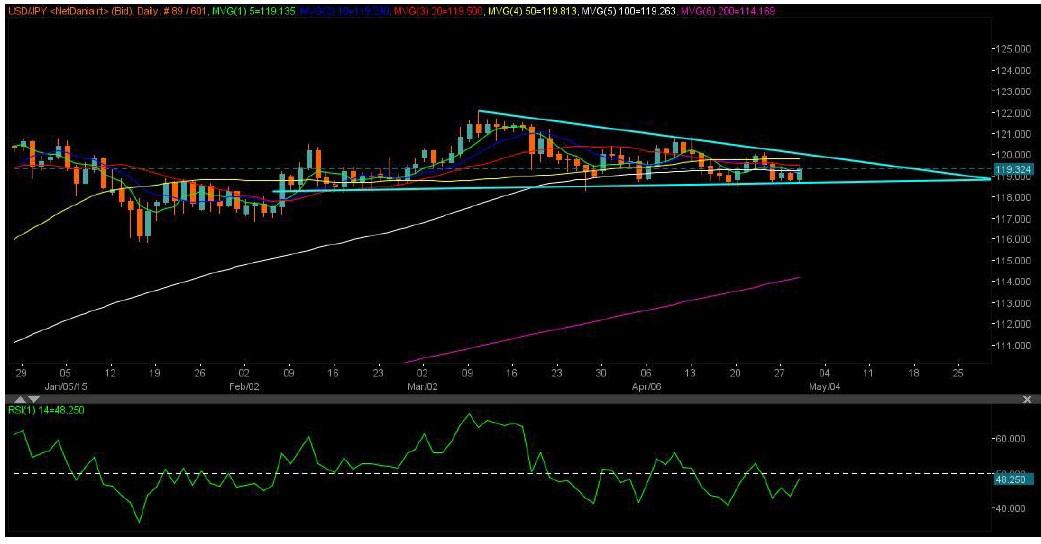

USD/JPY continues to move within a 300 pips range over the past month with 120.50 posing as a strong resistance and 118.50 as a major support. Despite the broad weakness seen in the US dollar over the past two weeks following the recent streak of weak US macro data, the USD/JPY remains well contained in the range with the pair bouncing‐off 118.50 support on several occasions. Narrowing down to this week, the pair extends its side trend in an extremely slim range with the strong support emerging around 118.80 ‐118.75 zone.

The US dollar index, which measures the relative performance of the greenback against six major currencies, was heavily offered this week after softer US services PMI reading and consumer confidence data which deferred Fed rate‐hike expectations to September than previously anticipated June rate lift‐off.

In the day ahead, all eyes are set on US GDP figures and FOMC statement which may have major impacts on the pair. At the moment, USD/JPY trades higher by 0.32% at 119.25 levels, witnessing a sharp rebound from 118.76 lows.

Technically, on daily chart, the USD/JPY pair is seen trading in a descending triangle formation with the upside capped by trend line resistance around 120.10 and the downside cushioned by critical support circa 118.80 levels. From the chart, it can be also inferred that sellers are exhausted at lower levels, unable to break below the strong support, and hence may prefer to exit their short USD positions ahead of FOMC and BOJ monetary policy decision.

This logic seems to hold true at the moment, as USD/JPY has swung back higher above 5‐DMA located at 119 levels and holds above the crucial resistance‐turned support at 100‐DMA located at 119.23 levels. The pair hovers near 119.36 highs, heading towards immediate resistance at 20‐DMA placed at 119.52 levels. Subsequently, we may even witness a test of the next resistance zone around 120.10 levels on extended USD short squeeze. More so, the daily RSI at 47.66 aims higher and strive to regain the bullish territory suggesting more room for upside.

On the weekly chart as well, the ascending triangle formation indicates bullish momentum to trigger and the pair may climb higher and test 120.50/80 levels above a break of 120.10. The weekly RSI at 59 also aims higher backing the case for further upside, finally bringing an end to the ongoing side trend.

Fundamentally, we have plenty of key events which may drive the moves in USD/JPY this week.

On the USD‐side of the story, the major highlight for today’s trade remains the US Q1 2015 GDP numbers and the FOMC statement to be released on the conclusion Fed’s two‐day monetary policy meeting which began on Tuesday.

First quarter advance estimate GDP is expected to show annualized +1.0% growth vs. +2.2% expansion seen in the in fourth quarter. US GDP report is due to be released at 12.30GMT.

While all eye will be set on FOMC decision due to published at 18GMT. The Fed is likely to downgrade the assessment of growth, but strike a more confident tone on the inflation outlook and drop any remnants of date‐based guidance on the policy rate, with the FOMC entering a fully datadriven mode. Hence, the Fed should confirm the neutral stance and keep the "data‐dependent" language, while traders are under pricing September's rate hike.

Adding to this, the longer and shorter duration US treasury yields rebounded, with 10‐yr yields at 2% and 2‐yields at 0.571%, both gaining 1.50% and over 2% respectively on the day which signals that the Fed could sound little less dovish this time which may eventually boost the USD bulls.

Meanwhile, markets seem to have already priced‐in a weak US GDP number and a delayed Fed ratehike stance which is clearly reflected in the recent downslide in the US dollar.

Chief Analyst at Danske Bank Lars Christensen believes, “We still see potential for renewed USD buying in particular on the back of tonight’s FOMC meeting where we believe that the FOMC will downplay the recent weakness in US data signalling that this was primarily driven by temporary factors.”

“Moreover, the committee will likely also note that inflation has stabilised lately, which in our view should reinforce market’s rate hike expectations”.

Chief US economist at Capital Economics Paul Ashworth notes. "A September lift‐off is the marginal favorite, but June and July are possibilities, if it becomes clear quickly that the slowdown in Q1 was a temporary weather‐related blip rather than something more serious."

On the JPY‐side of the equation, Bank of Japan’s (BOJ) monetary policy statement to be released on Thursday followed by the press conference will be closely eyed, as the pair may also receive fresh incentives from the decision.

Its wide anticipated that BOJ tomorrow will not bring in any new surprises, leaving its monetary policy unadjusted.

Lars Christensen, Chief Analyst at Danske Bank explains, “We do not expect the BoJ to announce any new easing measures in connection with the meeting but the statement will probably be softer in light of the recent weak data”.

“In our view, an unchanged policy from the BoJ is broadly priced in the market and thus should not lead to further JPY buying”.

“Hence, risks are probably skewed to the downside for the JPY if the BoJ surprises or if the statement is softer than expected”.

Hence, diverging monetary policy outlook between the US and Japan ahead of their respective monetary policy decisions continue to weigh on markets, supporting the USD/JPY pair.

To conclude:

Given the above factors at play, technical and both macroeconomic, we expect USD/JPY to break its side trend and finally rise to 120.10 levels and beyond that may test 120.50/80 resistance zone. To the downside, 118.80/60 support zone is expected to hold. In case of a breach of those levels, the pair may extend decline to 118.30. A break below that level, USD bears are likely to take over, putting an end to the recent bullish momentum seen in USD/JPY, drowning the pair to 117‐116.50 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD keeps the constructive tone near 1.0800

EUR/USD started the week in a positive note amidst the Dollar’s inconclusive price action, altogether motivating the pair to attempt a move to the proximity of the 1.0800 region, where the 200-day SMA also converges.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

Stagflation warning: Service economy contracts as prices rise

In another stagflation warning sign, the U.S. service sector contracted in April even as service prices rose. The Institute for Supply Management's non-manufacturing PMI dropped to 49.4 in April, dipping from 51.4 in March.