Outlook:

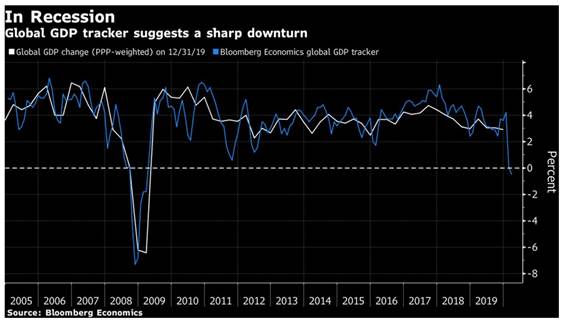

Yesterday we complained about wishful thinking driving equities and oil, but we underestimated the need for relief from anxiety and fear. But risk appetite should be short-lived once markets start getting their arms around two things—the infection rate in countries like India and Brazil, and the extent of the economic damage. According to Bloomberg's new global GDP tracker, this is going to be worse than the 2008 financial crisis. The tracker reading for March shows a contraction of 0.5% and that's hardly likely to be the worst and the end of it. See the chart.

In the US, it looks like our rough forecast of 35 millions jobs lost is not so far off track. The current thinking in 27 million in the two months through end May. See the chart. Today we get the Jolts report, but for Feb. This afternoon we get consumer credit, also for Feb. As before, the relevant data is yet to come for March and April.

The nature of the contract between citizens and governments is under stress, too. Just as governments are supposed to protect citizens in time of war and famine with stockpiles of tanks and oil and grain, the government should have had a stockpile of pandemic-fighting medical supplies. A Bloomberg op-ed says "The U.S. federal government's inadequate stockpiles of N95 respirators and ventilators is not a failure of corporate supply chains or globalization. It's a failure of planning for an emergency, which is the highest responsibility of governments. If we pay our taxes for any one reason, it is to be protected from calamity by our leaders, or at least our technocrats.

"The quasi-black market for protective equipment exists now because of that failure. In normal times, governments are called to build up strategic reserves, whether they be of oil, grains or N95 masks, so that, in an emergency, they can be released to avoid the chaos and inflated prices and profiteering we're seeing now." The problem is not off-shoring medical equipment production to China. It's failure to stockpile it at home. Sometimes governments have to "make markets" to do its job of protecting citizens. We would add that the libertarians who want to keep government out of anything resembling a market would not hesitate to use gasoline from the Strategic Oil Reserve to fuel their cars to get to work. It's a bit of a mystery why they object to stockpiling other goods, especially when the technocrats had predicted a pandemic years ago.

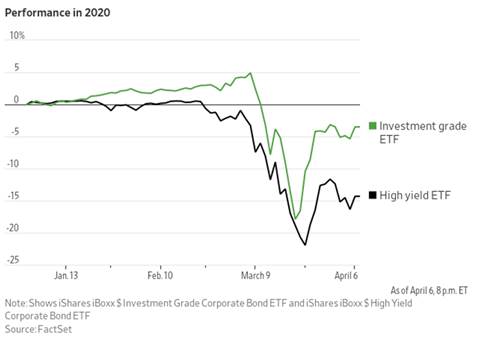

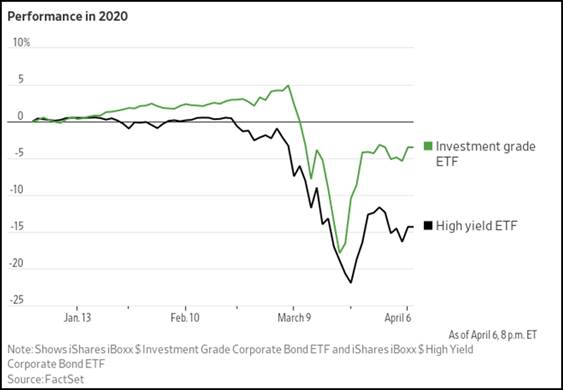

The only Really Good Reason to feel less fearful about the immediate economic future is that the Fed is stabilizing financial markets. It is juggling five or six funding projects all at once, with the small business plan just the latest. One of the other projects was buying investment grade bonds, leaving junk out in the cold because the Fed is constrained as to credit-worthiness. See the chart from the WSJ—it's working.

