EUR/GBP

The dollar traded higher against almost all of its major peers during the European morning Monday, ranging from +0.13% against CAD to +0.77% vs NOK. The greenback was virtually unchanged against GBP and NZD.

Eurozone’s preliminary CPI rose 0.2% yoy in August, unchanged in pace from the previous month and above market expectations of +0.1% yoy. The core CPI was also unchanged in pace from the previous month and EUR/USD bounced up on the news only to give back all the gains in the following minute. The unchanged CPI rate ahead of the ECB meeting on Thursday counter some of the concerns that the Bank may have to keep QE in place for longer or add to the size of it. We still expect ECB President Draghi to maintain an easing bias and reiterate the Bank’s readiness to use all instruments within its mandate to defend downside risks to price stability. In such case, EUR/USD is likely to move lower. However, we would prefer to see a clear move below the 1.1165 support level to trust further declines.

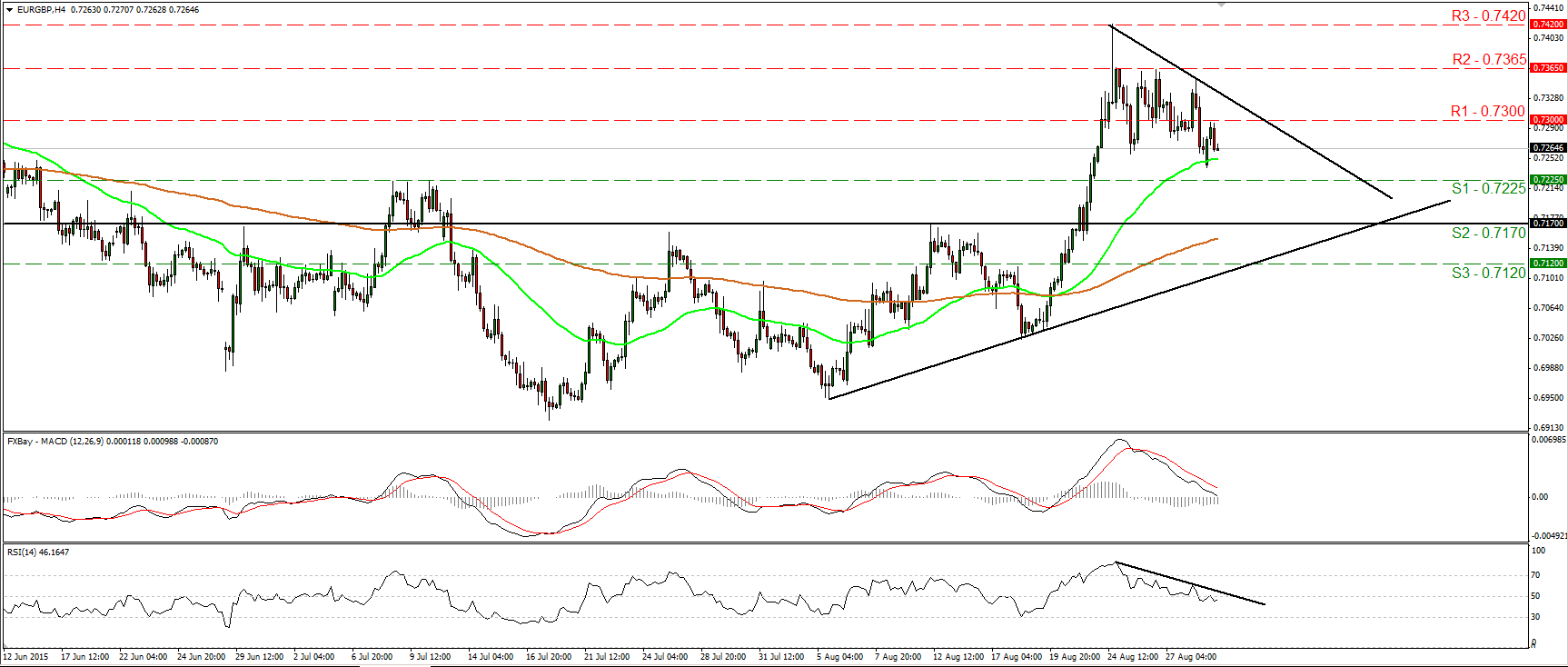

EUR/GBP traded lower during the European morning Monday, after it hit resistance fractionally below the 0.7300 (R1) hurdle. In my view, since the rate is trading below the short-term downtrend line taken from the peak of the 24th of August, I would consider the near-term bias to be negative. Therefore, I would expect the current decline to continue and perhaps aim for the resistance-turned-into-support zone of 0.7225 (S1), defined by the peaks of the 8th, 9th and 10th of July. A break below that zone could set the stage for more bearish extensions, probably towards the 0.7170 (S2) hurdle. Our short-term oscillators support the case that EUR/GBP could trade lower in the short run. The RSI, already below its downside resistance line, fell below its 50 line, while the MACD stands below its trigger line and looks ready to turn negative. As for the broader trend, the move above 0.7170 (S2) signaled a forthcoming higher high on the daily chart and turned the medium-term outlook positive. Therefore, I would treat any future short-term declines as a corrective phase, at least for now.

Support: 0.7225 (S1), 0.7170 (S2), 0.7120 (S3)

Resistance: 0.7300 (R1), 0.7365 (R2), 0.7420 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.