EUR/GBP

The dollar traded unchanged or lower against its G10 peers during the European morning Monday, reflecting the restrained mood of investors following the Greek banks capital controls heading towards referendum on Sunday. It was lower against EUR, SEK, NOK and CHF, in that order.

In Germany, all the regional CPIs rates fell on a monthly and annual basis in June. In four out of five reporting so far, prices actually fell on a mom basis. These figures indicate that the national inflation rate, due out later this afternoon, is likely to fall as well. This also increases the likelihood that Tuesday's Eurozone CPI is likely to fall. Nevertheless, the market is likely to look through the economic data this week and focus mainly on the Greek referendum and to any opinion polls released ahead of it. Even though the Greek PM urged voters to reject the creditors' proposal, the first polls in Greece showed that most of the Greeks are in favor of a deal.

Nonetheless the Greek dilemma still weighed on the markets. The flight to safety sent bond yields of the core Eurozone economies Germany and France down 8 to 12bps while the yields of the peripheral countries rose 13 to 20 bps. European equity markets were all in the red with the DAX index down around 3%. EUR/USD gained a bit in an attempt to cover the opening gap, but the move stayed limited below the key 1.1145 zone. A break of that territory is needed to see scope for further advances.

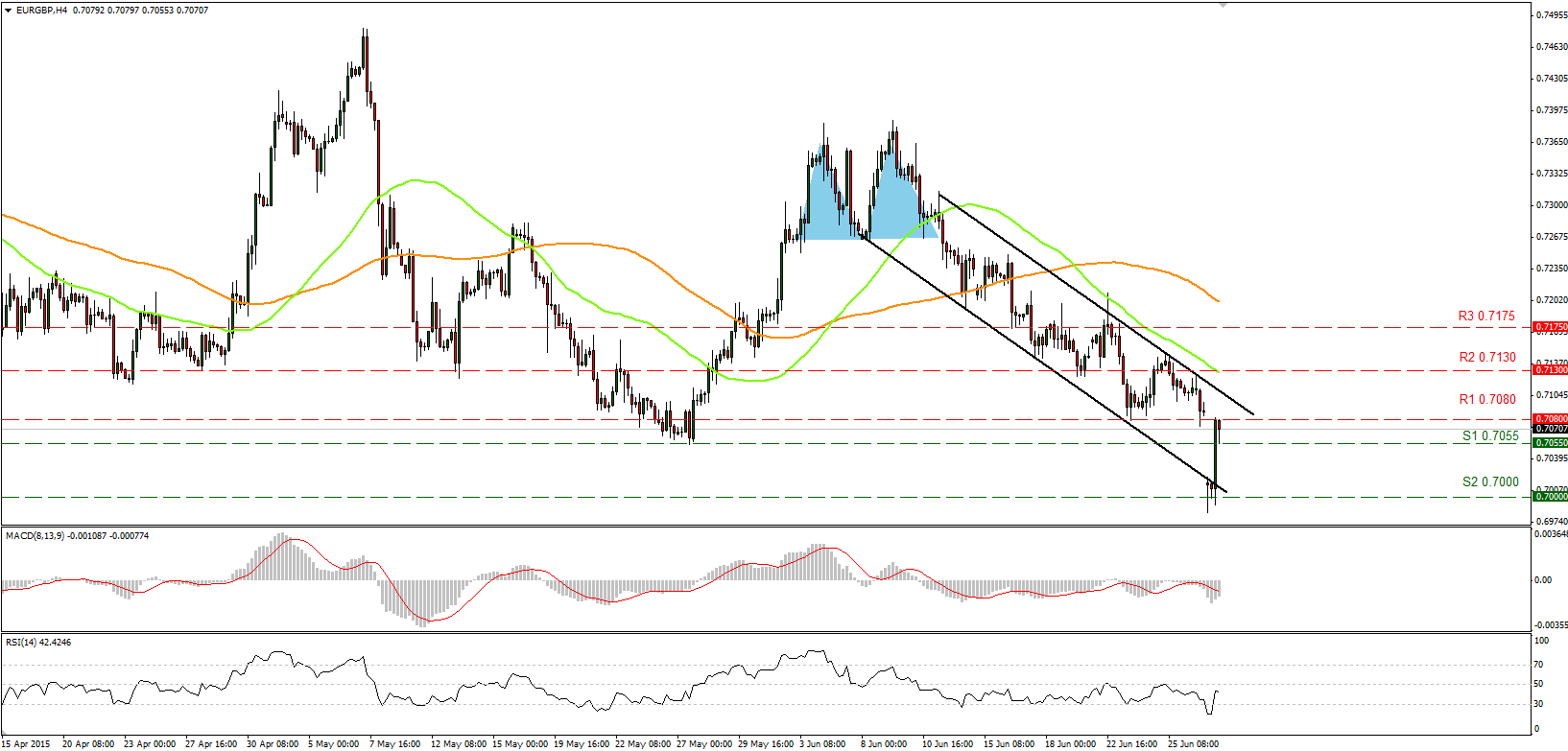

EUR/GBP gapped lower on Monday, dipping briefly below the key psychological number of 0.7000 (S2). The pair bounced back immediately and managed to cover the gap by midday in Europe. Currently, the pair attempts to break above the 0.7080 (R1) resistance line. A break above that hurdle is likely to push the rate higher, for an initial test of the upper boundary of the downslope channel and then perhaps towards our next resistance of 0.7130 (R2). Looking at our momentum indicators, however, further advances may not be immediate. The RSI found resistance fractionally below the 50 line and points down, while the MACD, already in its negative territory, failed to cross above its trigger line, topped and show signs of turning down again. These momentum indicators show a weak upside pace and amplify the case that the advance following the gap lower may have come to an end. I would expect the pair to decline again and challenge the 0.7000 (S2) support area in the not-to-distant future. On the daily chart, I would expect a decisive break below the 0.7000 (S2) line to turn the picture negative again.

Support: 0.7055 (S1), 0.7000 (S2), 0.6950 (S3)

Resistance: 0.7080 (R1) 0.7130 (R2), 0.7160 (R3)

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.