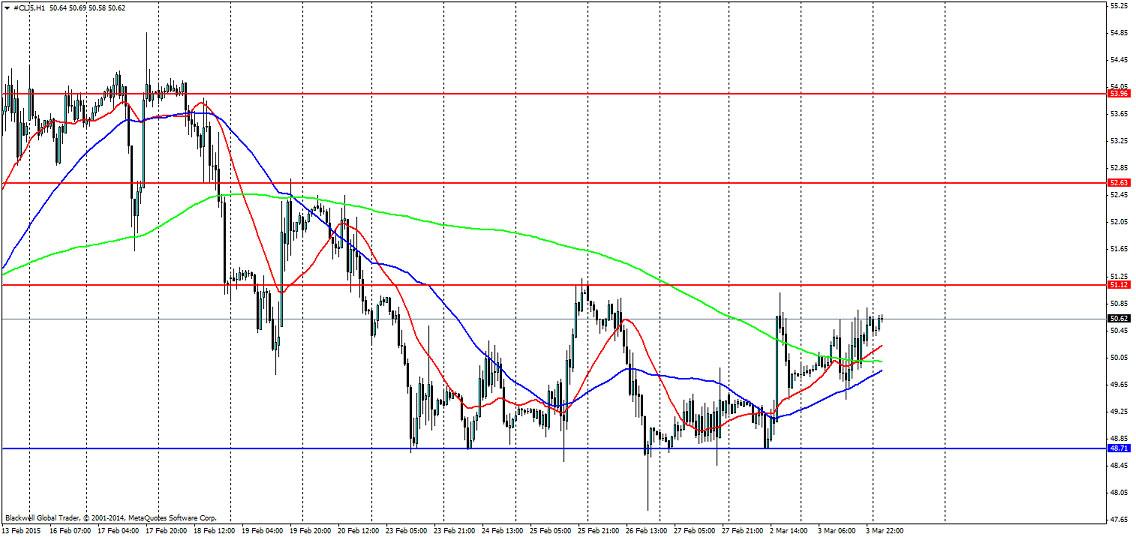

But the short term presents golden opportunities for swing trades and the many playing of key levels. Support is strong at 48.71 and it would take a large drop to change that suddenly, it’s likely that this level will remain for some time unless we see oil pushing over 12 million barrels in reports. Plays upwards are likely to find key resistance at certain levels 51.12, 52.63 and 53.96 are where oil will look to push to. A breakout of 51.12 should be seen as a strong bullish signal up to 52.63 where it will be a struggle between the markets and we could see a bounce of this level.

If we fail to see a push through 51.12 then a short here taking a few points is an applicable option and likely what most market players will be looking for.

Overall, oil has so far struggled to find direction and the American trading session has some very volatile candles which shows there is a battle going on out there. But the bulls are looking to take charge and the 51.12 level is the one to watch.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.