EURUSD

Unofficial news on the ECB QE of 50Billion Euro a month were reported yesterday and are in line with expectations but other than the QE size, conditions of the QE are no less important.

If the QE figure will differ to the upside from current expectations and yesterday’s rumors, volatility will spike and the currency is most likely to trade down towards the 1.1500 mark. If the QE is in line with expectations or is lower, the currency is most likely to remain within current range but the pair’s volatility will be left to QE conditions. We don’t expect to see an out of range strengthening for the EUR since we also have the Greece elections coming up on Sunday, leaving all EUR related trades under pressure.

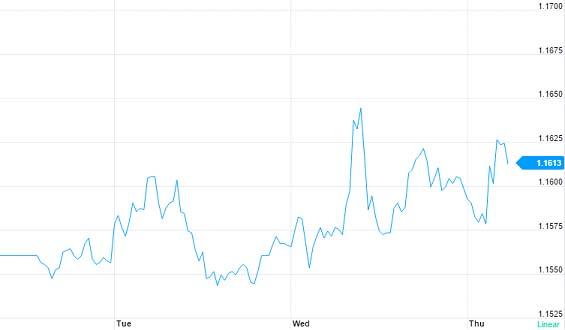

Below you can view this week’s movement chart of the currency now trading at 1.1613.

EURUSD support levels are seen at 1.1425-1.1440 and resistance levels are 1.1665-1.1680.

It feels like there’s more weakening room for the EUR vs USD but also much of the news to be released might already be priced in the market, making a strangle strategy more attractive than a simple Put option on the EURUSD.

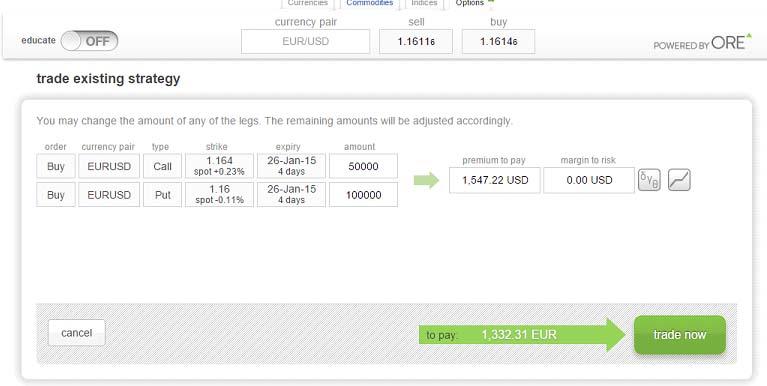

I have created a strangle position that is stronger to the downside, meaning it will profit more if the currency pair trades down. The strategy consists of both a Call and a Put but in this case the amount of the put is twice the amount of the Call, 100K vs 50K. The strategy is to expire on Monday, post the Greece elections taking place on Sunday. If today’s events effect the pair strongly and you encounter immediate profit, consider closing the position prior to expiry.

Below you can view the build of both legs of the strategy:

You can also view and trade this strategy in the ORE Marketplace under the name “ECB strangle”.

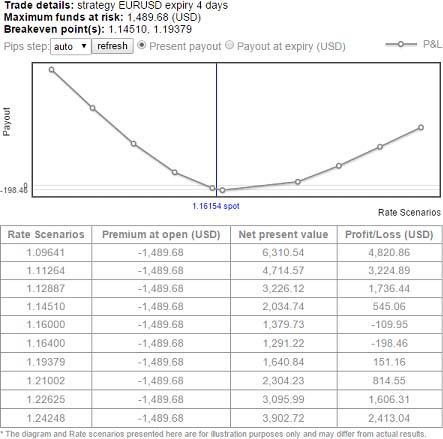

For better understanding of the rate scenarios, view graph below. The payout described is the present payout. You may view the payout on expiry in the marketplace. Notice that if the pair trades to its near support level of 1.145 today, you will profit 30% of your $1547 premium paid.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.