Market Overview

With US markets shut for Martin Luther King Day we are seeing limited direction this morning. The broad bias of a dollar positive move is still hanging over from last week as the strong US data is still fresh in the mind. There is little to steer markets today, with the People’s Bank of China standing pat on rates and little else of note on the calendar. The big mover seems to be the resumption of weakness on sterling, with the continuation of chatter about potential rate cuts in the wake of a fairly terrible stream of UK data last week and dovish comments from Bank of England members. Given the dollar strength, the reaction of Cable around the support of recent lows at $1.2900 and $1.2950 will be seen as a key watershed in the outlook for sterling.

Wall Street closed higher on Friday with the S&P 500 at +0.4% (at 3329) and this has helped Asian markets to a positive session today (Nikkei at +0.2% and Shanghai Composite +0.7%). European markets have slipped a shade early morning, but with little real direction. In forex, there is almost no direction to speak of aside from the weakness on GBP. In commodities, gold continues to build support, another +0.2% higher, whilst oil has opened positively today as supply in Libya has been knocked by civil unrest.

There are no key economic data releases today. US markets will be shut for Martin Luther King Day public holiday.

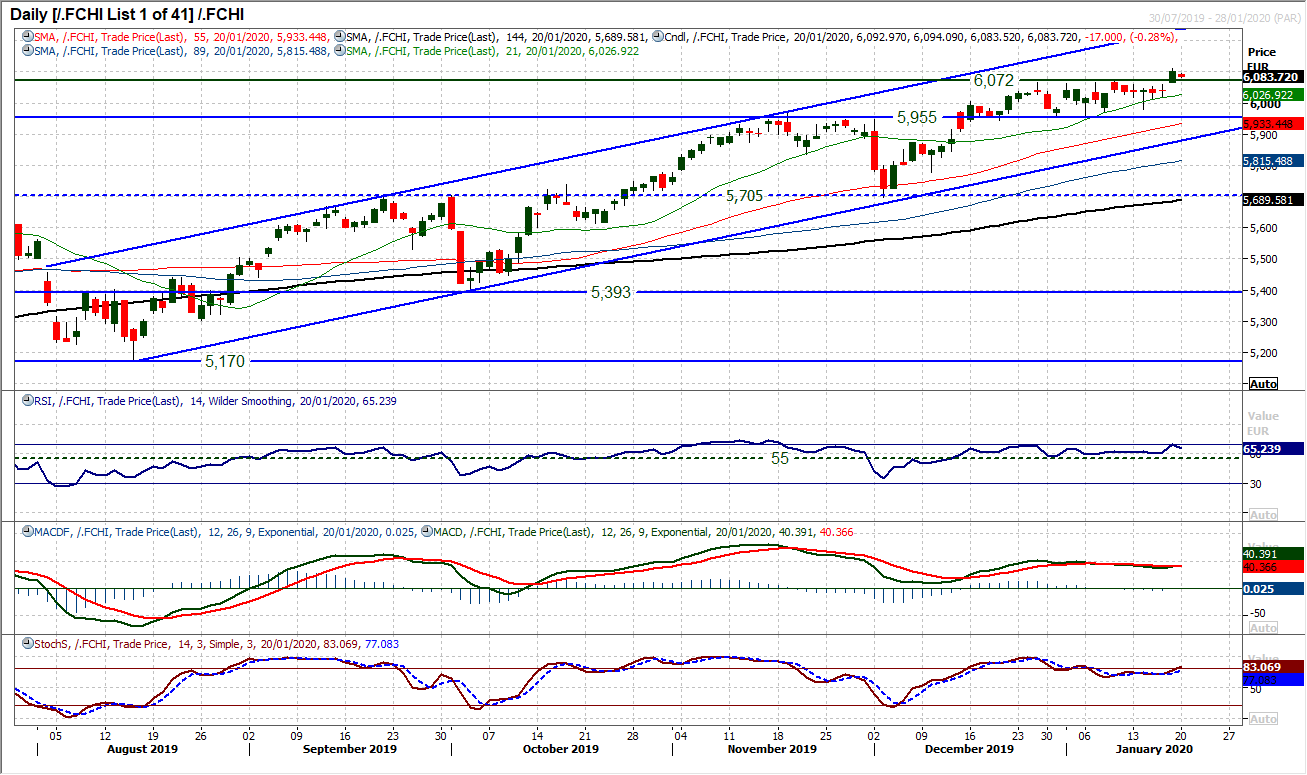

Chart of the Day – French CAC 40

