The Japanese yen touched an 18 month high against the US dollar yesterday when it reached the level of 105.54, before retracing to higher levels above 106.00. This sharp rally for the yen started last Thursday when the Bank of Japan (BoJ) decided to hold steady on monetary policy at its scheduled meeting. The markets had geared up for some more quantitative easing, another interest rate decrease, or even a mixture of both.

When the BoJ made the announcement of no additional measures, the USDJPY dropped 250 basis points, or 2.24%, reaching 108.735 in the space of 5 minutes. The yen rally didn’t stop there as the USDJPY closed the day at 108.087. Friday saw the rally continue further as price dropped to 106.25. Yesterday the BoJ governor Kuroda stated that a high value of the yen was not a good thing for the Japanese economy and was not welcome, this may have caused the decline in the dollar to stop and reversed the market trend, although that may be only temporary.

The USDJPY has a strong correlation to the US economy; a strong economy will usually lead to a higher exchange rate for the dollar against the yen. This Friday afternoon at 12:30 GMT we have Non-Farm Payrolls (NFP) and unemployment data for the US. The forecast for this month’s data is at 200k new jobs, slightly lower than last month’s 215k.

A large enough deviation from the expected number will create an increase in volatility for the USDJPY, as NFP is considered one of the strongest indicators of the health of the US economy. A low number will also decrease the likelihood of an interest rate hike in the immediate future; this should cause the US dollar to weaken even further against the yen. However, a higher number should send the US dollar higher again, as the market will perceive greater chances of an interest rate hike.

If you expect USDJPY volatility to increase over the next week then you may buy a Straddle strategy which consists of simultaneously buying a Call and a Put option with the same strike, expiry and amount.

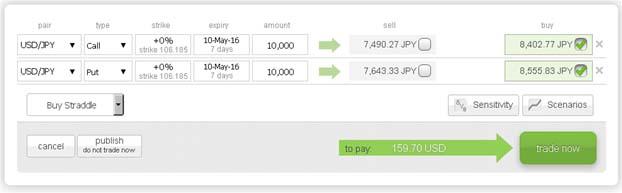

The screenshot below shows a Buy Straddle strategy for USDJPY with a 106.185 strike, 7 day expiry and for $10,000 would cost $159.67, which would also be the maximum risk.

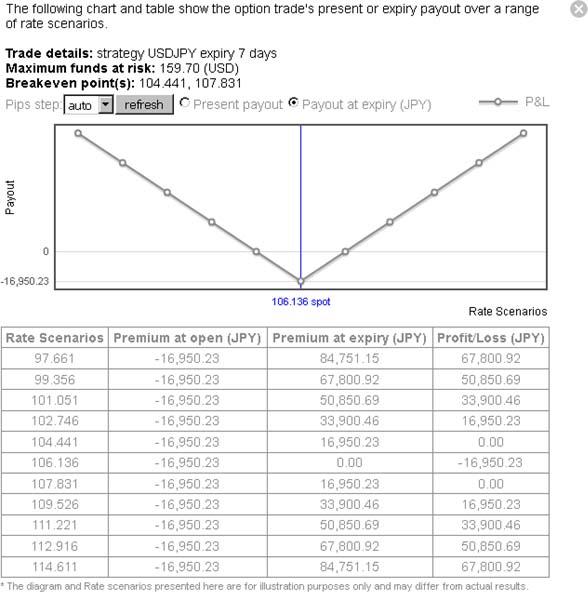

The screenshot below shows the profit and loss profile of the above Buy Straddle strategy, just click the scenarios button.

On the other hand, if you feel that the volatility for this currency pair will decline or stay flat over the next week, then you may Sell a Straddle strategy, which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amount.

The screenshot below shows a USDJPY Sell Straddle with a 106.182 strike, 7 day expiry and for $10,000 would generate $142.55 of revenue with a total risk of $342.55.

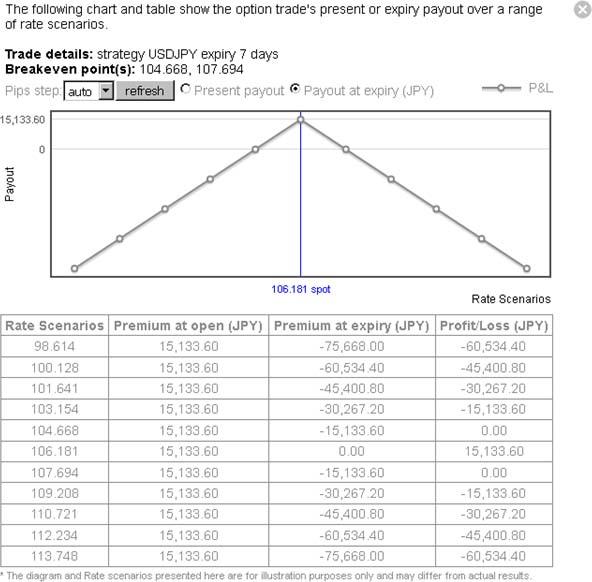

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.