From the beginning of this month, EUR/JPY was sold-off on every attempt to the upside, facing stiff resistance around the upper band of 140 handle. The cross is seen consolidating largely tracking the side-ways trend witnessed in EUR/USD. The shared currency trades in tight range over the past couple of week locked between 1.1080-1.1435 levels. The ongoing Greek saga keeps the euro undermined while a streak of upbeat US fundamentals boosts the US dollar, exerting additonal pressure on the EUR/JPY cross.

In today’s trade so far, EUR/JPY dropped nearly 100 pips from 140.03 highs mainly driven heavily offered EUR/USD after Monday’s Euro group meeting failed to deliver any conclusive results over Greek debt repayments ahead of June 30 deadline. More so, Goldman Sachs comments on EUR/USD further fuelled the downslide in EUR/JPY. Gold man Sachs said earlier on Tuesday that the European Central Bank’s (ECB) quantitative easing program will send the currency toward parity against the greenback, even in the event of a debt deal for Greece. However, the losses were restricted somewhat by a weaker yen versus the US dollar as traders favoured the buck ahead of a batch of crucial US economic data.

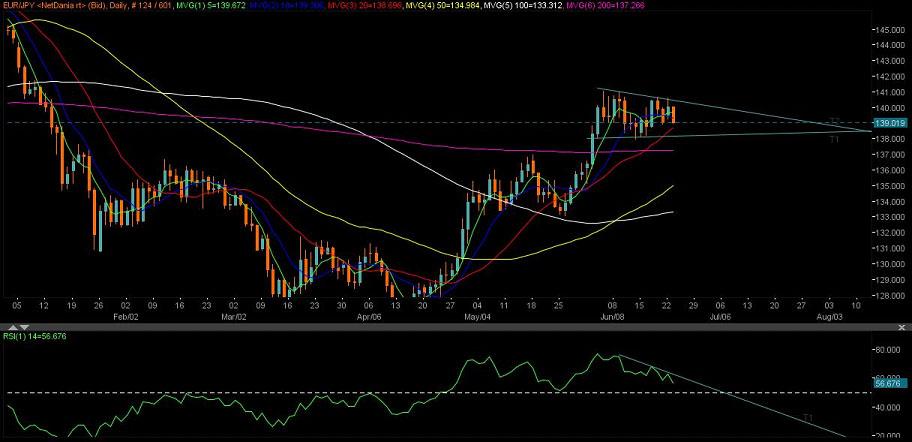

Technically, on the daily chart, EUR/JPY trades in a descending triangle formation with 140.60 levels acting as a strong resistance zone. The cross has breached the key support area around 139.25-139.30 where the 10-DMA and 20-DMA converge. At the moment the pair trades in red around 139 barrier, having printed fresh session lows at 138.92 levels. The daily RSI hovers around 55 and aims sharply lower supporting the case for further downside. Moreover, negative price-RSI divergence can be seen on the daily charts which also signals that EUR bears may remain in control, dragging the pair lower for a test of 138 barrier, below which the next support lies at 200-DMA located at 137.21 levels.

Fundamentally, the USD bulls have jumped back into the bids, pushing the greenback higher across the board. The greenback is rallying on continued signs that the rebound in US economic growth momentum is being sustained. The latest US home sales showed a better-than-expected performance in sales activity in May, up 5.1% on a monthly basis.

Hence, the absolute US dollar dominance keeps EUR/USD pressured below 1.13 handle while the looming Grexit fears after the optimism streaming from the latest round of talks between Greece and its lenders faded as technical talks between both the parties are likely to continue this week. Markets seem to have lost interest in t this ongoing Greece drama and view every rise near 1.14 handle as a good selling opportunity.

While analysts at Rabobank believe, “From the fundamental point of view, it is important to emphasize that the euro has become a funding currency, which means that it tends to weaken when demand for risky assets improves and strengthens when risk aversion increases (this explains why EUR/USD has been performing rather well despite the Greek saga)."

Looking ahead towards US session, traders are keeping an eye out for May’s durable goods release new home sales, and manufacturing data due to be reported later today. US durable goods orders data expected to show a 0.6% rise in core orders last month. While new home sales data is forecast to show a 524,000 rise in sales last month, gaining on April's 517,000.

A preliminary manufacturing gauge reading for the world's biggest economy is also due to be released on Tuesday, and markets are predicting a stronger performance for the sector this month. Hence, the US dollar is expected remain strongly bid ahead of a number of macro releases to be released later in the US sessions which is likely to add to the greenback’s strength.

Also, markets await the third estimate of the first-quarter US GDP growth scheduled for Wednesday while PCE Inflation figures will also be watched in order to confirm the recent strength in the US dollar.

While Greece headlines later this week will also be monitored as traders await the final conclusion on the Greek debt obligations ahead of its June 30 dead line. However, markets believe that any gains seen in EUR/USD on Greek hopes are expected to be short-lived as the monetary policy divergence between the Euro zone and the US is likely to keep the euro pressured. Overall, it’s expected that EUR/JPY is likely to maintain an offered tone this week mainly driven broad euro weakness. While EUR/JPY seems capped at 200-DMA as the yen softness on the back of broadly stronger USD is expected to keep the downside cushioned.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.