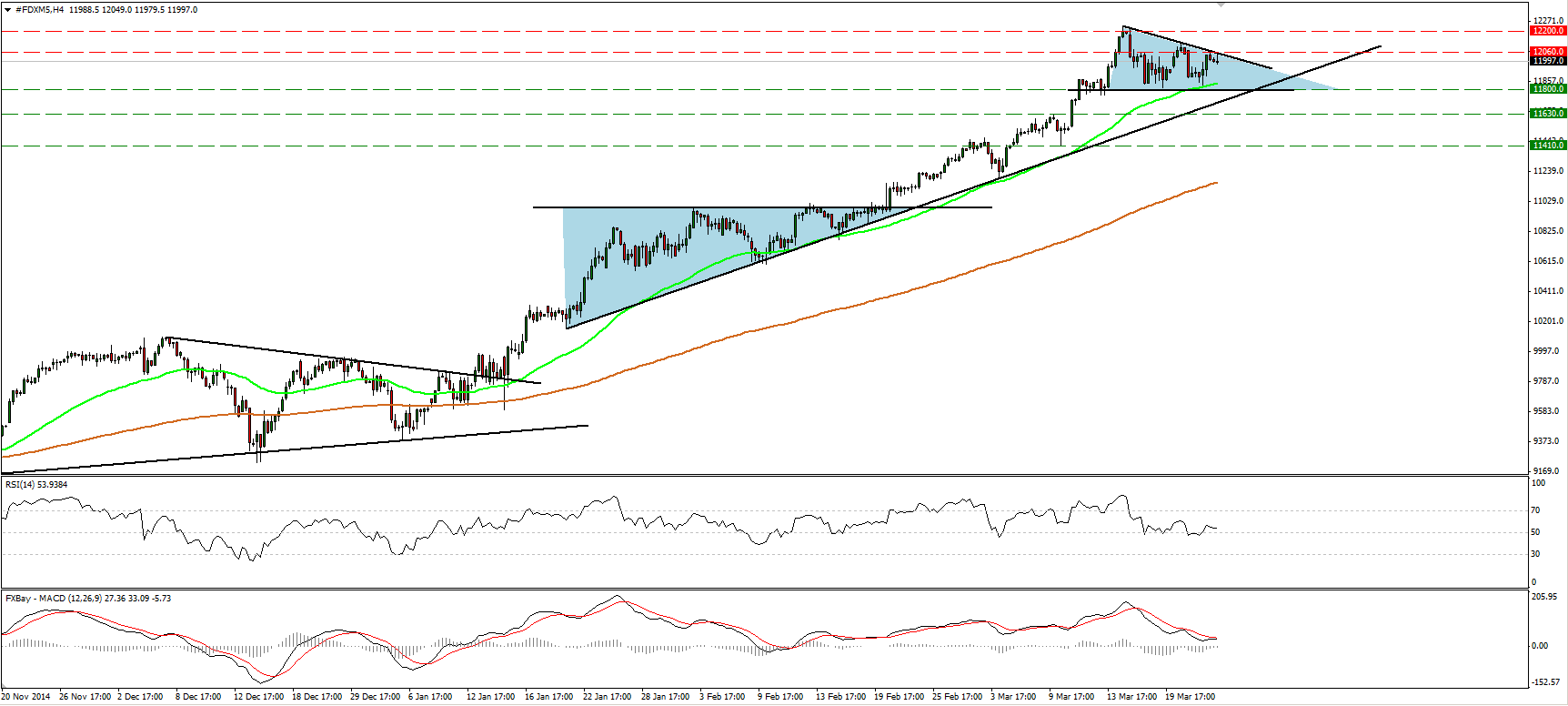

DAX futures

The dollar traded unchanged or lower against its G10 peers during the European morning Wednesday. It was lower against EUR, GBP, NOK and CHF, in that order, while it was stable vs AUD, SEK, JPY, CAD and NZD.

The German Ifo Business climate index rose for the fifth consecutive month in March, driven most likely by the low energy prices. The expectations index also rose, in line with the strong ZEW survey released last week. All three indices were above or in line with their expectations and suggested that the gradual improvement in German business confidence continues. It also suggests that business investment picked up in Q1 and fuels optimism about an economic recovery. The positive developments from low oil prices and a weaker euro will slowly feed through the real economy going forward and will provide further support to domestic sentiment.

Despite the strong data, the bulls were unable to push EUR/USD above 1.10. A clear break of that area is needed for the corrective wave to continue, perhaps towards our 1.1160 resistance line.

DAX futures moved somewhat higher during the European morning Wednesday, but hit resistance at the upper bound of a possible descending triangle formation and pulled back. Given that the price failed to overcome that boundary and remained within the pattern, I would expect the forthcoming wave to be negative and challenge once again the 11800 (S1) key support line, which happens to be the lower line of the aforementioned triangle. However, although I would expect the forthcoming wave to head south, the overall trend remains positive. DAX is trading above both the 50- and the 200-period moving averages, and above the uptrend line taken from the low of the 21st of January. I would get confident on the overall upside path though if, after the pullback, buyers seize control again and force the price to break above the upper bound of the triangle.

Support: 11800 (S1), 11630 (S2), 11410 (S3).

Resistance: 12060 (R1), 12200 (R2) (key resistance near the all-time high).

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.