EUR/JPY

The dollar traded higher against almost all of its G10 peers during the European morning Friday. It was higher against NZD, AUD, CAD, JPY, NOK and GBP, in that order, while it was lower vs CHF, SEK and EUR.

Eurozone's preliminary CPI rose 0.2% yoy in July, unchanged in pace from the previous month and in line with market expectations. EUR strengthened however as the core CPI rose 1.0% yoy from +0.8% yoy, above estimates of an unchanged reading. EUR/USD advanced but stayed limited below our 1.0985 resistance level. Given the positive sentiment towards the common currency we could see the rate trading higher in the short run. However, I would prefer to see a clear move above the psychological 1.1000 to trust further advances.

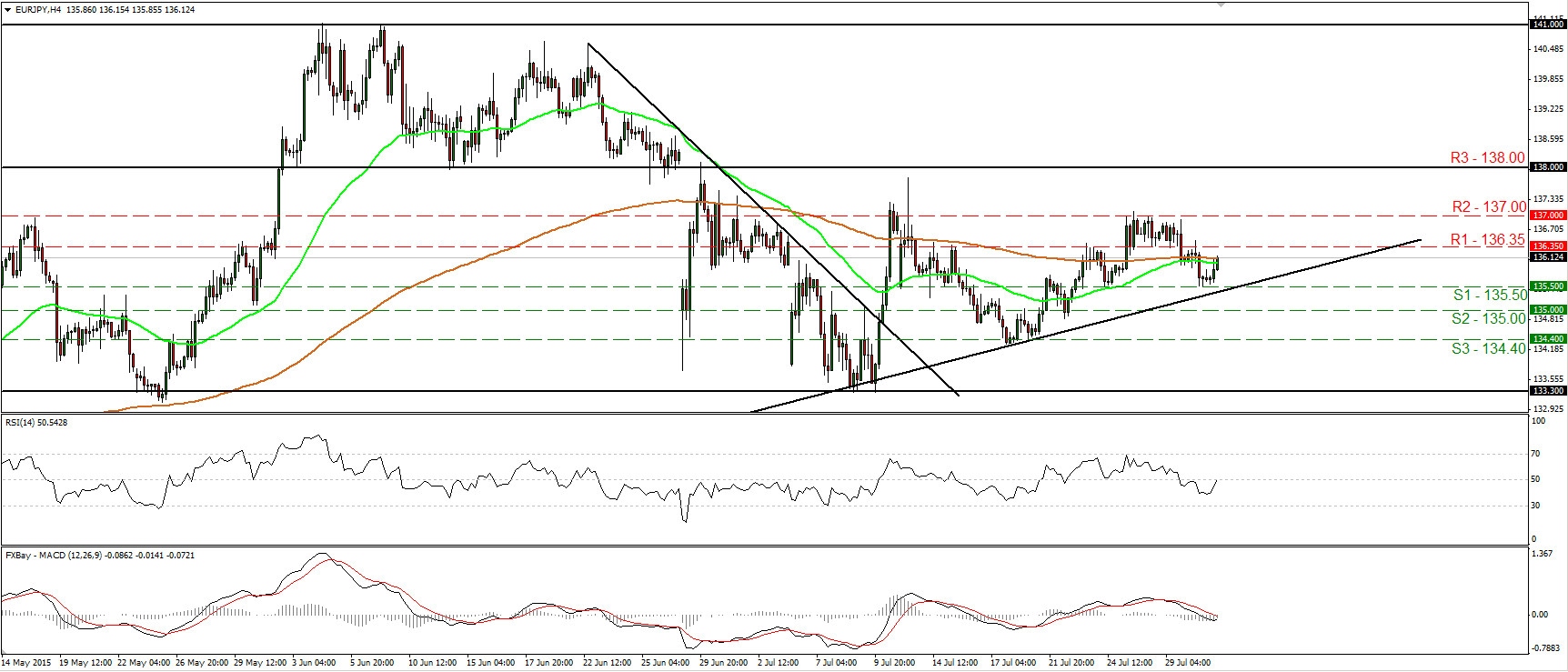

EUR/JPY traded higher during the European morning Friday, after it hit support at the 135.50 (S1) barrier, slightly above the medium-term uptrend line taken from the low of the 14th of April. Taking a look at our short-term momentum indicators, I would expect the positive move to continue. The RSI turned up and just poked its nose above its 50 line, while the MACD, although negative, shows signs of bottoming and that it could turn positive again. A clear move above 136.35 (R1) is likely to confirm the case of further upside and perhaps pave the way for the 137.00 (R2) zone. On the daily chart, the pair is still trading above the aforementioned medium-term uptrend line, and above the 133.30 support area, which stands marginally below the 50% retracement level of the 14th of April – 4th of June advance. As a result, I would see a cautiously positive longer-term picture. I would like to see a daily close below that area before I assume that the medium-term picture has turned negative.

Support: 135.50 (S1), 135.00 (S2), 134.40 (S3)

Resistance: 136.35 (R1), 137.00 (R2), 138.00 (R3)

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.