GBP/USD

The dollar traded mixed against its G10 peers during the European morning Monday in the absence of any major market-moving release. It was higher against JPY, GBP, EUR and CHF, in that order, while it was lower vs SEK and NOK. The greenback was unchanged against AUD, CAD and NZD.

The highlight of the week will be the FOMC meeting on Wednesday. With no press conference scheduled or updated projections, the focus will be on the statement accompanying the decision. We expect the statement to recognize the recent stream of soft US data but to emphasize that the Committee still views the weakness to be partly temporarily. If the Committee downplays the weakness in data and continues to argue for a rate hike, along with better data released over the week, USD could regain its strength.

In the UK, the point of interest will be Tuesday’s 1st estimate of Q1 GDP. The forecast is for the growth rate to decelerate a bit despite the strong industrial production in January and February and robust retail sales figures in Q1. A weak growth figure along with the zero inflation rate and the uncertain political outcome in the upcoming elections could result in rate hike expectations getting pushed back even further, leaving GBP vulnerable.

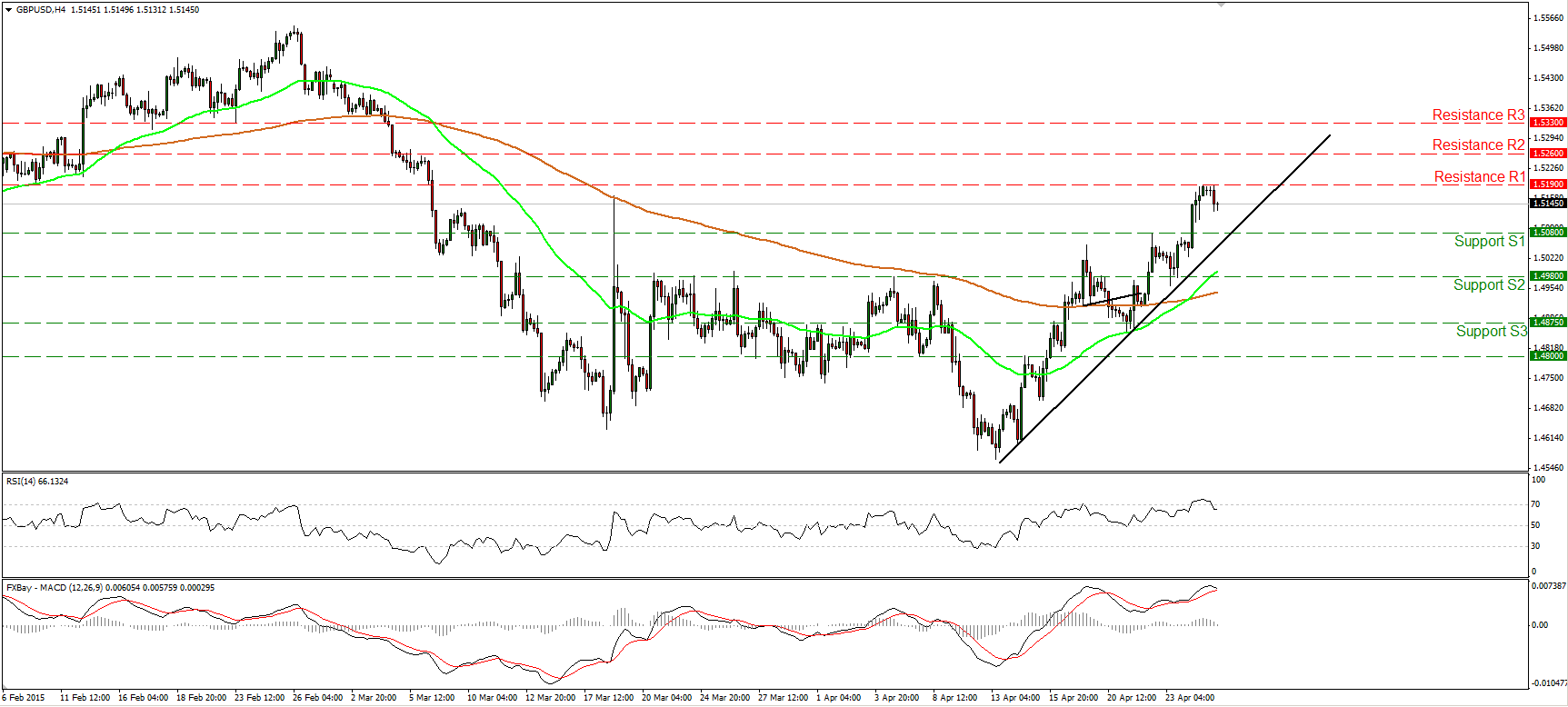

GBP/USD traded lower during the European morning Monday, after hitting resistance at 1.5190 (R1). Although the rate is still trading above the black uptrend line and this keeps the short-term picture somewhat positive, I would expect the retreat to continue ahead of tomorrow’s GDP figure. A weak number could encourage the bears to test the 1.5080 (S1) barrier as a support this time. A move below that hurdle and the aforementioned uptrend line is likely to signal the extension of the bearish wave and perhaps target the 1.4980 (S1) area. Our short-term momentum studies support the continuation of today’s pullback. The RSI exited its overbought territory and is now pointing down, while the MACD has topped and looks ready to move below its trigger line.

Support: 1.5080 (S1), 1.4980 (S2), 1.4875 (S3).

Resistance: 1.5190 (R1), 1.5260 (R2), 1.5330 (R3).

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.