The Fed minutes of the September 17 rate decision are due for release later today. The bank left interest rate unchanged, revised median interest rate forecast lower and also refrained from providing a hint at a possible rate hike in the near future.

Following the September 17 rate decision, the 2015 rate hike bets took a hit. This was followed by a horrible NFP number released last week, post which the 2015 rate hike bets were erased.

Heading into the minutes, here is how the picture looks like –

| Fed meeting | Rate hike probability (25 bps) | No rate hike probability (25 bps) |

| Oct 28, 2015 | 4.6% | 95.4% |

| Dec 16, 2015 | 36.3% | 62.1% |

| Jan 27, 2016 | 40.6% | 51.8% |

| Mar 16, 2016 | 43.6% | 37.7% |

It is clear that a 25 bps rate hike is seen happening in March 2015. However, the gap between a rate hike and no rate hike probability is narrow and can be quickly erased today itself.

Markets need clarity

The minutes are likely to carry the confusing language with regards to the timing of the interest rate hike. The data dependent stance and the call for “some further improvement in the labor market” and the language of ‘some, many’ is unlikely to impress the markets now.

Moreover, the markets need some clarity regarding the interest rate – whether Fed intends to hike rates or plans to keep them low for a prolonged period. Given the non‐committal stance of the Fed’s Yellen on September 17, it is unlikely that minutes could provide any clear idea of what Fed plans to do.

The confusing tone could very well spook markets and throw the March rate hike (25 bps) out of the window. A 5bps, 10ps, or 15 bps rate hike may happen, although, such rate hike would be equivalent of no change.

A further drop in the Fed rate hike due to the confusing tone of the FOMC minutes could lead to a fresh bout of risk aversion, sending risk assets – stocks, Sterling ‐ lower. The 10‐year yield treasury could drop below 2% and stay there, while traditional safe havens – Gold, JPY, CHF could strengthen.

A clear hint that rate hike won’t happen anytime soon could also erase March rate hike bets, however, clarity regarding what Fed intends to do is would keep markets happy.

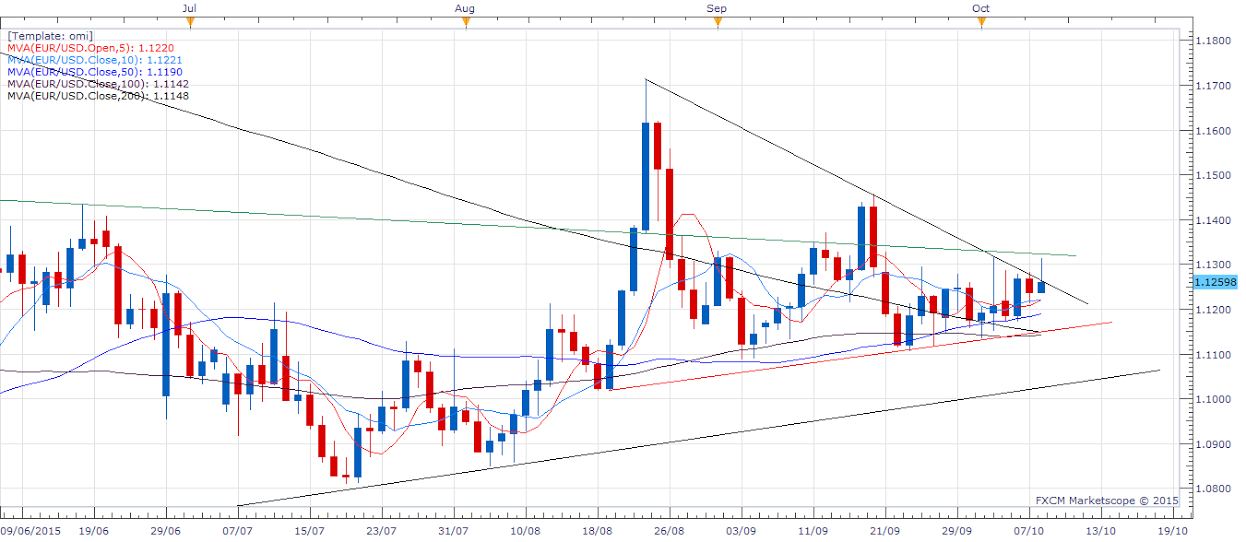

EUR/USD – Levels to watch out

EUR has failed to sustain above the falling trend line (black line), but may another attempt at 1.13.

However, bulls need to wait for a daily close above trendline resistance (green line) located at 1.1323.

Till then, the downside remains exposed. Given, the early failure to sustain above the falling trendline resistance at 1.1265, the pair is likely to head towards 50‐DMA at 1.1190.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.