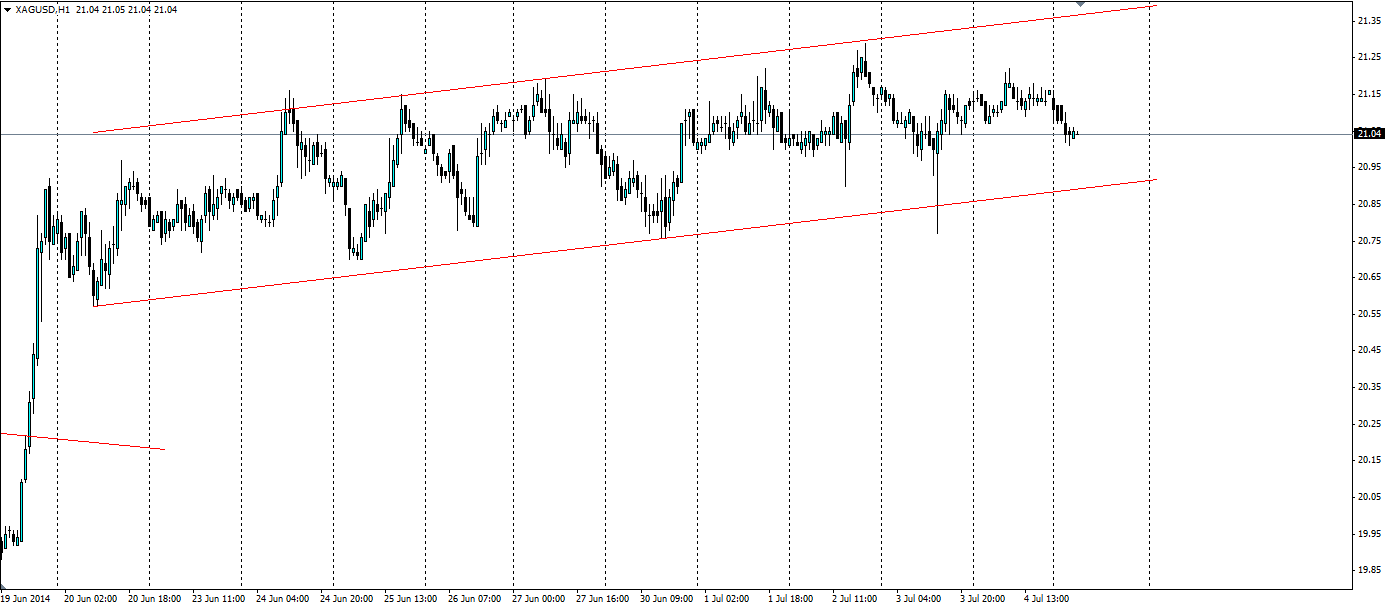

Silver is currently insistent is forming a range pattern with a slightly bullish trend to it that can be taken advantage of as it heads down to the lower end.

