The common currency ticked higher across the board since the beginning of the current month, largely on account of the rise in the German Bund yields and broad based USD weakness seen post Non‐farm payrolls report released last Friday.

The EUR/JPY pair jumped from 135.00 to print a high of 141.04 last Thursday. A minor correction to 139.00 was once again followed by fresh bids, which took the pair back to 141.00 levels. However, the pair failed to extend the rally over and above 141.00 and fell back to 139.00 levels as the Bank of Japan governor Kuroda expressed a low possibility of a further depreciation in the Yen’s REER. His comments triggered a broad based rally in the JPY, pushing the EUR/JPY pair well below 139.00 levels.

As of now, the pair is trading at 138.90 levels. The pair could drop to 137.10 (200‐DMA) ahead of the FOMC meeting next week as–

Bund rout likely to halt ‐ The German 10‐year Bund yield rose above 1% on Wednesday, its highest since September 2014. The markets had begun speculating about the ECB’s QE program back in September 2014, due to which German Bunds and the bonds across the Eurozone plummeted to record lows. The ECB finally began purchasing bonds worth EUR 60 billion per month from March. 9, post which a bond market rout pushed the 10‐year German yield from the record low of 0.049% to a high of 1.05%. Consequently, buy the rumor, sell the fact trade could have completed and we are likely to see the 10‐year yield stabilizes in the range of 0.8%‐1.00%. Hence, the markets could once again focus on the rate outlook and ditch the EUR.

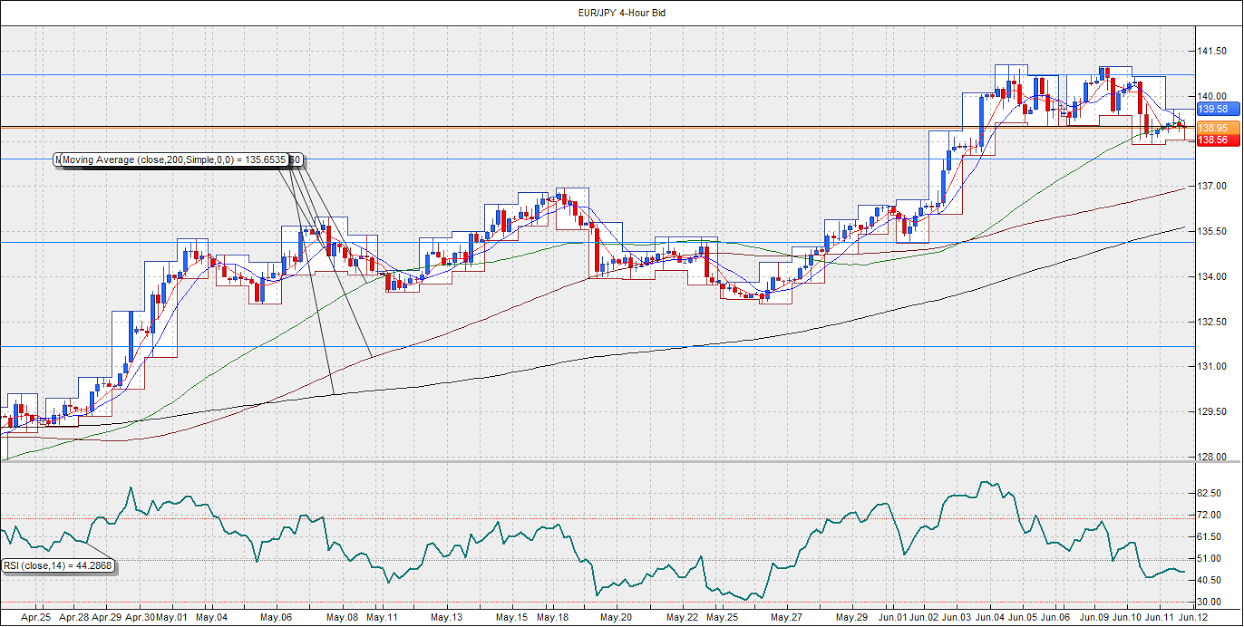

On 4-hour chart - Double top breakout

1. The pair faced rejection, twice around 141.00 levels. On the daily closing basis, the pair failed twice to close above 61.8% Fib R of 149.76‐126.08 located at 140.70.

2. On the 4‐hour chart, the double top breakout was seen in the previous session, although the pair bounced back above the neckline at 139.01 only to break below the same in the US session today.

3. The daily RSI has turned lower from the overbought zone with a bearish divergence, while the hourly and 4‐hour RSI indicate more losses to come.

4. A close below 139.01 of the current 4‐hour candle shall open doors for a double top breakout target of 137.00‐137.10 (200‐MA).

5. The immediate support is seen at 137.92 (50% Fib R of 149.76‐126.08), followed by a major support at 137.10 (200‐DMA).

6. The bearish outlook would be at a risk in case the pair sees a break above 140.00. However, only a daily close above the same would confirm further bullishness in the pair.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.