Equities in Europe have had a choppy start to 2020, but there was a decisive move across the major markets on Friday. A strong bull session has driven a breakout on the French CAC 40 to a new 12 year high. The market has been trading in a range between 5955/6072 for the past five weeks, but a gap higher and storm through the resistance and form a big bull candle well clear of 6072. This range breakout implies an upside target of 6189 in the coming weeks. Momentum indicators have been in consolidation recently and The RSI pushing towards 70 confirms the breakout, and whilst the Stochastics and MACD may be a little slower to respond, there is also a positive reaction coming. The breakout at 6072 is now a basis of support and with a breakaway gap back at 6059 there is a band of support initially 6059/6072. The 2007 high of 6168 is the next resistance.

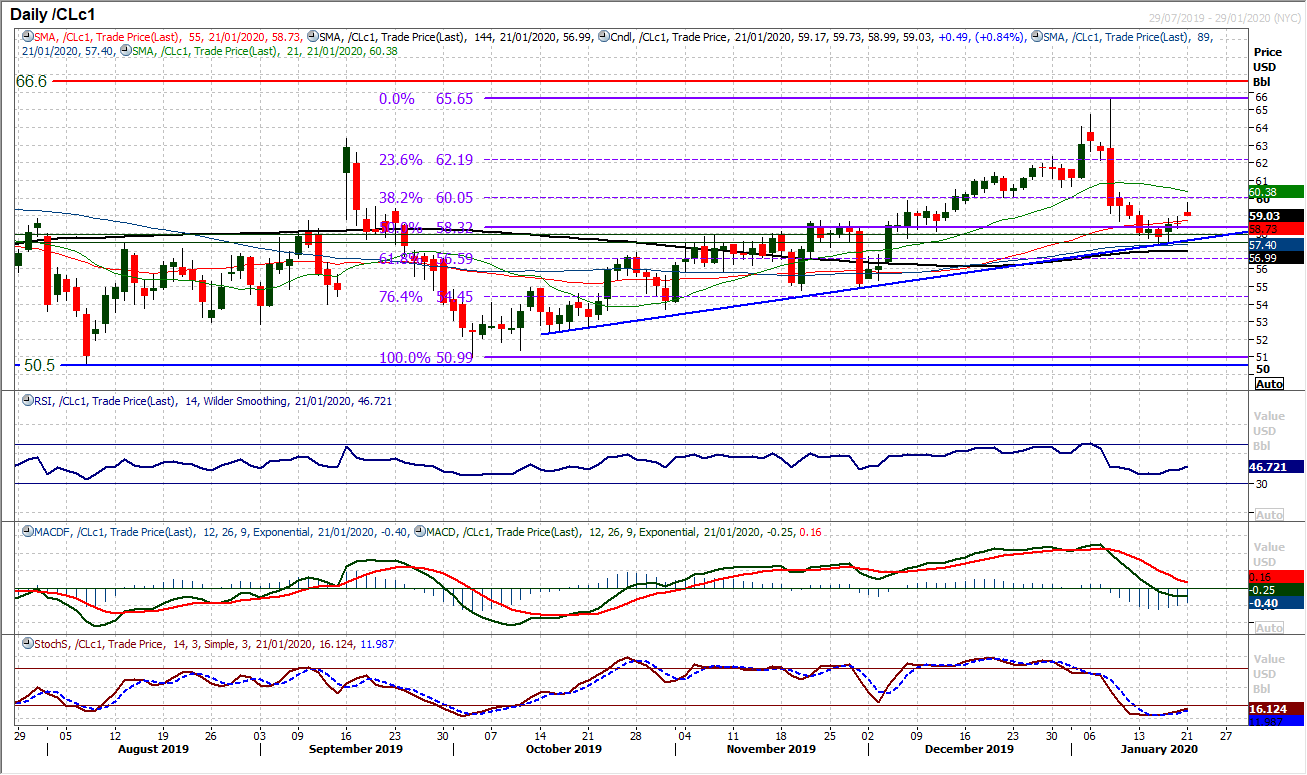

WTI Oil

We have been discussing the potential turning around of sentiment on oil in recent sessions. With the selling pressure slowing and the configuration of daily candles turning more favourable for the bulls, the price has begun to see improved outlook again. Higher daily lows are now forming, whilst it is possible to redraw a three month uptrend (to a shallower advance). The basis of support with what is a pivot band around $57.35/$57.85 is growing too. A gap higher today has failed to really push forward initially and there is a move to fill an initial gap at $59.00. However, there is a growing sense on momentum that a near term corner has been reached (with RSI and Stochastics turning higher). We still await a confirmed Stochastics buy signal but a test back of the resistance of the pivot around $60.00 and 38.2% Fib (of $51.00/$65.65) at $60.05 should be building now. Key support at $57.35.