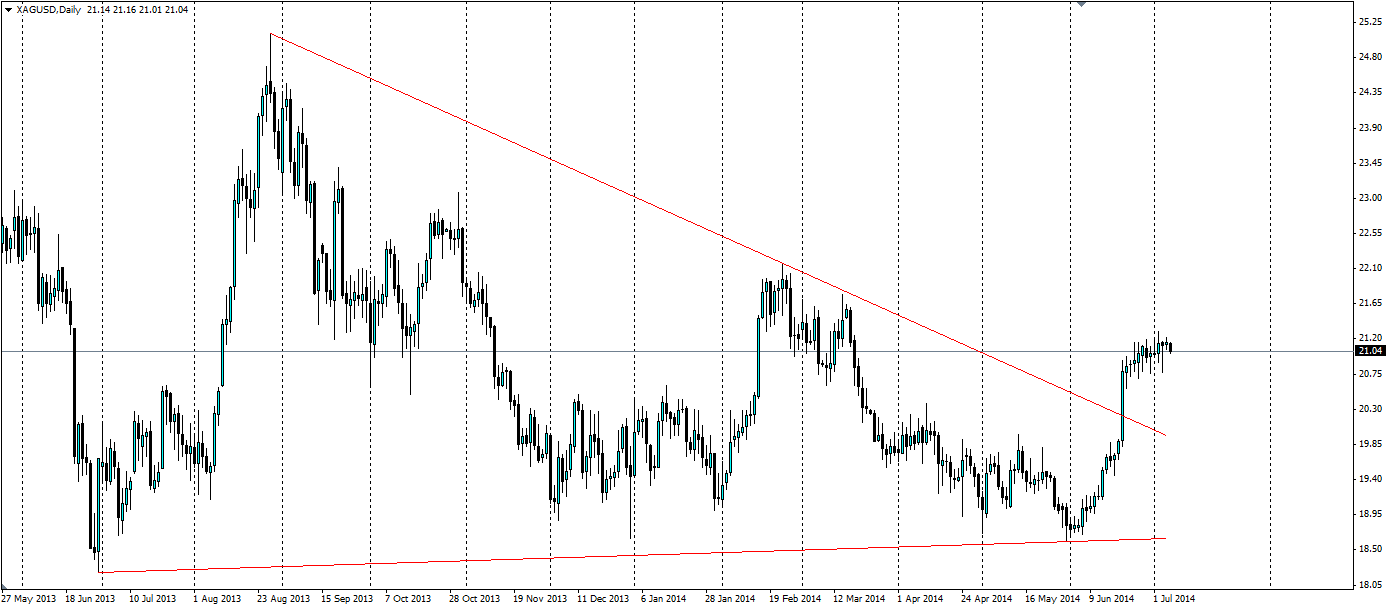

Silver recently broke out of a very old downward sloping triangle as it powered up over $1.00 per ounce, or over 5%. The breakout on the 19th June was largely down to the fact that the US Federal Reserve said that interest rates would remain low “for some time”. This in turn increased demand for haven assets, such as gold and silver, as the yield on US Treasury assets looks bleak. The strong breakout attests to how strong the triangle was.

The recent US nonfarm payroll data did not have as big an effect on silver as one might expect. The report showed the US economy added 288k jobs in June, much higher than the 215k the market was expecting. Logically, we would expect gold and silver to fall sharply on this news as it shows the US economy recovering, however the response was muted as the market is wary of the recent negative GDP data (-2.9% annually)and the uncertain outlook on interest rates. The resistance held firm at US$20.77 per ounce and a large bullish rejection wick formed as the price pushed over the $21.00 mark.

