EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Friday. It was higher against GBP, JPY and NZD, in that order, while it was lower vs SEK, NOK, EUR and CHF. The greenback was unchanged vs AUD and CAD.

The British pound was the main loser after the country’s manufacturing PMI declined to 51.9 in April from 54.0 previously. The market had expected a moderate rise to 54.6. The sharp decline signals a slowdown in growth. Coming after the weaker GDP growth rate for Q1 announced last week, the decline in the manufacturing PMI is another negative sign that the UK economy is losing momentum. With the UK general elections less than a week away and the opinion polls suggesting a tight finish with no clear winner, the 2 week implied volatility spiked above 14, a level last seen before the Scottish referendum in September. The increased uncertainty is likely to put GBP under pressure and the recent appetite for euros could halt the advances in GBP/USD due to stronger EUR/GBP.

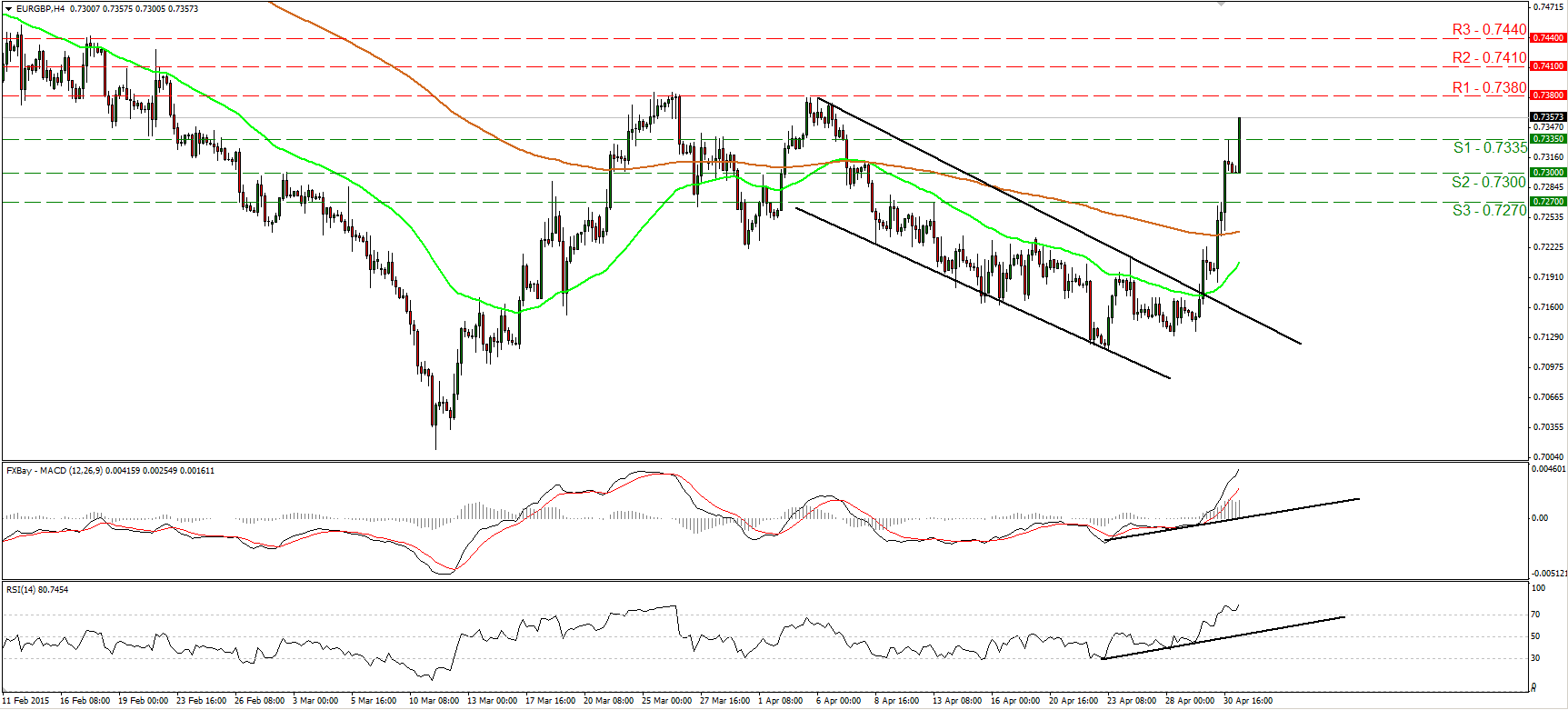

EUR/GBP accelerated higher during the European morning Friday, breaking above the resistance (now turned into support) barrier of 0.7335 (S1). After the break above the downside resistance line on the 29th of April, the price structure has been higher highs and higher lows, and therefore I have switched my short-term view to positive. I believe that we are likely to see the rate challenging the 0.7380 (R1) barrier soon, where a clear upside break could signal extensions towards the next hurdle at 0.7410 (R2). Our short-term oscillators detect strong bullish momentum and amplify the case for the continuation of the positive leg. The RSI already within its overbought zone has turned again up, while the MACD, already above both its zero and signal lines, accelerated higher and keeps pointing north. On the daily chart, the recent rally brings into question the continuation of the larger downtrend. A clear move above the 0.7380 (R1) territory, which stands very close to the 38.2% retracement level of the 16th of December – 11th of March decline, could signal the completion of a possible double bottom formation. That could bring a medium-term trend reversal.

Support: 0.7335 (S1), 0.7300 (S2), 0.7270 (S3).

Resistance: 0.7380 (R1), 0.7410 (R2), 0.7440 (R3).

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.