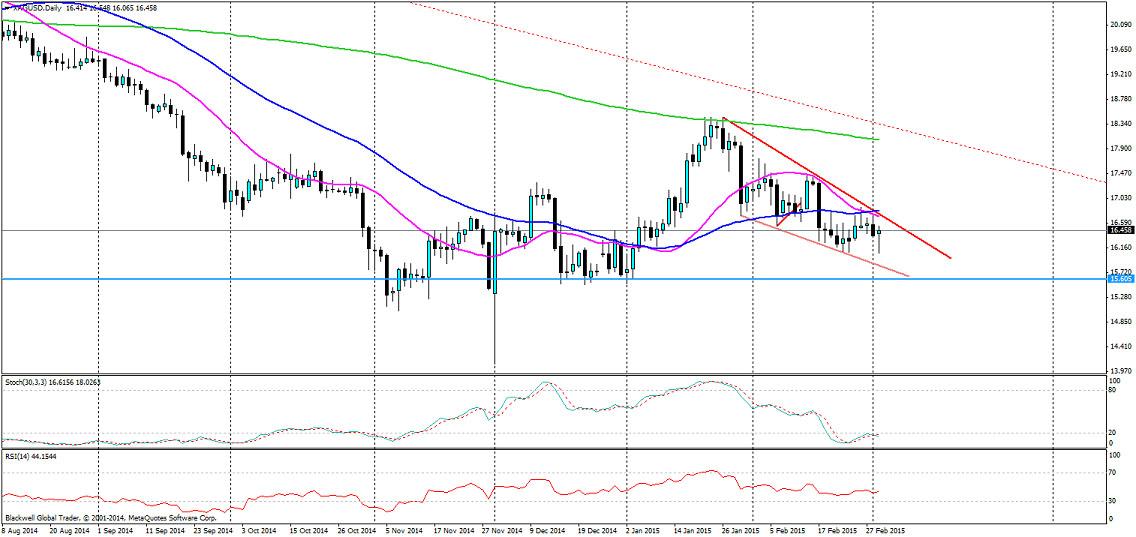

The silver wedge continues to tighten as markets look to shift into a lower gear and drop down the charts.

The question is how much further can we drop at present with the silver market looking very timid. Not much further I feel as currently we have seen a strong resistance patch at 15.065 and the market will most certainly be looking to play to this level at least.

What the market this week will be focused on is labour data and the build-up for FED action. The labour market has so far been quite positive, and as a result the market will be looking for driving points to get it lower. Each time we have the prospect of rate rises on the horizon in a talk we see silver shift lower and non-farm this week is expected to be 238K, a rather weak reading to previous ones, so there its certainly room for a large drop lower.

So with Yellen wanting to talk up the prospect of interest rate rises to the market, it’s inevitable that we will see lower lows in silver, at least down to the 15.065 level. But from a technical perspective, we have a solid wedge forming and we also have a golden cross forming as the 20 MA crosses through the 50 MA pointing to bearish sentiment picking up the pace.

Long term a descending wedge is a breakout pattern upwards, however, we have some more time to go before that is a reality and once we have a touch on the 15.065 level, there will be scope for a breakout higher for the silver market; just not right now while we continue to trend lower.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.