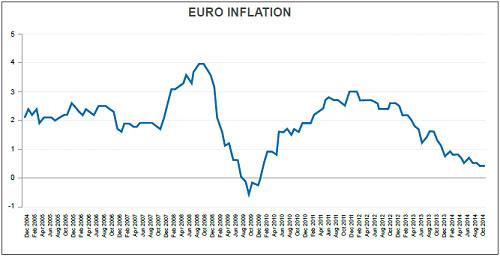

Low inflation continues to taunt the ECB despite some indicators picking up. The debate is now whether a QE programme is needed to boost inflation.

GROWTH EXPECTATIONS:

Eurozone GDP has ticked higher in the third quarter of 2014 but is still worryingly low at 0.2% q/q. This is an improvement on the 0.0% seen in the second quarter and puts annual growth at 0.8% higher than a year ago. France has led the way with 0.3% quarterly GDP growth, with Germany just registering in the positives at 0.1% q/q and Italy remaining in recession at -0.1% q/q.

The European Central Bank (ECB) has been watching these growth rates closely and the speculation is now rife that they will add further stimulus in the first quarter of 2015 to combat the low growth rates. Unemployment was steady throughout the quarter for the EU, remaining at 11.5%. The Spanish Unemployment rate has continued to make the most impressive moves falling from 24.5% to 23.7%.

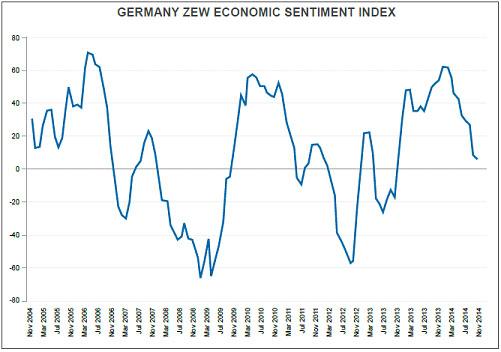

The ZEW economic sentiment reports gave the ECB great cause for hope in December as the German figure returned its biggest rise in two years. German economic sentiment rose from 11.5 to 34.9 and EU-wide economic sentiment rose from 11.0 to 31.8. This could be the proof the ECB is looking for to show that their stimulus packages are having the desired effect.

The PMI figures were more of a mixed bag than the economic sentiment reports. French manufacturing and services remain stubbornly rooted in contractive territory at 47.9 and 49.8 respectively. German Manufacturing dipped below 50 in October but managed to close the year in expansion at 51.2.

MONETARY POLICY:

During the quarter, the interest rate was held all three times at -0.20% for deposits and the refinancing rate at just 0.05%. There have been plenty of hints from ECB President Mario Draghi that a stimulus package in the form of Quantitative Easing (QE) is a distinct possibility. The market was not expecting a change in interest rates, however, many were expecting QE to be announced. The market now looks forward to it in early 2015, with the Euro suffering as a result of the speculation.

Stubbornly low Inflation has remained a problem for the ECB, which explains all the talk of further stimulus. Headline CPI for the EU is at just 0.3% y/y. This did tick up to 0.4% in October and November, but fell back in December. The positive for the ECB is that inflation looks to have bottomed out as the effects of the stimulus and the weaker Euro work its way through

FX OUTLOOK:

The Euro has performed more or less as expected over the quarter. Mario Draghi continued to talk down the Euro as he hinted at a QE programme that will see the ECB purchase government debt. The Euro found brief levels of support as the stimulus was not forthcoming, however, the likelihood of stimulus and the strength of the US economy has pushed the Euro below the 1.20 mark.

Looking forward to the first quarter of 2015 could be another bearish quarter for the EUR/USD pair. The strength in the US economy is likely to continue, and the US dollar will benefit from this and the prospects of the US FED raising interest rates. At the other end of the scale is the ECB looking to add more stimulus which should push the EURUSD pair further down.

EQUITY OUTLOOK:

The DAX has had a choppy ride during the final quarter of 2014. It briefly touched an all-time high on 5th December but could only manage two closes above the 10,000 point level before the absence of further stimulus and political turmoil in Greece pegged it back. The trouble in the Russian markets and a collapse of commodity prices saw volatility across the board. Volatility in European stock indices as well as global stock markets is a trend that is likely to continue into 2015 and diverging monetary policies looks set to be a major theme.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.