USD/SEK

The dollar gained broadly during the European morning Tuesday, extending its gains following the improved inflation data on Friday and due to expectations of strong US data later in the day. The greenback was ranging from +0.20% against NOK to +0.80% vs JPY, while it was virtually unchanged vs SEK.

The Swedish krona was the only major currency that slipped from the dollar’s strength, after the country’s PPI for April rose on an annual basis. Following the dip of the CPI back to deflation in April, another sign of weakness in prices could prompt the Bank further ease its monetary policy. Therefore, the rise in PPI lessens the probability for further action, at least for now. However, given the Riksbank’s preference of a weak Krona and its ability to act in-between the scheduled meetings, I would consider the recent strength of SEK to be temporary and to provide renewed selling opportunities in the near future.

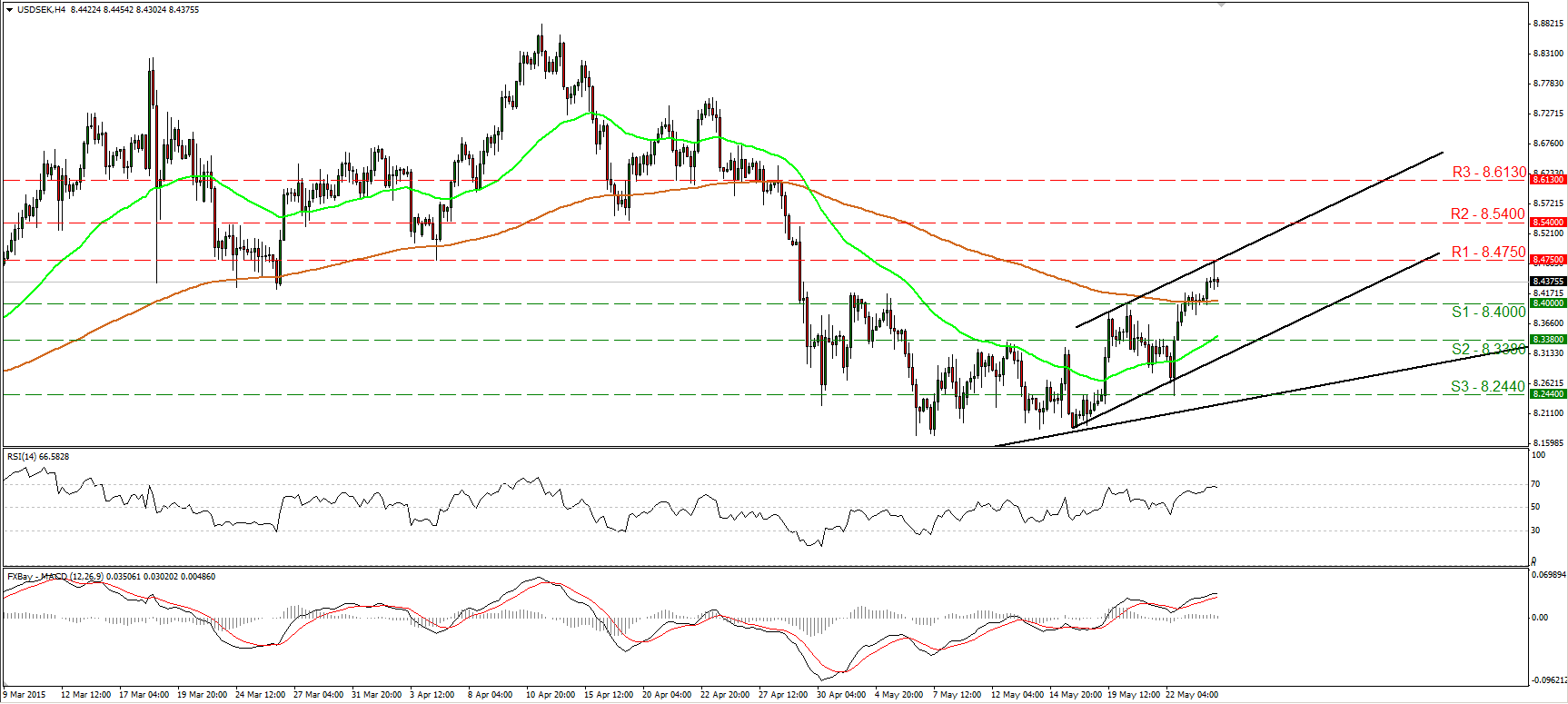

USD/SEK traded higher during the European morning Tuesday, but hit resistance at 8.4750 (R1) and retreated to trade virtually unchanged. The price structure on the 4-hour chart suggests a short-term uptrend as marked by the black upside channel. Nevertheless, given our proximity to the upper line of that channel, I see the possibility that the forthcoming wave could be negative. Our short-term oscillators support that scenario. The RSI hit resistance near its 70 line and turned down, while the MACD shows signs of topping and could fall below its trigger line soon. A break below the support line of 8.4000 (S1) is likely to confirm the case and perhaps challenge the lower bound of the channel and the support barrier of 8.3380 (S2). On the upside, a break above 8.4750 (R1) is needed to confirm a forthcoming higher high and signal the continuation of the near-term trend. Something like that is likely to open the way for our next resistance at 8.5400 (R2). Switching to the daily chart, I see that the 14-day RSI emerged above its 50 line, while the daily MACD stands above its trigger and points north. These momentum signs indicate upside speed and give evidence that the 13th of April – 15th May retreat was just a corrective phase of the prevailing longer-term uptrend.

Support: 8.4000 (S1), 8.3380 (S2), 8.2440 (S3).

Resistance: 8.4750 (R1) 8.5400 (R2), 8.6130 (R3).

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

The EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 on Monday during the early Asian trading hours. The softer US Dollar provides some support to the major pair.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.