Sterling Yen has picked up its bear trend again after having traded between 159.00 and 164.00 for the past 6 weeks. Last Friday price opened at 161.60, today’s open was at 156.18. Sterling seems to have picked up momentum to the downside again after recent comments from the Bank of England that negative interest rates may be necessary in the near future if the economy continues to falter.

Martin Weale, a Monetary Policy Committee member, stated that it may be necessary to cut rates again. He mentioned that there could be unwanted side effects if interest rates turned negative, implying there is that possibility.

However, it would seem that the Yen should depreciate more than the Pound given that interest rates in Japan are currently at minus ¾%. But markets move under the forces of expectations and not on facts alone. The Bank of England had been talking of raising interest rates and that had halted Sterling’s depreciation. Now that the possibility of higher interest rates is off the table, the Pound’s price looks like it has turned back to the prevailing bear trend.

There is also the fact that the Yen acts as a safe haven currency in times of market stress. In August 2008 when the stock market collapsed GBPJPY went from 214.09 to a low of 118.785 by January 2009 as the financial crisis unraveled.

The stock market is currently experiencing high levels of volatility and there is a general sense of uncertainty about the performance for stocks as we go into 2016. It may be worth watching the FTSE for further indications as to where this pair may be heading.

Economic fundamentals are week for both currencies, latest data shows that GDP growth rate in Japan is a meagre minus 0.3% and this morning’s Leading Economic Index was released at 99.8 down from 101.8 last month. While the UK has a slightly better GDP Growth rate, but still low at 0.6% and a relatively higher unemployment rate at 5.1%.

If you think the price of GBPJPY will continue to trend further down over the next week then all you may buy a Put option, which gives you the right to sell this pair at a predetermined price (strike) on a set date (expiry) and for a specific amount.

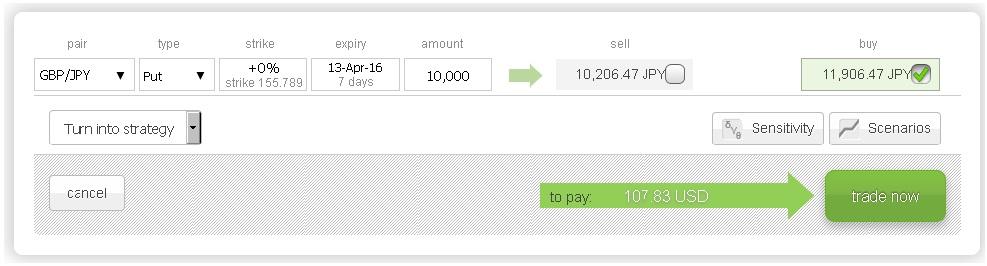

The screenshot below shows a GBPJPY Put option with a 155.789 strike, expiry 7 days and for £10,000 would cost $107.83, which would also be the maximum risk.

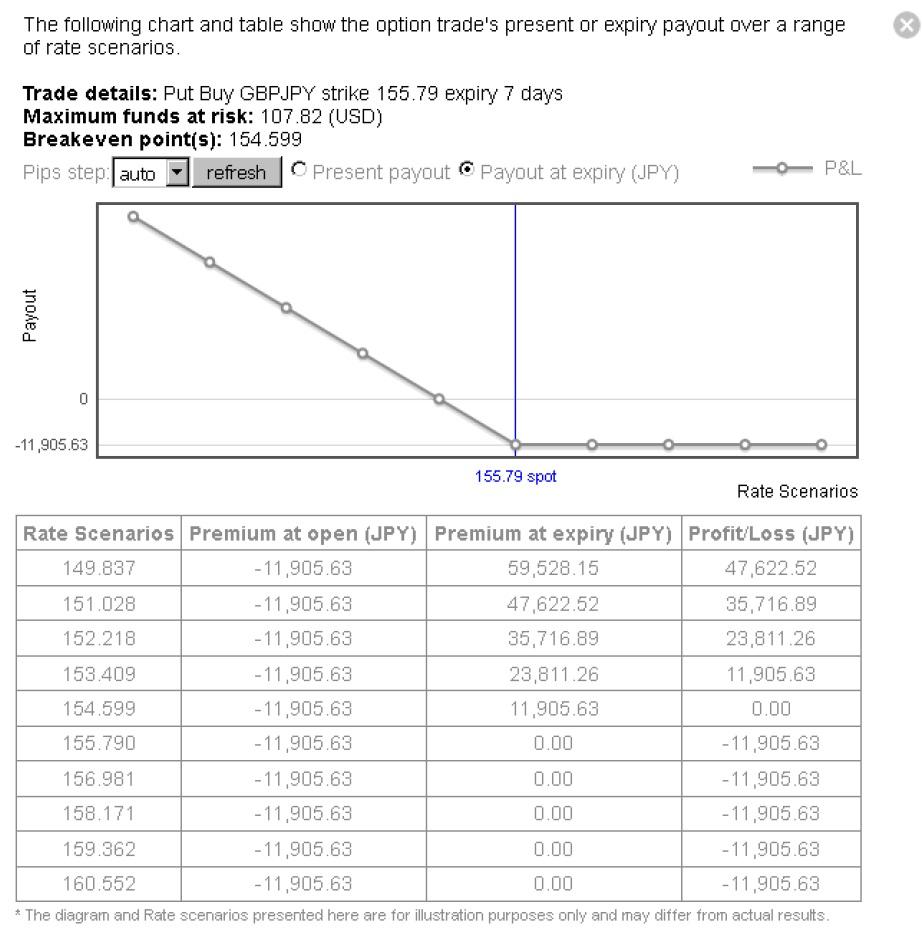

This screenshot shows the profit and loss profile of the above Put option, just click the Scenarios button.

