Manufacturing Growth Is Officially Slowing

Manufacturing Growth - I have been looking for weak economic data points for a few months because the ECRI index has been shooting off warning signs. It was the only metric I saw which was starkly negative in Q2 which means it was tough to follow it.

However, now we have evidence to support its prediction as growth is slowing. The housing market is showing signs of weakness and the buying conditions for autos are also weak.

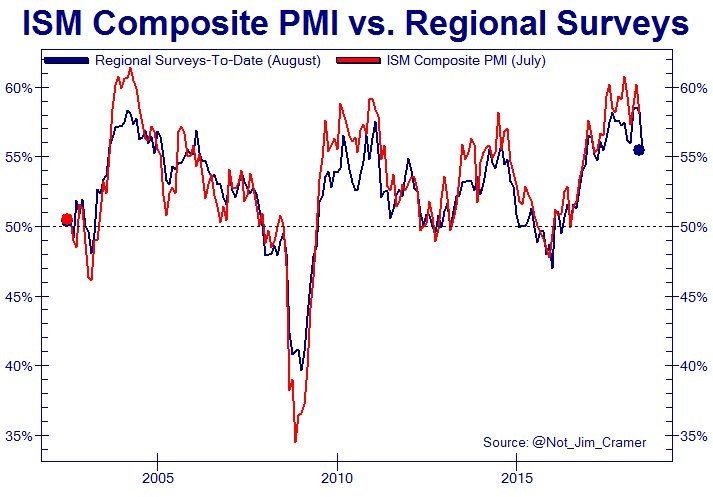

Two of the three regional Fed manufacturing reports have shown weakness. These are leading indicators for the August ISM PMI. I expect the hard data will follow suit in the next few weeks when it is released.

As you can see from the chart below, the regional Fed reports now expect an ISM PMI of about 55. To be clear, that’s a good reading. The economy has gone from great to good in August.

Manufacturing Growth - Weak Kansas City Fed

The fear is if the rate of change keeps falling, the economy will be at trend growth by the end of the year. GDP growth could be below 2% in Q4. I’m hanging my hat on weakness in sentiment readings which have been stronger than the hard data this year up until August.

The most recent weak soft data report is the August Kansas City Fed report as it had a 14 reading which was way below the lowest estimate of 22. The consensus and the July readings were both 23.

This reading is the weakest once since December which was 13.

From April to July, manufacturing in the Kansas City District was really strong.

August production was up from 12 to 18, but it’s still down huge from the peak of 42 in May. The volume of new orders was only 8 which was down from 9 in July and down from 29 in April.

The good news is inflation fell as the prices paid for raw materials fell from 52 to 44 and the prices for finished goods index was flat at 27.

Those stats were all on a month over month basis. On a year over year basis, they look better because August last year was much weaker than July of this year.

The composite index fell from 44 to 37 and the volume of shipments index fell from 44 to 32. Year over year inflation fell dramatically, as prices received fell from 60 to 50 and the prices paid index fell from 86 to 67.

Manufacturing Growth - Let’s look at the 6-month expectations results

The composite index fell from 34 to 29. Production fell from 49 to 44.

The volume of shipments fell from 52 to 40. As you can see, unlike the Philly Fed report, this one showed expectations also weakened.

Let’s now review a quote from this report.

One firm said, “Tariffs and threats of tariffs is causing raw material increases that are eating away the benefit of a lower corporate tax rate. We are unable to pass along tariff caused increases, for items under contract.”

The tariffs are hurting manufacturing and will hurt the rest of the economy if the threats turn into policy.

Manufacturing Growth - Economic Surprises Are Negative

It’s interesting how the reports this month have missed the low end of the expected range, while the reports from previous months beat the high end of the expected range.

It’s a troubling trend I have noticed. It can be spun to say that it’s good to see capacity has breathing room and houses are becoming more affordable, but this is how slowdowns start.

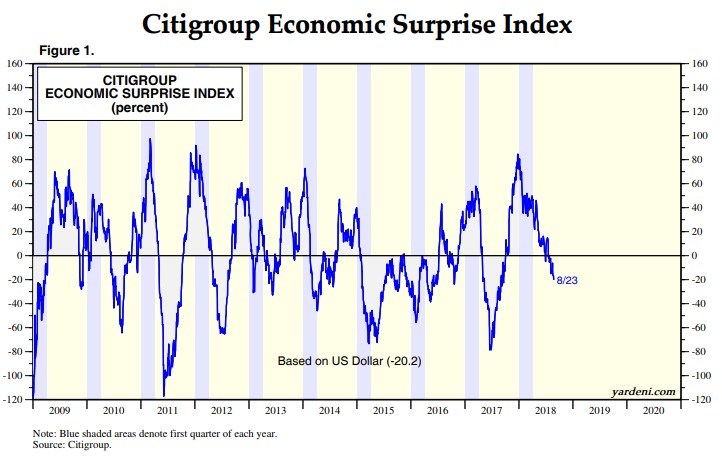

If the trend continues in a few months, the economy will be in another slowdown like late 2015 to early 2016. As you can see from the chart below, the Citi Surprise index is at -20.2% which means more reports are missing estimates than beating them.

It’s important to realize this metric is all about rate of change which means it doesn’t measure the size of the weakening.

For example, the index was extremely weak in the early summer of 2017 even though the economy was growing decently.

This indicator is a hypersensitive measurement of where the economy is headed. It will be early on trend changes, but it will also have a few false readings.

These readings are mostly false sell readings because the stock market usually increases and the economy usually expands.

It’s easy to say a recession is coming because the economy is late in the cycle.

That is not justification for a thesis because cycles don’t die of old age.

I think a recession will occur in 2020, but not because this is about to be the longest expansion since the mid-1800s. Past mistaken recession calls in which I thought the age of the cycle made each weak period more likely to end with a recession taught me lessons.

This is a slowdown and nothing more until we have further evidence.

The yield curve doesn’t support a recession since it’s not inverted. The low 10-year yield supports a slowdown.

Manufacturing Growth - PMI Composite Shows Weakness

The August flash PMI reading was 55 which missed estimates for 55.6 and was below last month’s reading of 55.9. The Manufacturing growth reading fell from 55.5 to 54.5.

This missed estimates for 55.1 and missed the lowest estimate which was 54.8.

It was the weakest reading since November. The services index fell from 56.2 to 55.2 and was below the consensus for 56.

Services reported the fastest increase in prices in 4 years. New orders in services were the lowest this year.

According to the commentary in this flash PMI report, annualized GDP growth is expected to be 2.5% which is down from the expected 3% in July.

The report suggests growth is fine, but if Q3 GDP growth is 2.5%, it would be a big slowdown from 4.1%. GDP growth will decelerate sharply if the August consumer sentiment reading is an accurate depiction of consumer spending.

Either way, it’s clear manufacturing growth slowed in August.

Don Kaufman: Trade small and Live to trade another day at Theotrade.

Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, registered investment adviser, registered broker-dealer or FINRA|SIPC|NFA-member firm. TheoTrade does not provide investment or financial advice or make investment recommendations. TheoTrade is not in the business of transacting trades, nor does TheoTrade agree to direct your brokerage accounts or give trading advice tailored to your particular situation. Nothing contained in our content constitutes a solicitation, recommendation, promotion, or endorsement of any particular security, other investment product, transaction or investment.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past Performance is not necessarily indicative of future results

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.