GBP/USD

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against CAD, GBP, NOK, AUD and NZD, in that order, while it was lower vs JPY, SEK, EUR and CHF.

In Germany, the regional CPIs for August generally fell or decelerated on a monthly basis, and decelerated on an annual basis. These figures indicate that the national inflation rate, due out later this afternoon, is likely to be lower on a yoy basis as well. This also increases the likelihood that next week's Eurozone CPI rate is likely to decline. Such disappointing data ahead of the ECB meeting, could add to expectations that the Bank may have to keep QE in place for longer. This may put EUR under selling pressure.

The British pound continued its plunge even after the 2nd estimated of the UK GDP confirmed the initial estimate and showed that economy expanded 0.7% qoq in Q2. The figure was in line with expectations. Strong growth alongside accelerating wages, could encourage hawkish MPC members to join the lone dissenter McCafferty in voting to raise rates. The speech of the BoE Governor Carney at the Jackson Hole Economic Symposium tomorrow will be of a particular interest. We would be looking for any hints regarding the Bank's stance, given the recent developments in China. Any hawkish comments by the Governor will bring forward expectations for a rate hike, and the pound could strengthen. For now I would expect the negative move to continue, at least temporarily.

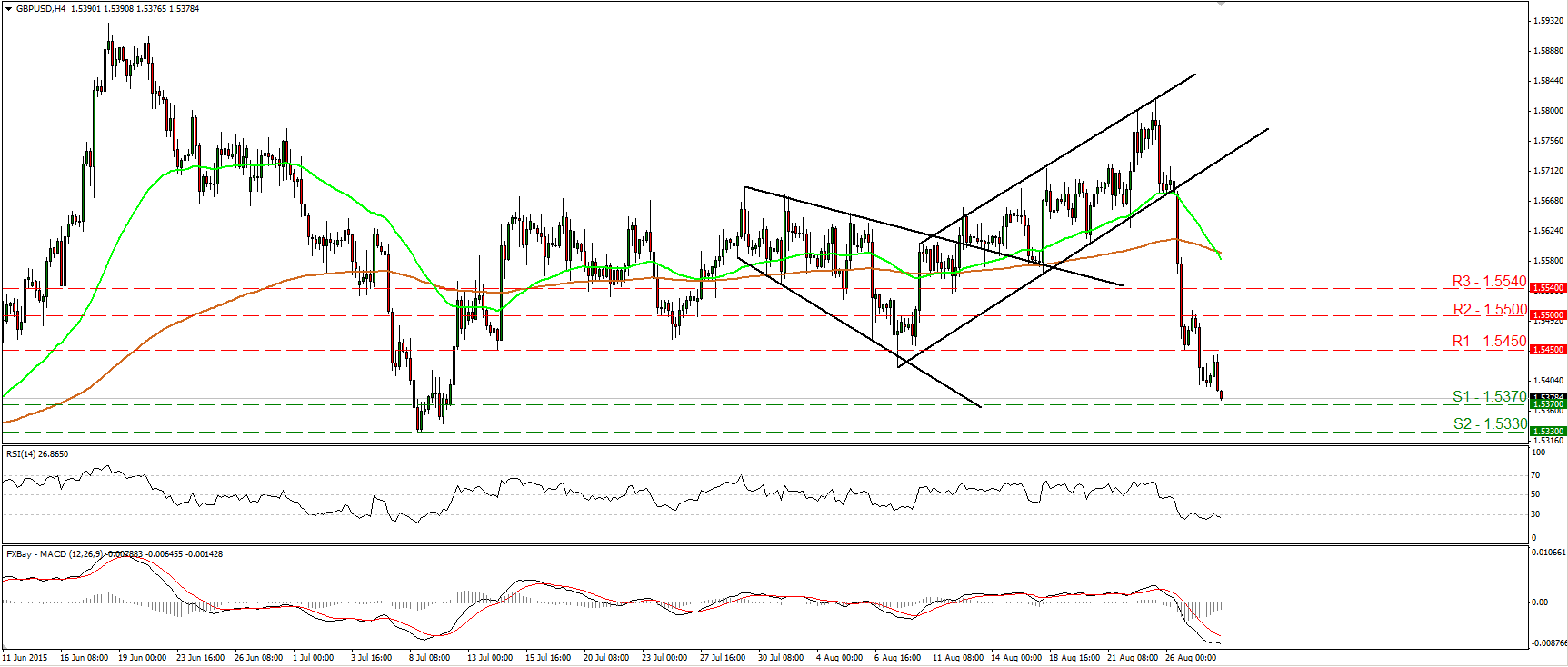

GBP/USD trade lower during the European morning Friday, after it hit resistance marginally below the 1.5450 (R1) hurdle. At midday, the rate is headed towards the support of 1.5370 (S1), where a clear break is likely to target the 1.5330 (S2) area, defined by the low of the 8th of July. Our short-term oscillators detect strong downside speed and support the case that Cable could continue trading lower. The RSI, already within its oversold territory, hit resistance at its 30 line and turned down, while the MACD stands well below both its zero and signal lines, pointing south as well. As for the bigger picture, Wednesday's collapse brought the rate back below the 80-day exponential moving average. As a result, I would change my view to neutral as far as the overall outlook of Cable is concerned.

Support: 1.5370 (S1), 1.5330 (S2), 1.5270 (S3)

Resistance: 1.5450 (R1), 1.5500 (R2), 1.5540 (R3)

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.