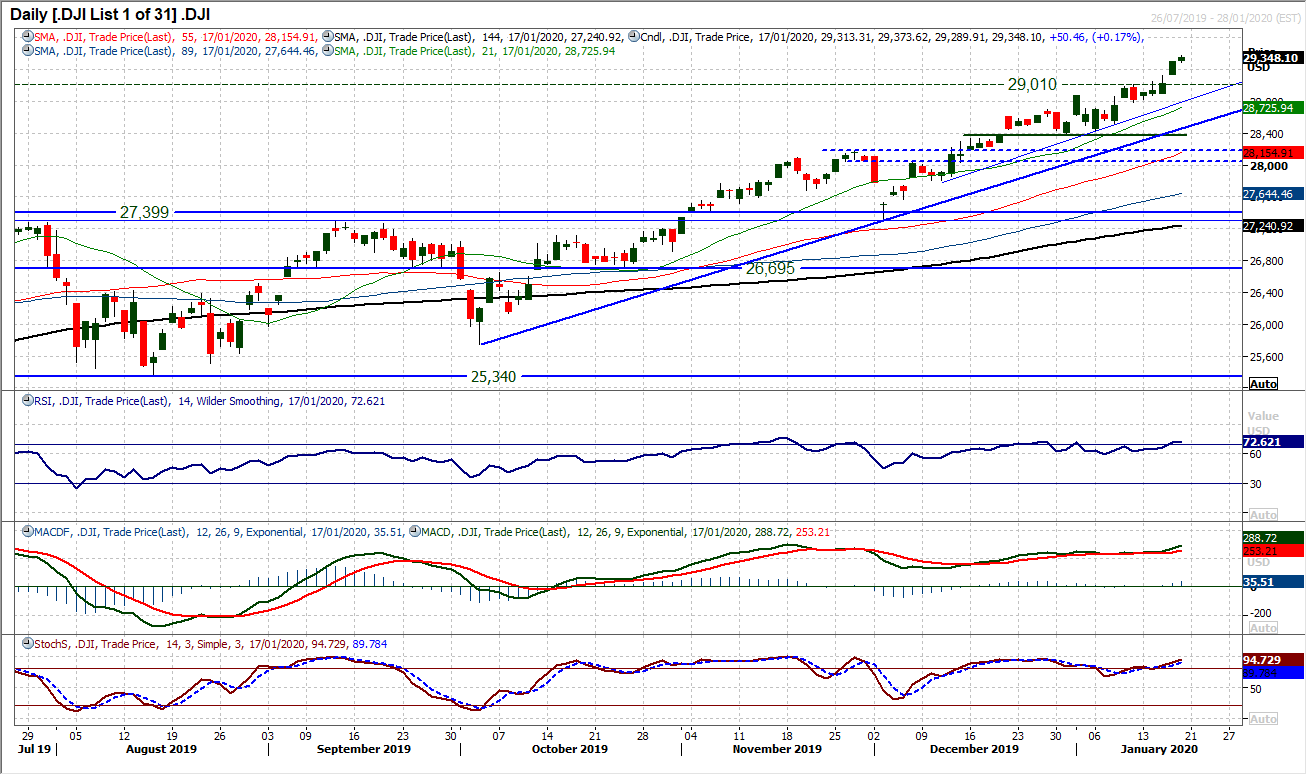

Dow Jones Industrial Average

Another positive candle on Friday and another close at an all-time high. Momentum with this run higher continues to build into strong configuration now. Although with marginally stretched momentum there will be a corrective move at some stage, seemingly not yet. The market is gapping higher on a near daily basis now, but also any intraday corrections to fill the gap are used as a another chance to buy before posting new all-time closing highs again. The first real support is at 29,010 and back around 28,873. Support of a five week uptrend comes in at 28,835 today too. The market is shut today for Martin Luther King Day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.