The next few days are filled with important market data releases and on Friday Greece’s payment of 1.5 billion EUR is due. Later today we have the European Central Bank (ECB) rate decision, which is expected to remain at 0.05% and commentary on the EU monetary policy outlook. Tomorrow we have the Bank of England (BoE) rate decision, expected to remain unchanged at 0.5%. On Friday we’ll see Europe's Gross Domestic Product (GDP) figures and U.S. unemployment numbers, one of the most anticipated reports, where 225,000 jobs are expected to have been created in May.

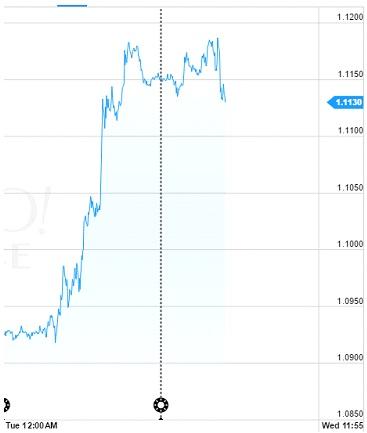

Yesterday the EUR/USD has traded strongly upward, moving up around 2% and is currently trading at 1.113. See graph below:

Chatter in the market suggests the strong move is due to advanced Greece talks towards a deal and also the Dollar index weakness as slower than expected market growth looms.

The future direction of the pair this week may be driven by the data and its volatility is expected to remain high. Today volatility is around 15% for a 1 week at-the-money option, which means near a 1% daily average move in the underlying, and it may increase towards the end of the week.

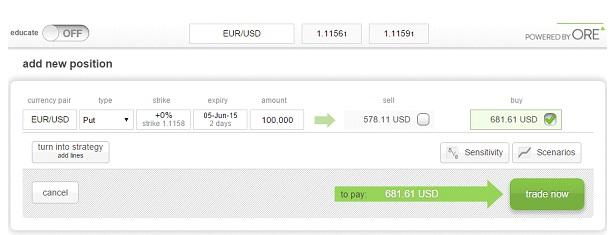

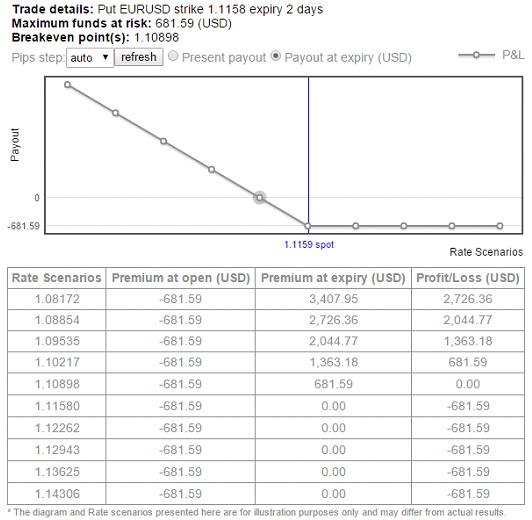

Below is an example of a long Put option trade, with an ATM (at-the-money) strike rate and a 2 day duration to expire Friday, June 5th. Using the scenario tool, you can view your profit or loss over a range of EUR/USD rates at expiry. For example, if the pair trades back down near yesterday’s levels, at 1.095 you will be in profit of 200%. If the market stays in place or trades higher, you maximum loss will equal the premium, in the example that is $681.

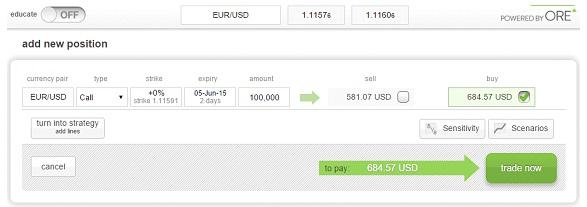

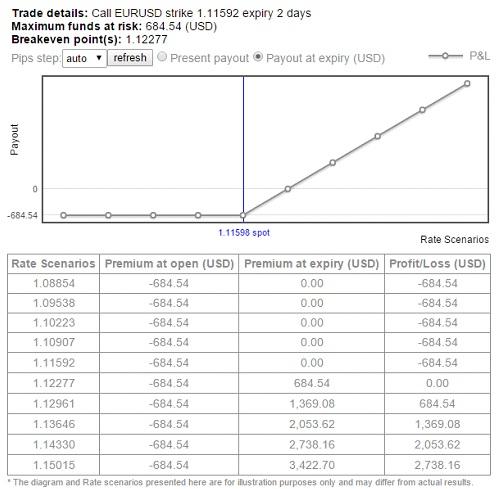

If you expect the pair to continue its rally, view below an example of a long Call option with the same parameters as the Put option example. In this example, if the pair trades at 1.1300 on expiry, you’ll be in profit of over 100% on your open premium.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.