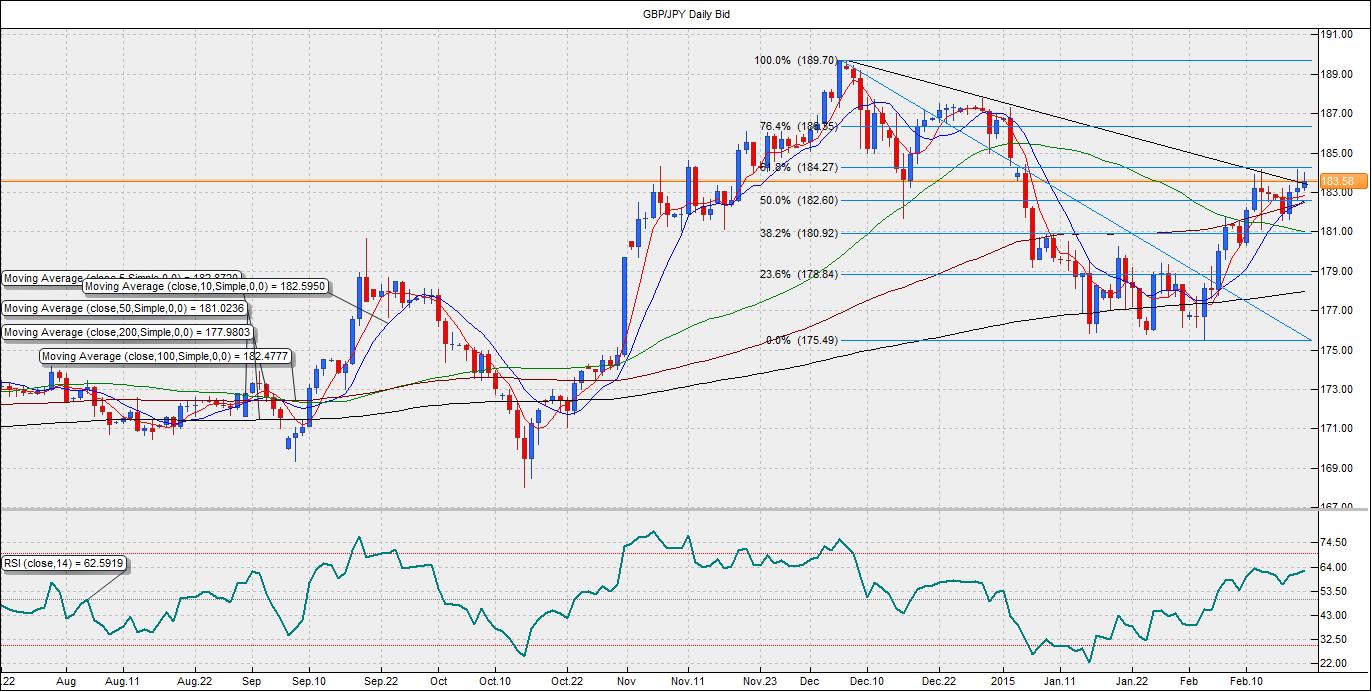

However, the pair could not extend gains above 184.20 and fell to 183.50 levels. The next major trigger is seen from the UK retail sales due for release tomorrow. The headline figure is seen at an impressive 5.9% year-on-year in January. However, month-on-month the retail sales are seen falling 0.2% compared to the previous month’s gain of 0.4%.

GBP to weaken on Retail Sales

The pair could drop to 181.50 levels if the UK retail sales disappoint market expectation. Moreover, a weak number would indicate slow growth in consumption despite a sharp rise in the wage growth data released yesterday. Furthermore, the GBP appears overbought after an upbeat jobs data and the hawkish Bank of England minutes. Hence, a weak retail sales data could trigger a sharp unwinding of GBP longs.Greece led uncertainty to support the Yen

The renewed concerns regarding the Greece debt could support gains in the Japanese Yen. German government rejected Greece’s proposal of loan extension due to which the shared currency was sold-off. The risk aversion would also keep the British Pound under pressure. With the German government’s refusal, we may not see a concrete deal coming through from the Eurogroup meet scheduled tomorrow. Consequently, the pair could take a hit on risk aversion.Technically, the pair appears stuck around 184.20-184.30 levels. Despite an upbeat jobs data and BOE minutes released yesterday, the pair finished well below 182.50 (50% retracement of 175.49-189.70) and 184.26 (61.8% retracement). The pair is also struggling to sustain gains above the falling trend line resistance located at 183.50.

Thus, a weak retail sales print could result in the sharp fall in the GBP/JPY pair to 181.50 levels. However, a strong retail sales print along with a short-term fix to Greece’s debt problem would be enough to send the pair higher to 185 plus levels.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.