The Pound and the Aussie Dollar pair have been respecting some Fibonacci lines as they form a ranging pattern over the last three months. If the current line holds, we should see a movement down, but be wary of the Bank of England.

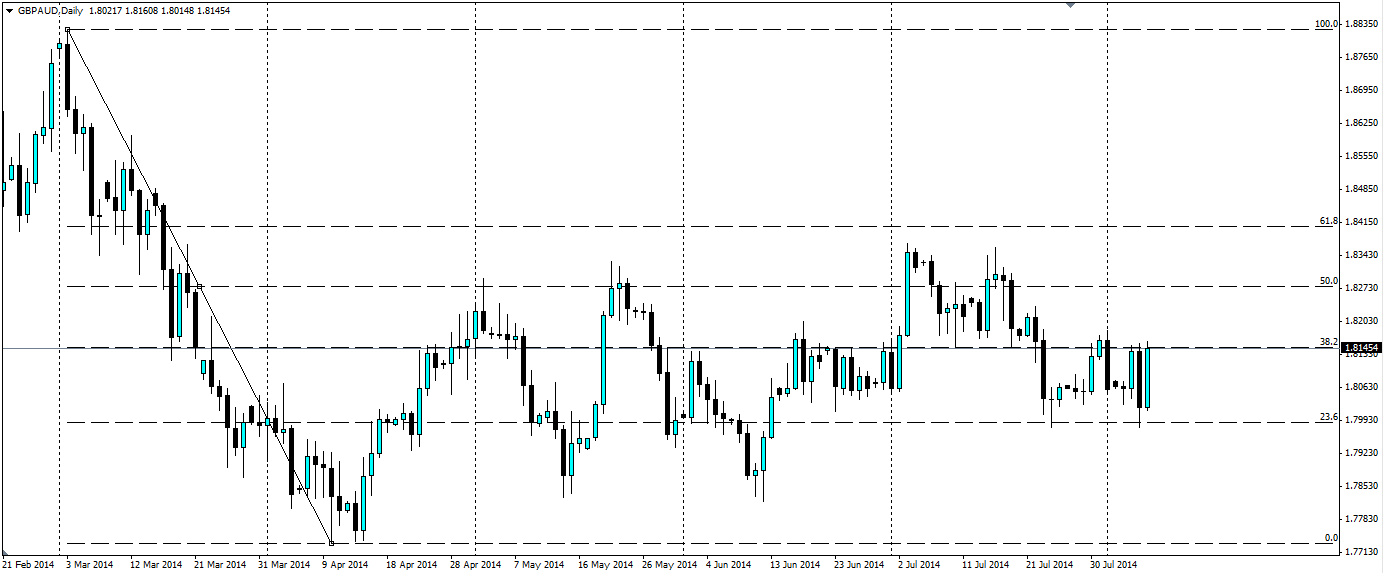

Drawing a line from the top hit in late February to the low in early April gives us our Fibonacci lines. From here the GBPAUD pair has looked to test the 50.0% without much success, however, the two that provide most interest are the 38.2% and 23.6% lines.

As you can see on the daily chart above the 38.2% and 23.6% lines have become support/resistance lines on several occasions. The price is currently sitting just under the 38.2% line after Australian Unemployment data disappointed the market. The Unemployment rate jumped from 6.0% to 6.4% which the AUD felt heavily. Yesterday it was the Pound that had a grim day as Manufacturing Production missed estimates of a 0.6% rise m/m, coming in at just 0.3%.

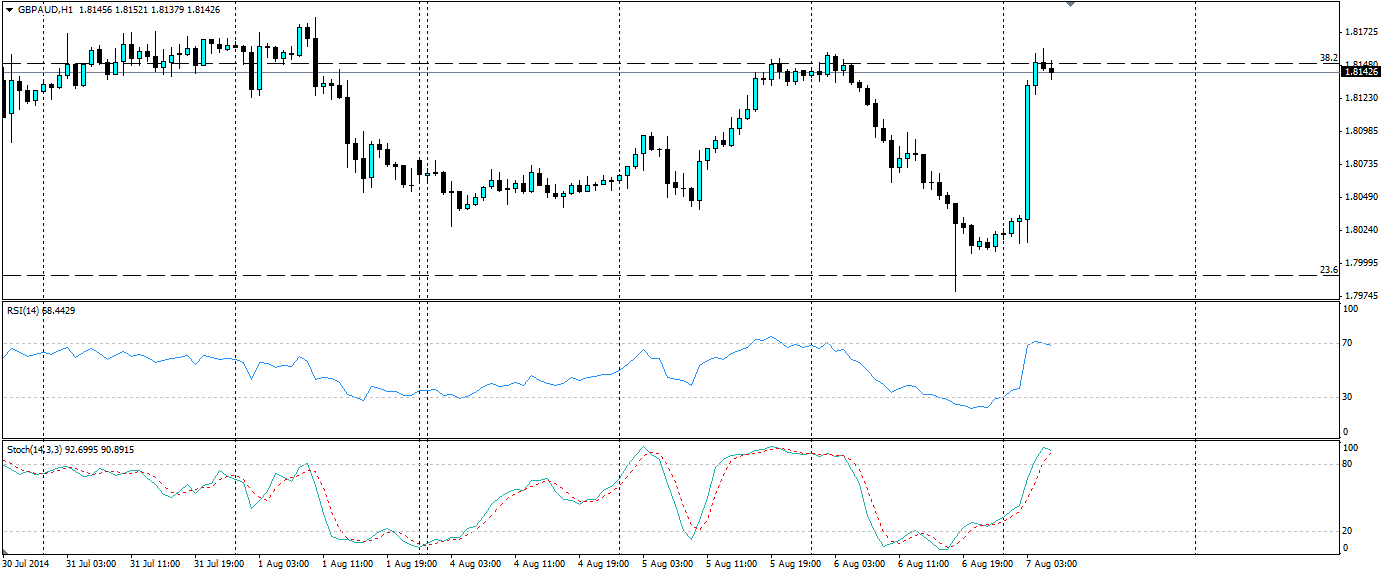

At present on the shorter timeframe charts we can see the price has already tested and rejected off this level of resistance. It would not be out of the realms of possibility to see another test of this level before it properly rejects off and heads down to the 23.6% level. This could provide an entry point for traders looking to take this pair short.

Both the Stochastic Oscillator and the RSI look to be finished with the oversold level and are heading down, with the two lines of the Stoch looking to cross over. These are both bearish signals and could point to a bounce off the 38.2% level with a top of 1.8146.

It must be said that there is one enormous caveat with going short on the pound, and that is the Bank of England meeting to decide interest rates. It is well known that interest rates have not moved in several years from the historic low of 0.5%, however, the talk has become more about ‘when’ not ‘if’ interest rates rise. Votes from the last Monetary Policy Committee (MPC) meeting show all votes as neutral; this is a change from the partially dovish votes of previous meetings and shows the changing attitude of the MPC which will eventually lead to interest rate rises. No one is expecting a rise today, however, they could outline a timeframe to do so; in which case the pound will smash through the 38.2% line, so it is important to set your stop losses to protect your capital.

The GBPAUD pair has been ranging between the Fibonacci lines and a bounce lower could be on the cards. Keep an eye on comments from the Bank of England as this will no doubt add volatility.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.