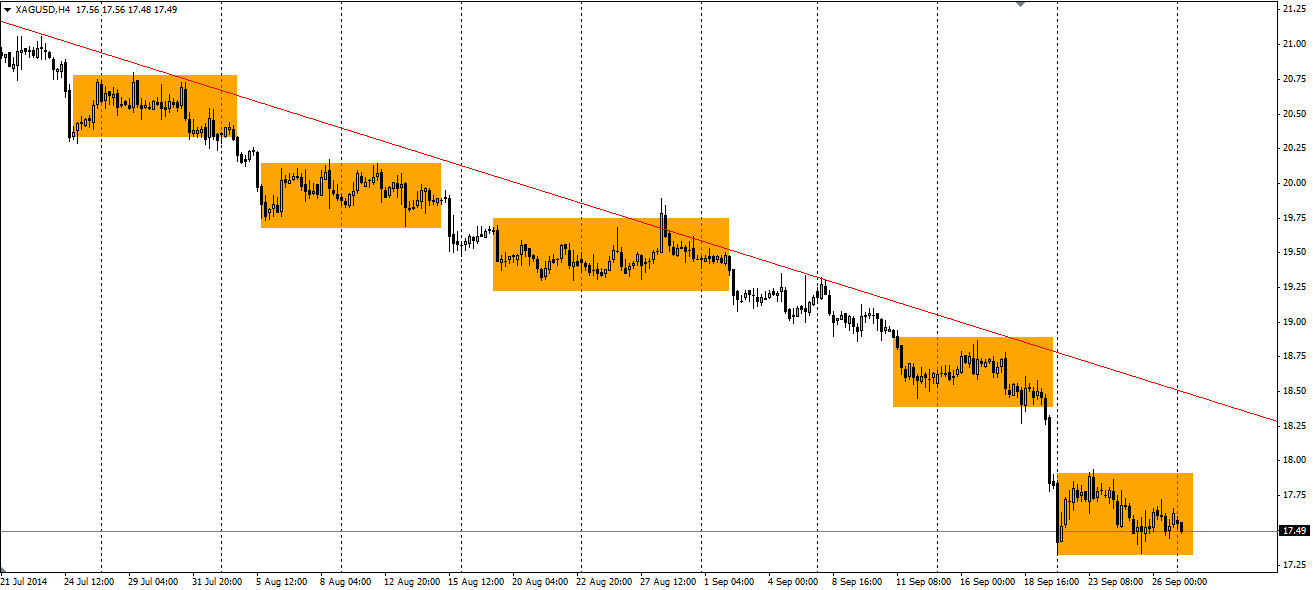

The silver markets make for interesting trading as they go through periods of price consolidation before we see large movements. It looks like we are seeing this pattern repeat itself currently.

Recently the big movements have been bearish, which has led to the formation of a bearish trend, while the consolidation patterns have allowed scalping traders to play the range. The strength in the US dollar and the prospect of tapering ending and interest rates rising has led to metals falling out of favour with investors. This can be seen in gold threatening the $1200 level and silver holding above $17 an ounce.

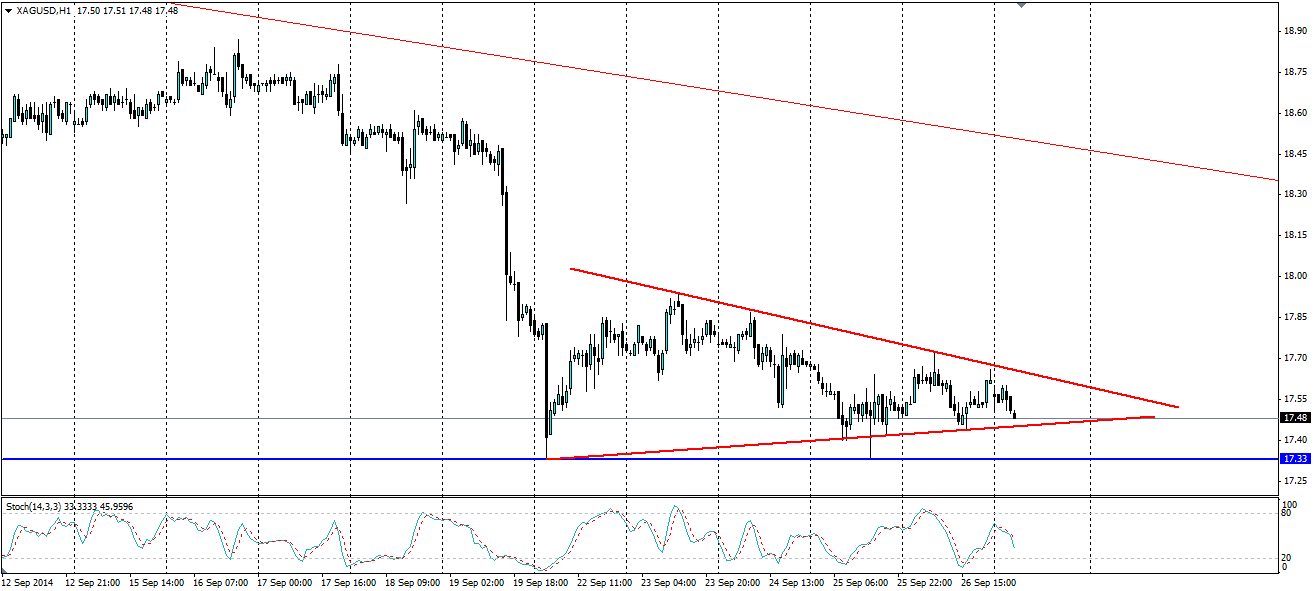

At the moment we have some consolidation in the price of silver between $17.93 and $17.33. The current shape is a pennant which is likely to lead to a bearish breakout around the low $17.40s region. This will be the first breakout as there is heavy support at $17.33, and if this breaks down it is possible we will see $16.50 as the next level of heavy support.

The price of silver has been consolidating in a scenario that has repeated itself as it trends down. Look for a breakout through $17.33 to take the price towards the mid-$16 range.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.