The WSJ reports "Corporate bonds are among the biggest beneficiaries of the Fed's recent programs. Before the central bank's intervention in March, sales of corporate bonds had come to a virtual standstill, hurt by the tumult rippling across global markets. And investors yanked a record $43.8 billion out of mutual funds and exchange-traded funds tracking high-grade bonds in the U.S. in the week through March 18, according to Bank of America Global Research.

"After the Fed said March 23 that it would launch facilities to buy not just Treasurys but also corporate bonds carrying investment-grade ratings, the corporate-debt market showed signs of stabilizing. Companies ranging from Mastercard to Nike to Pfizer were able to issue bonds at lower yields than their initial guidance, a sign that investor appetite for the debt had improved. Over the following two weeks, companies issued a record $177 billion of investment-grade bonds, according to Dealogic."

Assuming the Fed's stabilization efforts continue and are effective, the US can pull out of the crisis a little more smoothly. Analysts are already talking about what the recovery will look like. We continue to say it's wildly premature to talk about recovery. A couple of days of better news about hospitalizations in New York doesn't mean the pandemic is not going to last and last and last—consider the South. We guess the stock market rally and pushdown on the dollar has at least three days to go, but longer run, reality-checking is inevitable. Gather ye rosebuds.

Tidbit: An FT story yesterday is not related to the pandemic but so much like a story a few decades ago that it's really amazing. That would be Long-Term Capital, bailed out the banking industry at the prodding of the Fed. This time no central banks are involved, but what is similar is big-shot financial institutions having no common sense and bad auditing (aka getting lazy) and getting snookered.

The story is about Luckin Coffee, which defrauded investors by inflating sales. Now Goldman Sachs will grab all the chairman's shares after he defaulted on a margin loan and sell them as ADRs to recoup losses. The lender group to that margin loan includes Credit Suisse, Morgan Stanley and Barclays. Once the company lie was disclosed, the shares fell enough to generate a loss of perhaps $168 million for the lenders by the time they get to sell the shares.

Back to the company, which wanted to beat Starbucks in China—its expansion was funded by "top private equity groups, including BlackRock, Singapore's GIC and Centurium Capital Partners, an investment group founded by former Warburg Pincus China head David Li. Louis Dreyfus." Note it was a short seller who outed the company by hiring people on the ground to look at sales at the shops themselves. But the self-important big boys couldn't be bothered to do that.

The number of ratings downgrades is skyrocketing. Defaults and bankruptcies are sure to follow. The pandemic is going to open quite a few cans of worms. One of those cans is the new New York Fed plus FDIC rule that banks don't have to disclose balance sheets for the duration of the pandemic. The joint paper is titled "Value of Opacity in a Banking Crisis" and uses data from the Great Depression. The idea is that if corporations, hedge funds, PE firms, state and local government entities, and other institutional bank depositors could see the true condition of their banks, they would run for the hills, not to mention holders of the bank's bonds. Individuals would be getting FDIC insurance (on a max of $250,000), but bigger names have amounts at banks that far exceed the insurance limit.

The article on this story is not at the WSJ or the FT, but rather the Wolfstreet newsletter. That tells you something right there.

The Fed and FDIC say that banks having to report the balance sheet information is a tool that imposes discipline in normal times, but these times are not normal. “In a crisis, however, theory predicts that undesirable outcomes can occur if the publication of balance sheet information induces runs on solvent banks. As a result, it may be desirable for regulators to suspend the publication of bank-specific information during a crisis so as to make banks more opaque to depositors.

“Such a policy action prevents depositors from being able to distinguish between banks with stronger and weaker balance sheets, reducing the chance that depositors will run on a weak, but still solvent bank (an inefficient type of bank run).”This is what the New York state regulator did in 1933 and 1934 before the FDIC was invented.

This is, on other words, government complicity in banks lying to the public and institutional depositors and investors. Little children are taught that lying is always Bad.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.