GBP/USD

The dollar traded unchanged or lower against most of its G10 counterparts during the European morning Wednesday, ahead of the US ADP report. It was lower against GBP, NOK, NZD and AUD, in that order, while it was virtually unchanged against EUR, SEK, JPY and CAD. The greenback was higher only against CHF.

The British pound weakened a bit after the country’s service-sector PMI disappointed and decreased more than expected in July. Nevertheless, investors overlooked the soft figure and the pound strengthened immediately as market focus remains on Thursday. The Bank of England will release its rate decision, the quarterly Inflation Report and the minutes of the meeting, all at the same time. The first reaction will most likely be on the number of dissenting votes, if any, and later on the new economic forecasts. Market expectations and ours are to see once again two split votes from the most hawkish MPC members, Weale and McCafferty, and if we see another member joining the dissenters this could be noticeably GBP-bullish. Following the tidal wave of the votes, we will shift our focus on the new economic forecasts for signs of further GBP support.

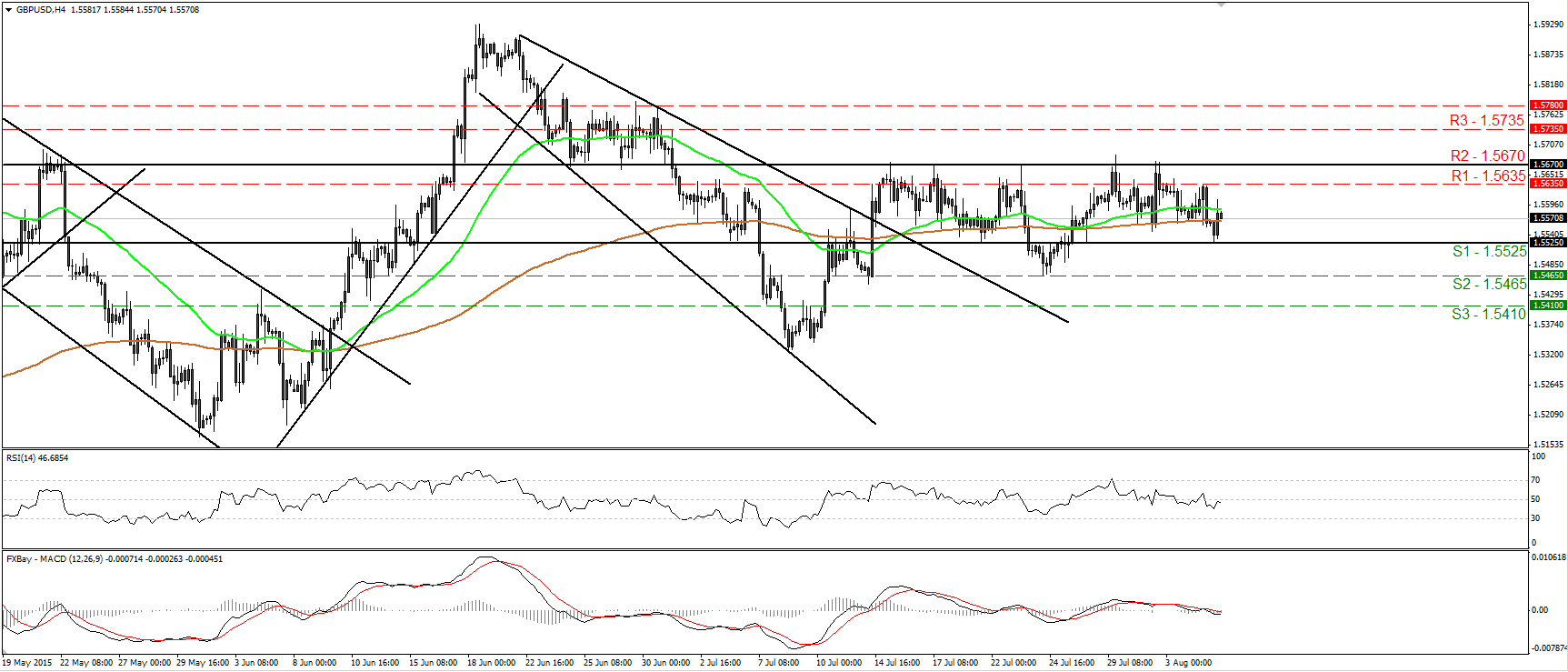

GBP/USD traded somewhat lower during the European morning Wednesday, but hit support at 1.5525 (S1) and rebounded. Since there is no clear trending structure on the 4-hour chart, I would take the sidelines as far as the short-term picture is concerned. Although the rebound could extend higher for a while, I prefer to wait for a break above the well-tested resistance zone of 1.5670 (R2) before I get more confident on the upside. Something like that would confirm a forthcoming higher high and could initially target the 1.5735 (R3) resistance line, defined by the peak of the 1st of July. The RSI has been oscillating around its 50 line, while the MACD stands fractionally below zero pointing east. These indicators corroborate my view to stay flat, at least for now. As for the broader trend, the price structure on the daily chart still suggests an uptrend. What is more, Cable is still trading above the 80-day exponential moving average. These technical signs make me believe that the overall picture remains somewhat positive and that there is still the likelihood for the rate to trade higher.

Support: 1.5525 (S1), 1.5465 (S2), 1.5410 (S3)

Resistance: 1.5635 (R1), 1.5670 (R2), 1.5735 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.