Tomorrow there is the release of the U.S. GDP, expected at 1.0% and the interest rate decision, expected to be unchanged at 0-0.25%. Thursday there is the release of the Euro zone Consumer Price Index (CPI) expected at 0.0%.

EUR/USD has seen some swings this month, ranging between its highs on April 6 at 1.1028 and lows on April 13 at 1.0527 as seen in the graph below.

If you believe these next few days will continue to be volatile, a popular voatility strategy is a long strangle. The strangle is very similar to the straddle with one difference, the strikes of the options. In a straddle, you purchase both a Call and a Put with the same strike and in a strangle, similarily you purchase a Call and a Put bu t they have different strikes andthe strikes are OTM (out-of-the-money. This means the Call will have a strake that is higher than the spot market and the Put will have a strike that is lower. This results in lower cost to buy the stratgy compared with a straddle.

You can trade this position on MT4 using ORE option symbols or on the ORE web solution, OPTIONSREASY.

The position with the MT4 symbols:

BUY symbol C#EURUSDw+2, with strike = 1.0915

BUY symbol P#EURUSDw+0, with strike = 1.0815

By purchasing both these options, you are creating a strangle that will expire Friday, May 1st.

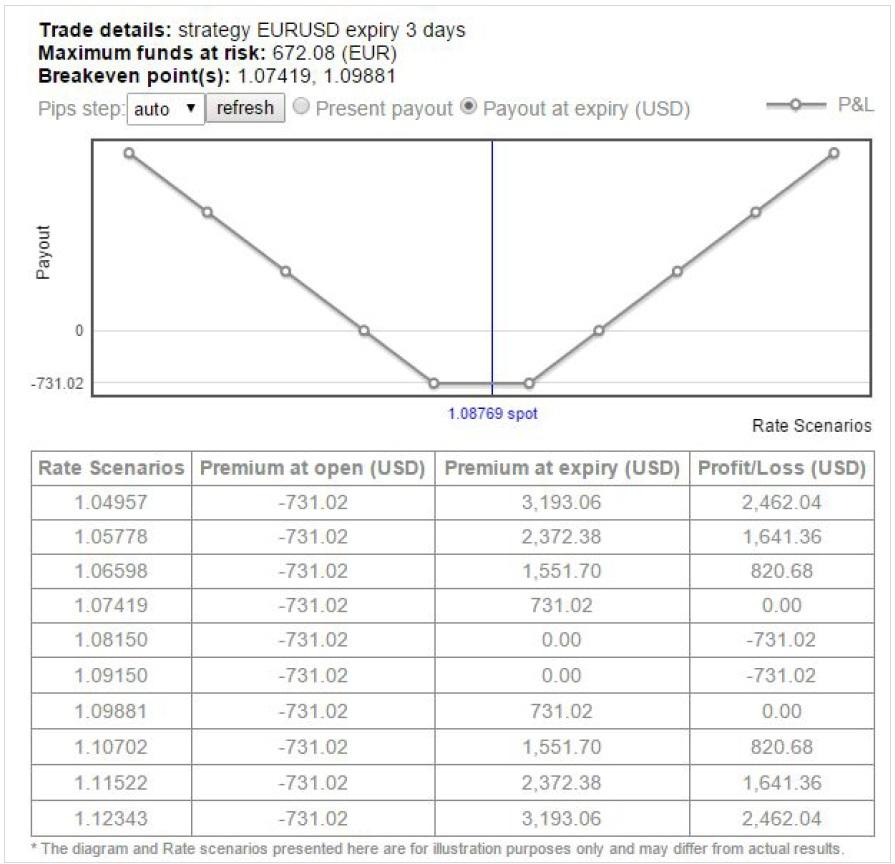

The graph below shows the strategies profit or loss at expiry over a range of EUR/USD rates. The total cost of this position of an amount of 1 lot (100,000 EUR), at the time of writing = $731.

If the market trades back to its month highs, the position will profit $400, more than 50% of its value at open. You will also receive a profit if the market trades down below 1.0741. If the market does not move out of the range 1.0741 - 1.0988, you will make a loss with maximum risk $731.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.