On the other hand, if you think that GBPJPY price will retrace back up over the next week then you may buy a Call option, which gives you the right to buy GBPJPY at a specific strike, expiry and amount.

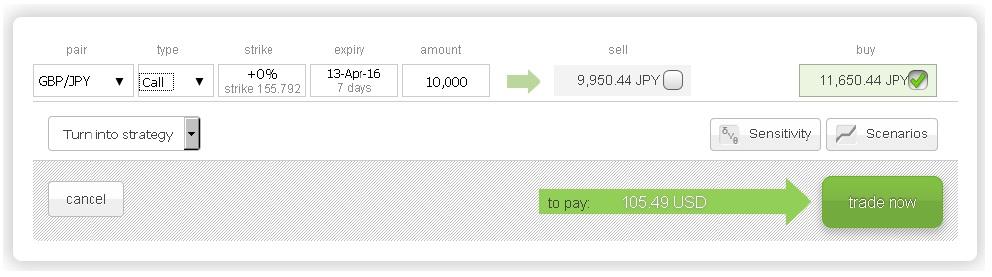

The screenshot below shows a GBPJPY Call option with a 155.792 strike, 7 day expiry and for £10,000 would cost $105.49, which would also be the maximum risk.

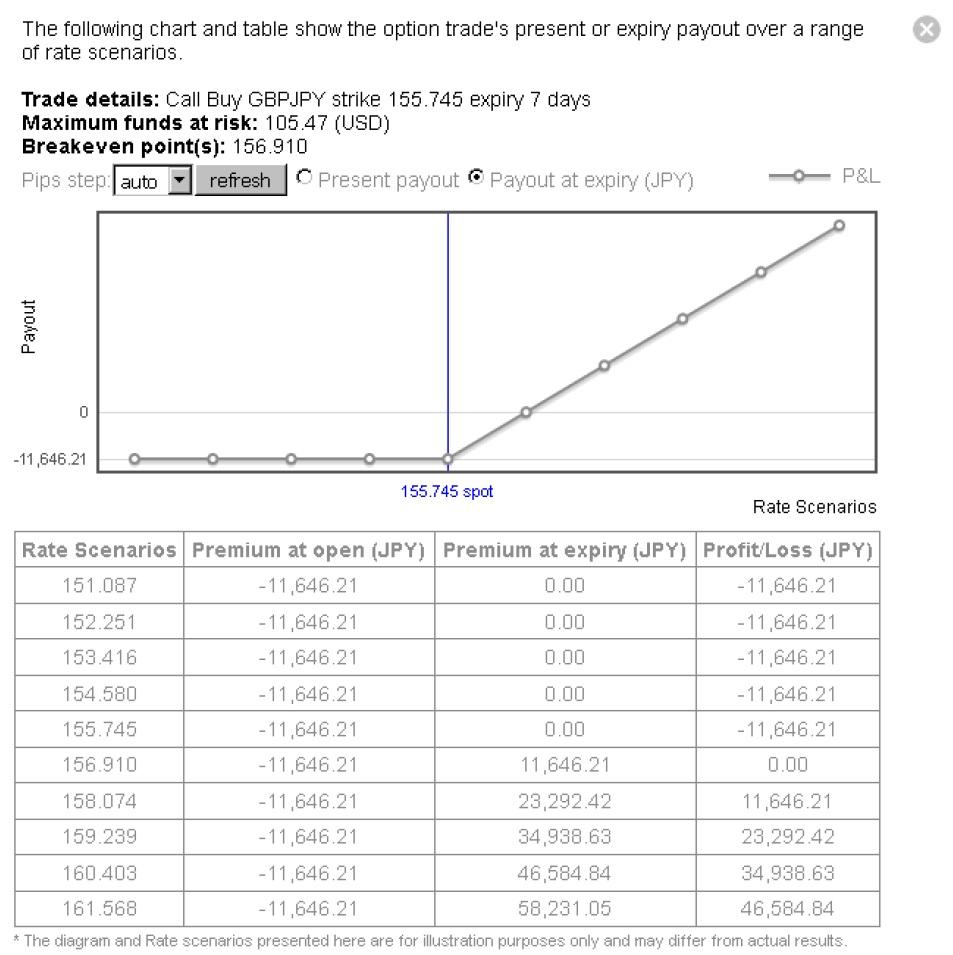

This screenshot shows the profit and loss profile of the above Call option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.