DAX futures

The dollar traded lower against most of its G10 peers during the European morning Friday, ranging from -0.15% vs AUD to -0.80% vs EUR. It was stable only against NZD and JPY.

The German Ifo Business climate index rose for the sixth consecutive month in April, driven most likely by the low energy prices, the lower exchange rate and the ECB stimulus introduced in January. The current assessment index rose as well, in line with the strong ZEW survey released earlier this week. On the other hand, the expectations index declined a bit in line with the decline seen in the ZEW expectation index on Tuesday, possibly reflecting concerns over Greece. Besides that, if the current situation is so improved, there is less reason to expect further progress in the next months. Overall, the strong data suggested that the gradual improvement in German business confidence continues. It also suggests that business investment in Eurozone’s largest economy picked up in Q1 and fuels optimism about an economic recovery. The positive developments from low oil prices and a weaker euro will slowly feed through the real economy going forward and will provide further support to domestic sentiment.

The Nasdaq Composite index closed yesterday at an all-time high of 5056. The index overcame its 15-year-old record close yesterday, which occurred in March 2000, after the dotcom boom. Higher oil prices boosted energy stocks, while solid tech earning reports contributed to the surge. Nasdaq futures continued to rally during European morning Friday, which could hint further rally in the index.

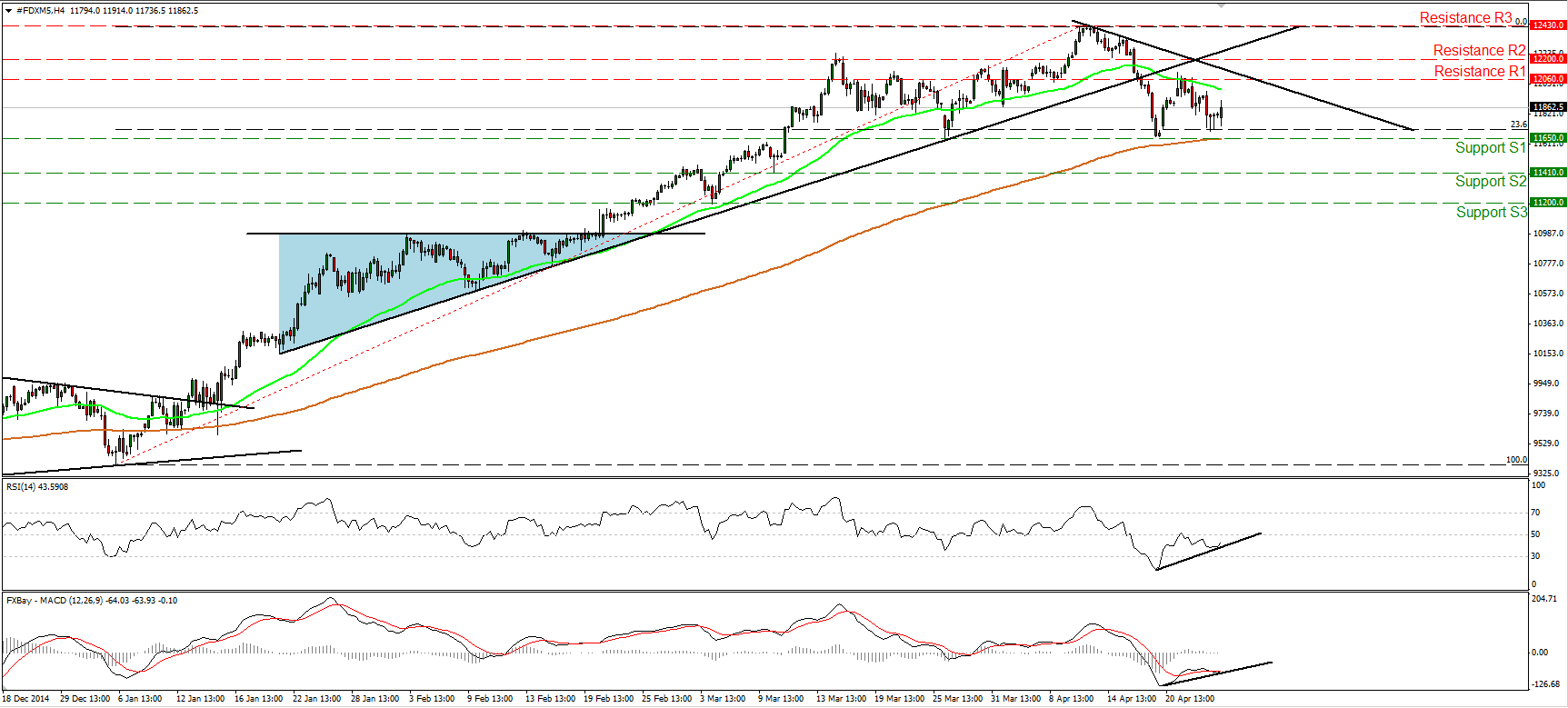

DAX futures traded higher during the European morning Friday, after hitting support slightly above the key support line of 11650 (S1), at the 23.6% retracement level of the 6th of January – 10th of April advance. Although the index is still trading below the uptrend line taken from 21st of January, I believe that the picture is not negative yet. A clear close below 11650 (S1) would be necessary to turn the picture negative. Something like that could pave the way for our next support at 11410 (S2), defined by the low of the 10th of March. Our momentum studies are both rising above their respective upside support lines. What is more, the RSI is pointing up and could be headed towards its 50 line, while the MACD is now ready to cross again above its signal line. These momentum signals give me a reason to take a neutral stance and to wait for a move below the 11650 (S1) hurdle to get confident on the downside. On the other hand, a move above 12200 (R2) would probably signal that the fall from the 10th of April was just a 23.6% correction and could target again the highs of 12430 (R3).

Support: 11650 (S1), 11410 (S2), 11200 (S3).

Resistance: 12060 (R1), 12200 (R2), 12430 (R3).

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.