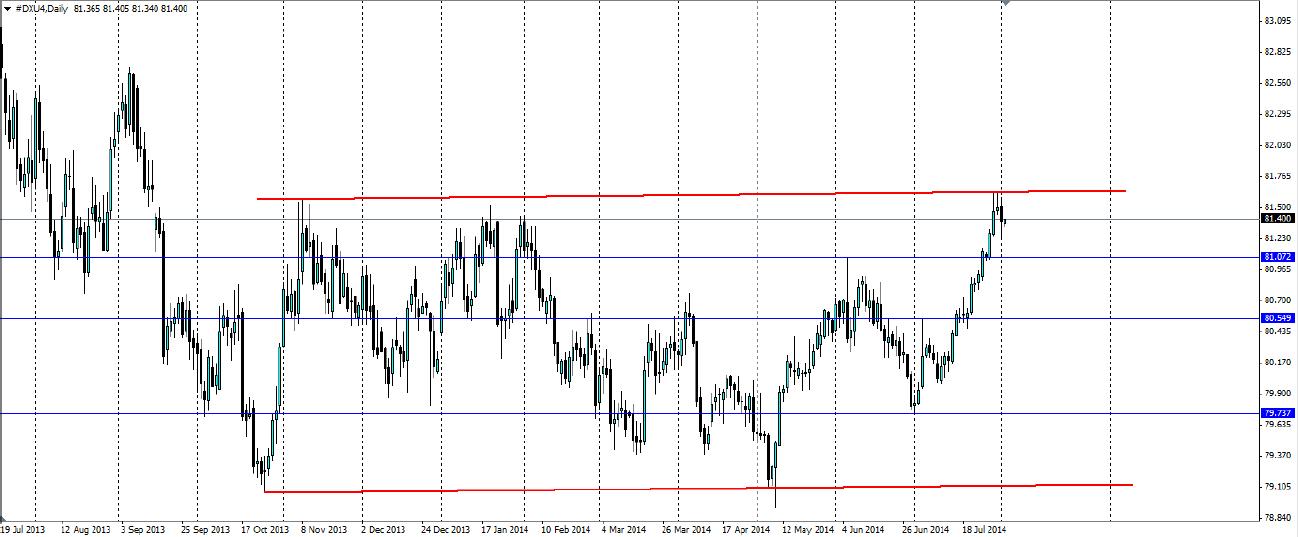

The Dollar Index has had a solid run in the past month or so, but taking a wider view shows the resistance it is up against. The price looks to have rejected solidly off the top of the channel and could begin to reverse down to the bottom of the channel.

The US dollar index has surged ahead over the course of July, as optimism about the job market from the US Federal Reserve fuelled the Dollar bulls. The month began with positive nonfarm payroll data that showed 288k jobs added to the US economy in June and the unemployment rate fell to 6.1%. Recently the Advance GDP figure added more upward pressure on the US dollar with a strong Q2 reading of 4.0% (annualised) growth. This is a good turnaround from the -2.9% in Q1.

The end of last week was the rain on the parade of the US dollar Bulls, suggesting the dollar may have overextended. The latest Nonfarm payroll data showed the US economy added 209k jobs in July. A good result, but below the 230k the market had expected and well below last month’s 288k. Furthermore the unemployment rate rose unexpectedly from 6.1% to 6.2%. This contributed to the rejection off the top of the channel and the formation of a rough triple top as seen on the below H1 chart.

The price is currently sitting under the neck line having broken through it and pulling back. The next effort will be to test the bullish trend line from the past month, and if this breaks down, we could see a strong movement towards the bottom of the channel. The RSI also points to a bearish movement, with several lower highs.

A reversal will look for previous levels of support/resistance as targets for the downward movement. Support for a bearish movement can be found at 81.07, 80.55 and 79.74. These could all act as exit points for traders looking to catch the downward momentum of a bearish reversal.

The US dollar index looks to have met some tough resistance at the top of a channel and could be overextended. A triple top and a descending RSI point to a possible bearish reversal which could take the US dollar much lower.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.