Japanese Yen steady as markets eye Nonfarm Payrolls

-

ECB warns against BoJ normalisation.

-

Yen improves after verbal intervention.

-

US nonfarm payrolls projected to fall to 190,000.

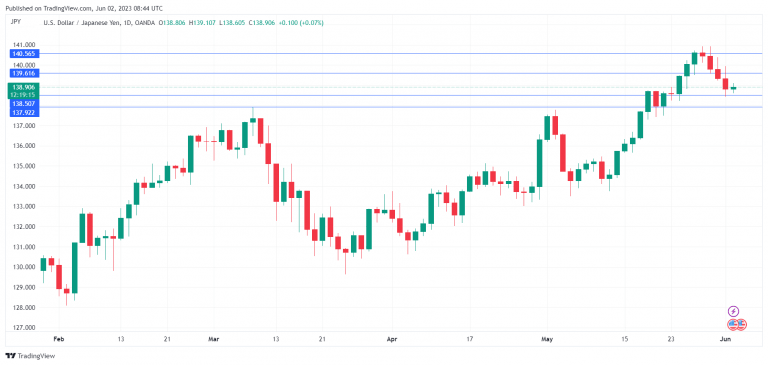

USD/JPY is steady on Friday, trading at 138.95, up 0.11%. The yen has posted four straight days of gains and is up 1.1% this week.

The yen has rebounded, after coming close to the 141 line on Tuesday. Much of the yen’s improvement is due to verbal intervention, as Tokyo reacted sharply to the yen’s downswing. Masoto Kanda, Japan’s top currency diplomat, warned on Tuesday that Tokyo would “closely watch currency market moves and respond appropriately as needed” and hinted that currency intervention was on the table if necessary. Japan has intervened previously in the currency markets and would likely do so again if the exchange rate swings too sharply.

There has been growing speculation that the Bank of Japan will begin to normalise policy, and such moves could have a massive impact on the yen. Earlier in the week, the ECB weighed in, warning that policy normalisation could “test the resilience of global bond markets”. It was most unusual for one central bank to comment on the activities of another, and the warning underlies the concern that the ECB and no doubt other central banks have if the BoJ tightens after decades of an ultra-loose policy.

In the US, all eyes are on nonfarm payrolls. The ADP employment report, which precedes nonfarm payrolls, was strong, coming in at 278,000, down slightly from 291,000 and crushing the consensus of 170,000. Investors don’t consider the ADP all that reliable, but there are other indications that the US labour market remains resilient, such as Thursday’s solid unemployment claims report. Nonfarm payrolls are expected to fall to 190,000, following 253,000 prior. If nonfarm payrolls surprises to the upside, it could cement a Fed rate hike at the June 14th meeting. Market pricing has been swinging sharply, with the odds of a pause currently at 76%, according to CME’s FedWatch. Only a week ago, the odds of pause stood at 36%.

USD/JPY technical

-

USD/JPY faces resistance at 139.61 and 140.56.

-

There is support at 138.50 and 137.92.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.