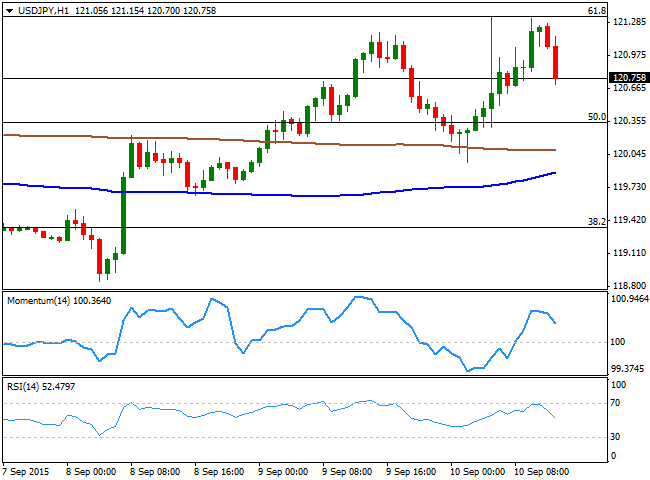

USD/JPY Current price: 120.75

Capped by critical Fibonacci resistance. Stocks fell in Asia, with the Nikkei 225 giving back some of the wild advance posted on Wednesday, and weighing on the Japanese yen. The USD/JPY pair spiked to a daily high of 121.33, as lawmakers comments added to equities volatilities. Japan's LPD Yamamoto, who has previously advised PM Abe, called for an extension of quantitative easing in the next October BOJ meeting. Also, Bank of Japan Governor Haruhiko Kuroda, noticed that whilst the economic recovery has been irregular, although conditions are given to reach the 2% inflation target. US tepid data however, is sending the pair back south, having been unable to extend beyond a key Fibonacci resistance, the 61.8% retracement of the latest weekly decline around the mentioned daily high. The 1 hour chart shows that the technical indicators have turned sharply lower from overbought levels, whilst the 100 SMA is slowly advancing far below the current price. In the 4 hours chart, the technical indicators also point for a continued decline in the short term, with a break below 120.35, the 50% retracement of the same decline, favoring a continued slide towards 119.60.View Live Chart for the USD/JPY

Support levels: 120.35 120.00 119.60

Resistance levels: 120.95 121.35 121.80

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.