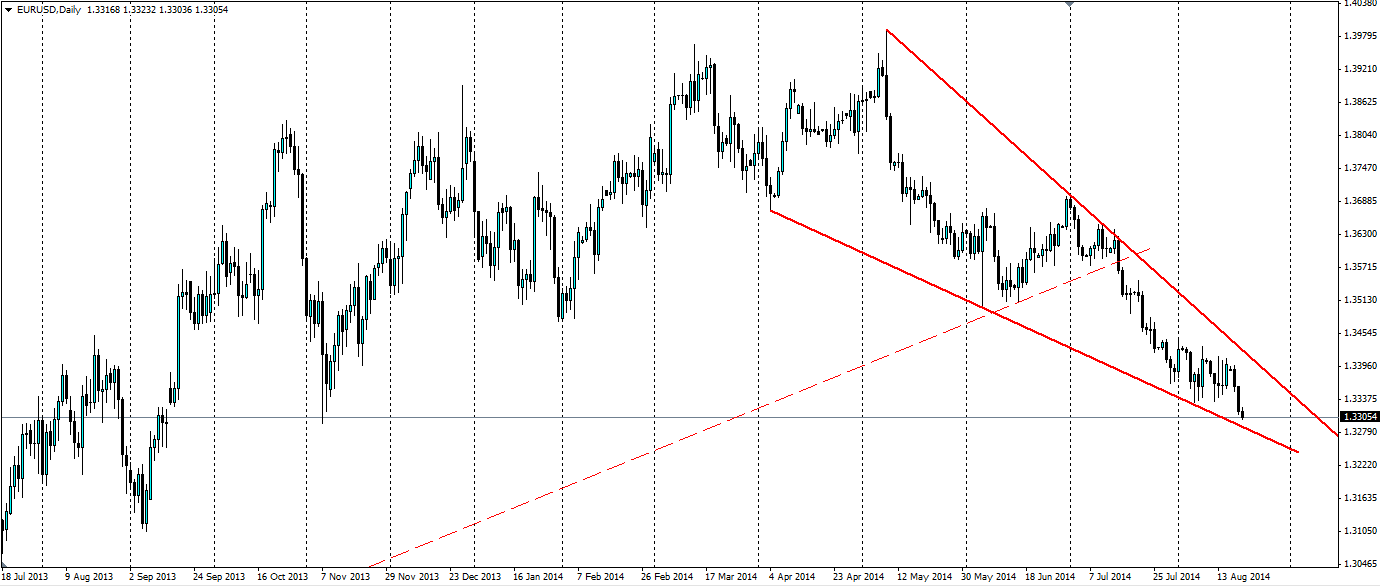

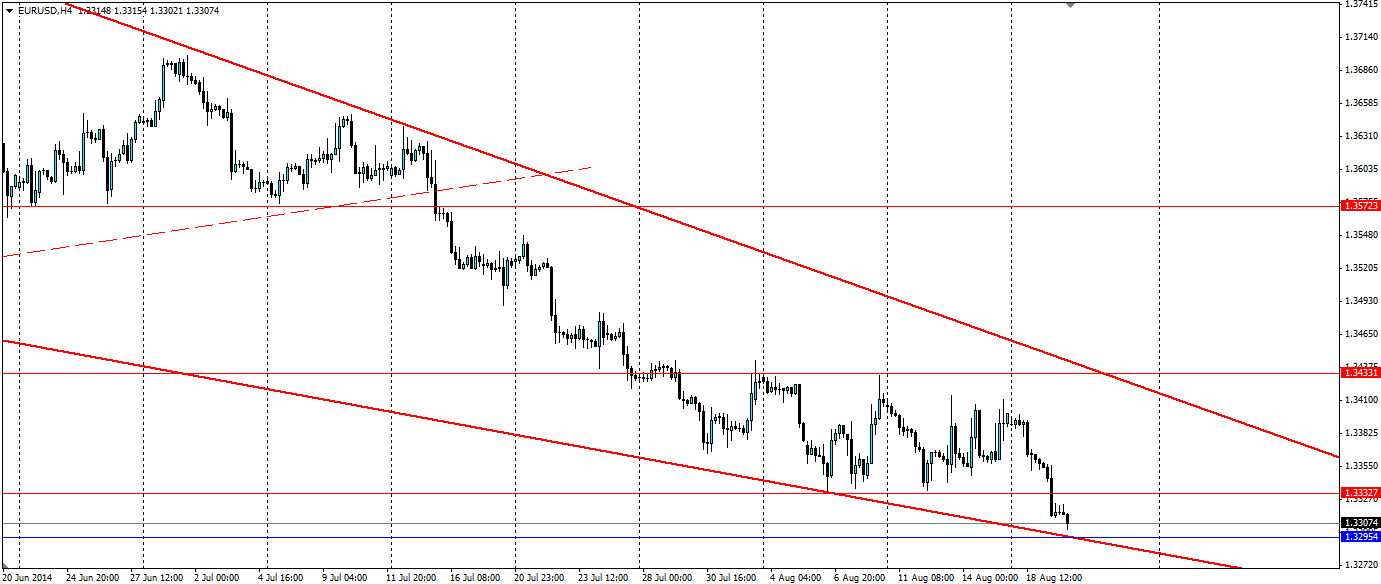

The Euro is stuck in a downward sloping wedge against the US dollar and it looks set to continue. We may see a test of the upper trend line at some stage, but on the whole it looks like we will see fresh one year lows.

The Euro has been plagued by a plethora of disappointing data and the threat of more stimulus is always present. This week has seen the Trade Balance come in at 13.8b, well below estimates of 15.0b and the ECB current account also disappointed the market with 13.1b, also short of estimates of 19.5b.

Last week saw economic sentiment in Germany fall to a level not seen since December 2012. The ZEW economic sentiment report for Germany saw a fall from 27.1 to 8.6, and the EU wide report was also a disappointment at 23.7, down from 48.1. Euro-zone CPI also gave cause for concern as it fell from 0.5% to 0.4% and quarterly GDP was dead in the water at 0.0% q/q, down from 0.2% growth in Q1 this year.

The ECB won’t mind the falling Euro too much. Mario Draghi himself has said "the fundamentals for a weaker exchange rate are today much better than they were two or three months ago". A weaker exchange rate will make exports more attractive and make imports more expensive, boosting inflation locally.

The end of this week could be a pivotal one for the Euro as ECB President Mario Draghi is due to speak at Jackson Hole, Wyoming, where leaders of the world’s largest central banks have met. The ECB is coming under mounting pressure to act to save the Eurozone from recession and Quantitative Easing could be one answer. This Friday could be the day Draghi announces his intentions. The Euro certainly could break out of the wedge to the downside.

Until then we have PMI figures for Manufacturing and Services from France, Germany and the EU. These figures actually showed improvement when they were announced last month so we may see a slight pull back from the current lows if these figures are encouraging.

From a technical point of view, the price is very close to the bottom line of the wedge and may actually use the support at 1.3295 as a sticking point. If the PMI figures are positive, we could see a bounce up towards the bearish trend line. If Draghi talks the Euro down further the support at 1.3295 is not likely to hold and the next support levels at 1.3202 and 1.3102 are likely to be tested along with the dynamic support in the form of the bottom of the wedge.

Traders looking to catch downward momentum should wait for a breakdown of the wedge before going short. Otherwise a rejection off the top of the wedge will be a good short entry signal that will take the price back towards the lower level.

The downward sloping wedge on the EURUSD charts looks solid, however, any talk of stimulus from Draghi this week could see the bottom line tested heavily.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.