Crude Oil has recently reached levels, below $36.00, last seen in January 2009. It has been in a constant down trend since reaching its 2014 high at $107.65 in June. Excess supply has been the main factor. And this factor doesn’t seem to show signs of changing course. On December 4th OPEC decided to keep the production limit in place, there had been hope of a reduction. Their statement cited continued global growth and demand for crude oil products.

The markets obviously didn’t see it the same way, WTI price has only fallen since its open at $42.13 on December 4th. With more supply pressureon the horizon. The US house of representatives has just proposed a bill, for Government funding and to raise the constitutional limit on debt, that also includes a proposal to lift the ban on crude oil exports.

Yesterday Crude Oil stock data was released with an increase in inventory of 4.8 million barrels. The forecast for this week’s data had been for a decrease of 1.85 million. The price of crude fell from $37.84 just before the release, to $36.85 within the space of 1 hour.

Some argue that price cannot keep falling as at some point extraction costs will not be met. This is true for producers in the US. However for the rest the world they may still actually be getting more for their crude oil than they were 6 months ago.

The US dollar’s appreciation against most currencies means that a foreign producer can accept a lower price for crude as long as he is still getting more in local currency per US dollar. The effect is easy to see for a Canadian crude oil producer. If USDCAD is at 1.1000 and crude at $45, let’s say crude falls to $35 but the exchange rate also goes to 1.3400. In this case the Canadian crude oil producer has not lost any revenue in Canadian dollar terms.

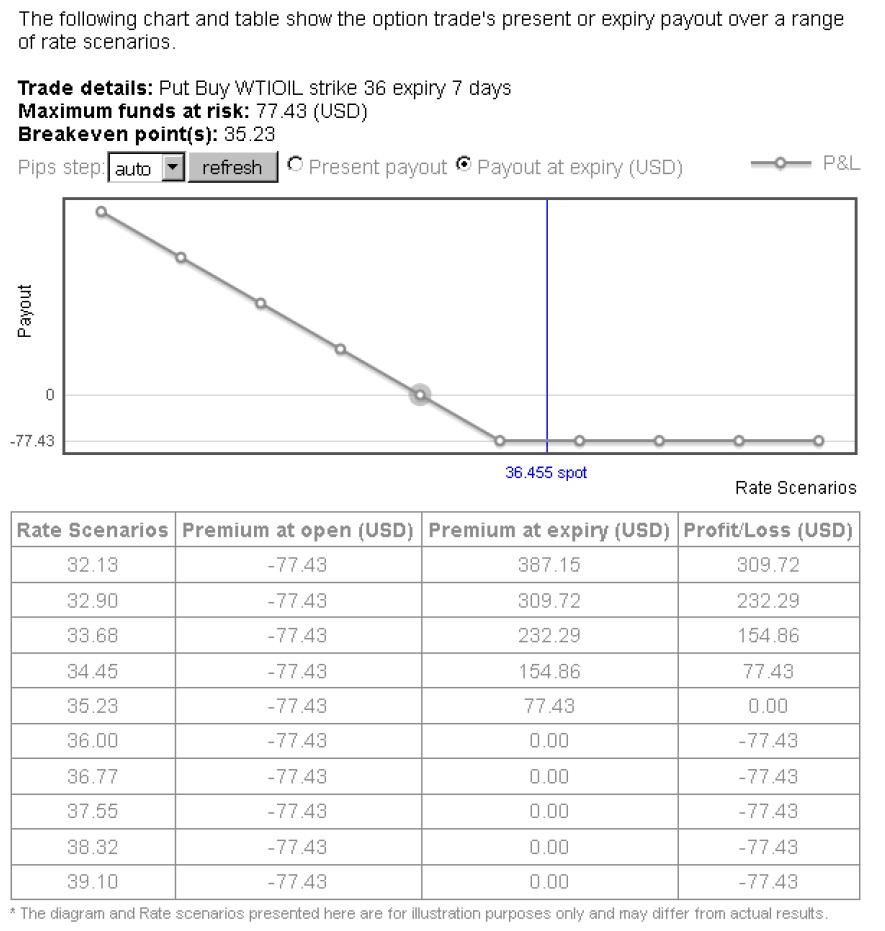

If you think WTI Oil will continue to see its price fall then you may buy Put option, which gives you the right to sell Oil at a preset price (strike) on a preset date (expiry) and for an amount of your choice.