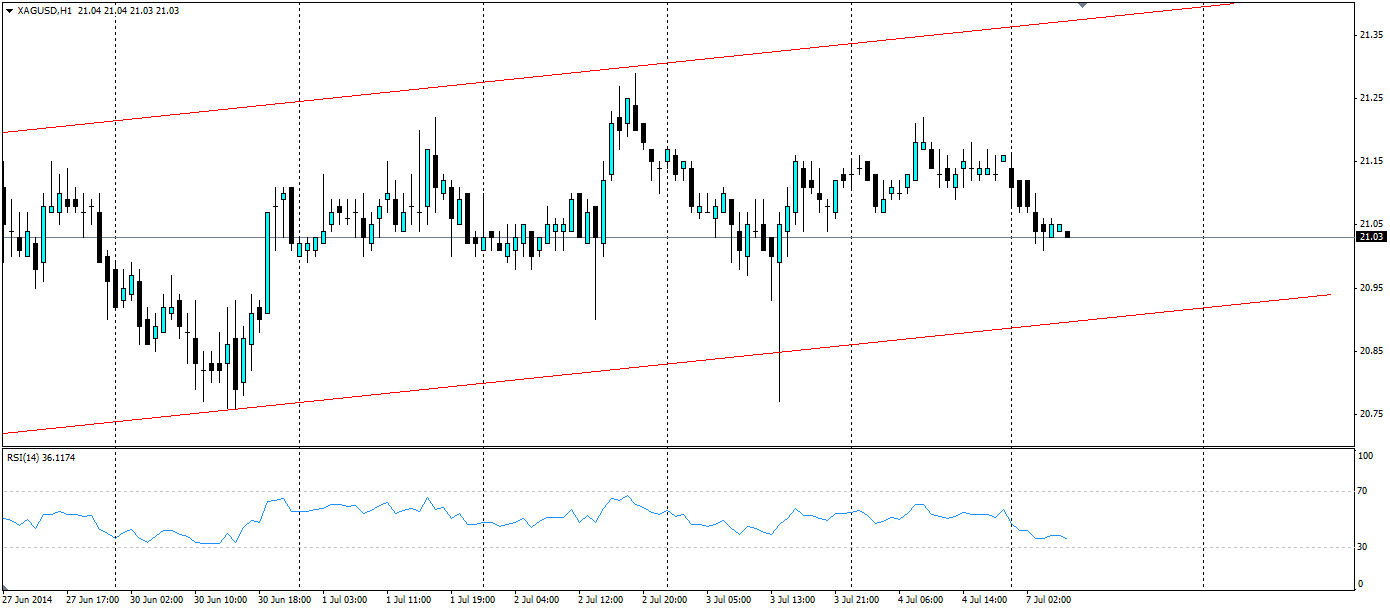

The ranging pattern has seen the support line tested several times with only the non-farm data providing a false breakout. This means the channel will hold in the near term and it will take quite a bit to break the channel down. Indeed the RSI shows the current momentum has reversed and is now back with the bulls having found support at 21.01. This could result in a touch of the upper resistance line.

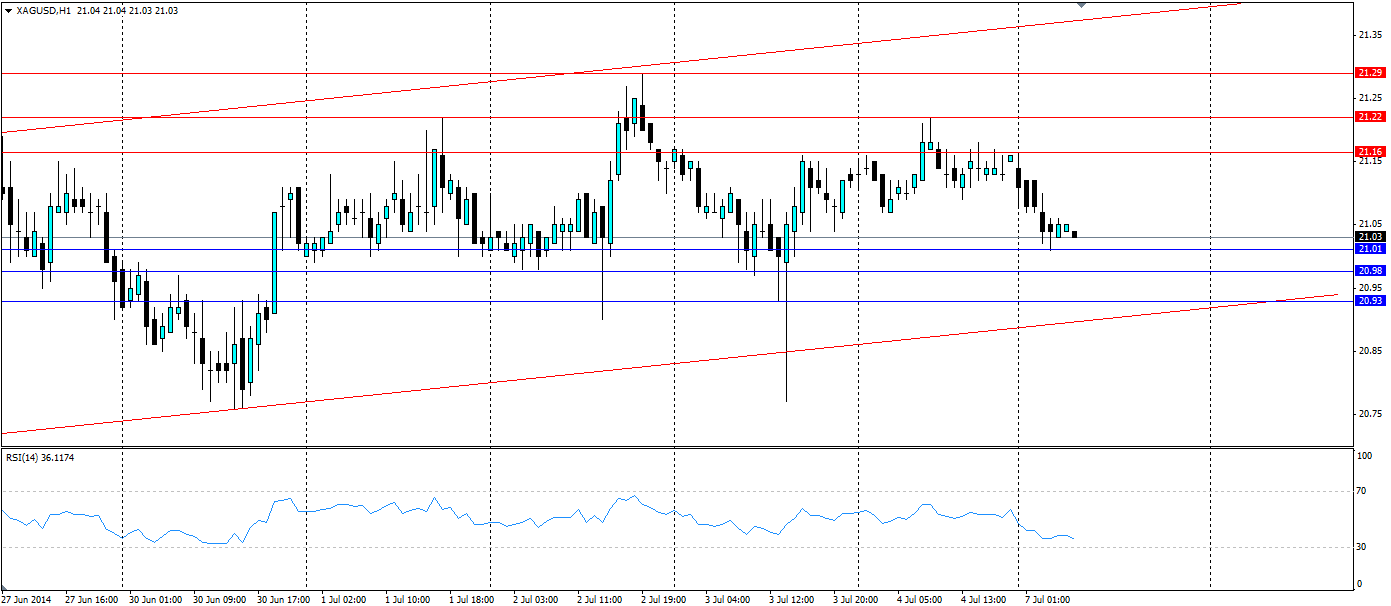

In this case there are four options for traders to take advantage of the price action. If there is a touch of the bottom support line, traders will look to have a stop sell below the trend line to take advantage of a break out, with a stop loss inside the line. At the same time a stop buy can be placed above the support line to catch the momentum of a bounce off the trend line.

If the price moves upwards to the top resistance line, a similar set up can be put in place. This will either catch a break out to the top side, or a bounce back down inside the channel. In any case, look for the levels of support and resistance when deciding price levels to target.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.