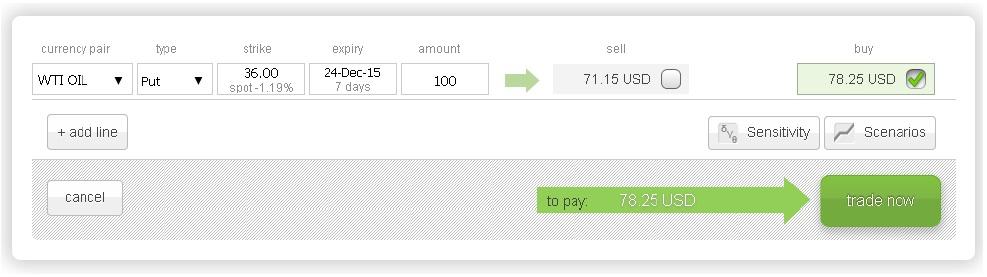

The screenshot below shows that a WTI Oil Put option with a $36.00 strike, 7 day expiry and for 100 barrels would cost $78.25, which would also be the maximum possible loss.

The screenshot below shows the Profit and Loss profile for the above WTI Put option, you can obtain it by clicking on the Scenarios button.

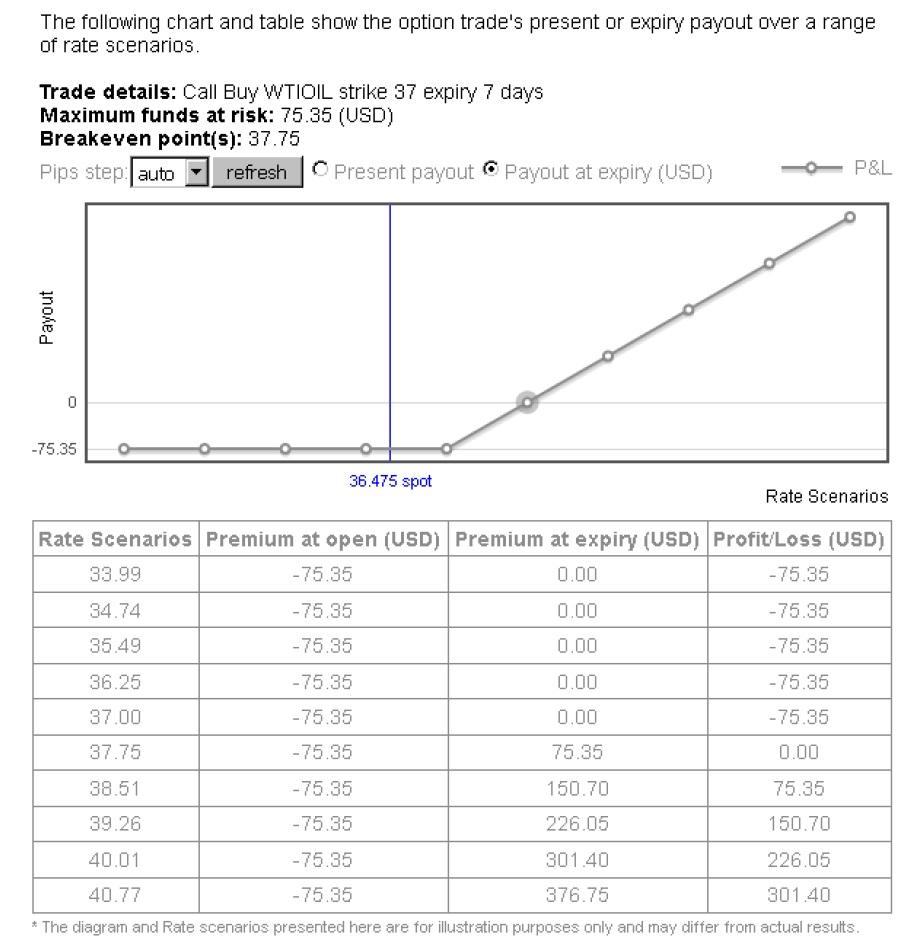

If on the other hand you feel that WTI Oil will turn its trend around and retrace upwards you may buy a Call option, which gives you the right to buy WTI Oil at a set strike, expiry and amount of your choice.

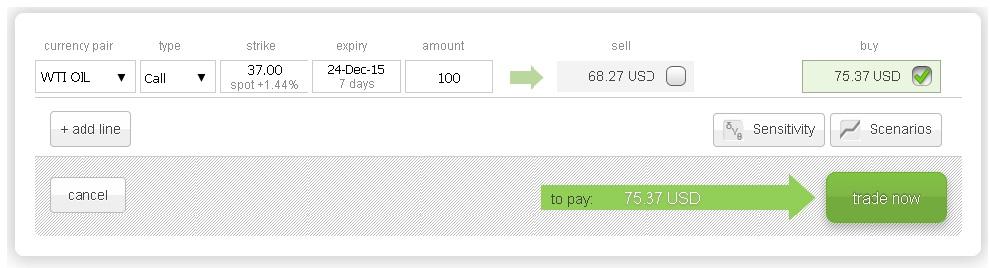

The screenshot below shows a WTI Oil Call option with $37.00 strike, 7 day expiry for 100 barrels would cost $75.37, which would also be the maximum possible loss.

This screenshot shows the Profit and Loss profile of the above WTI Oil Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.