EUR/GBP

The dollar traded higher against the majority of its G10 counterparts during the European morning Wednesday. It outperformed EUR, NOK, CAD, SEK, and GBP in that order, while it was lower against NZD, AUD, and JPY. The greenback traded virtually unchanged against CHF.

The final service-sector PMIs coming out from the euro-area showed continued improvement in the region. France’s figure came at 53.4 as anticipated, well above January’s print of 49.4, confirming that the outlook of France’s domestic economy have started to brighten. Germany’s final print was below the preliminary estimate but still better than the previous month. These data drove the overall Eurozone number up to 53.7 from 52.7, the highest level since July 2014, before the escalation of the conflict in Ukraine started weighing on the bloc’s economic recovery. Eurozone’s retail sales improved as well.

The recent rebound in Eurozone’s data, especially from Germany, which is recovering its position as the region’s powerhouse, suggest that the ECB is likely to revise up its growth forecast tomorrow at its policy meeting. However, I don’t expect the Bank to do the same with its inflation projections. On the contrary, bearing in mind that Draghi said in December that the forecasts didn’t fully incorporate the drop in oil prices, inflation projections for this year and perhaps next year could be cut. The inflation projections will be important in giving guidance to the extent of the QE program, thus a downside revision could weigh on the common currency, driving it below 1.1100, the lows of the 26th of January. I would expect such a dip to pull the trigger for our next support area of 1.1025.

In the UK, the service-sector PMI declined to 56.7 in February from 57.2, confounding expectations of a rise. Notwithstanding the small slide, the index still points to strong growth. The correction appears normal given the sharp rise in January. Strong growth, rapid employment gains and accelerating core inflation confirm the improving momentum of the UK economy. I would expect the pound to remain supported, especially against the EUR.

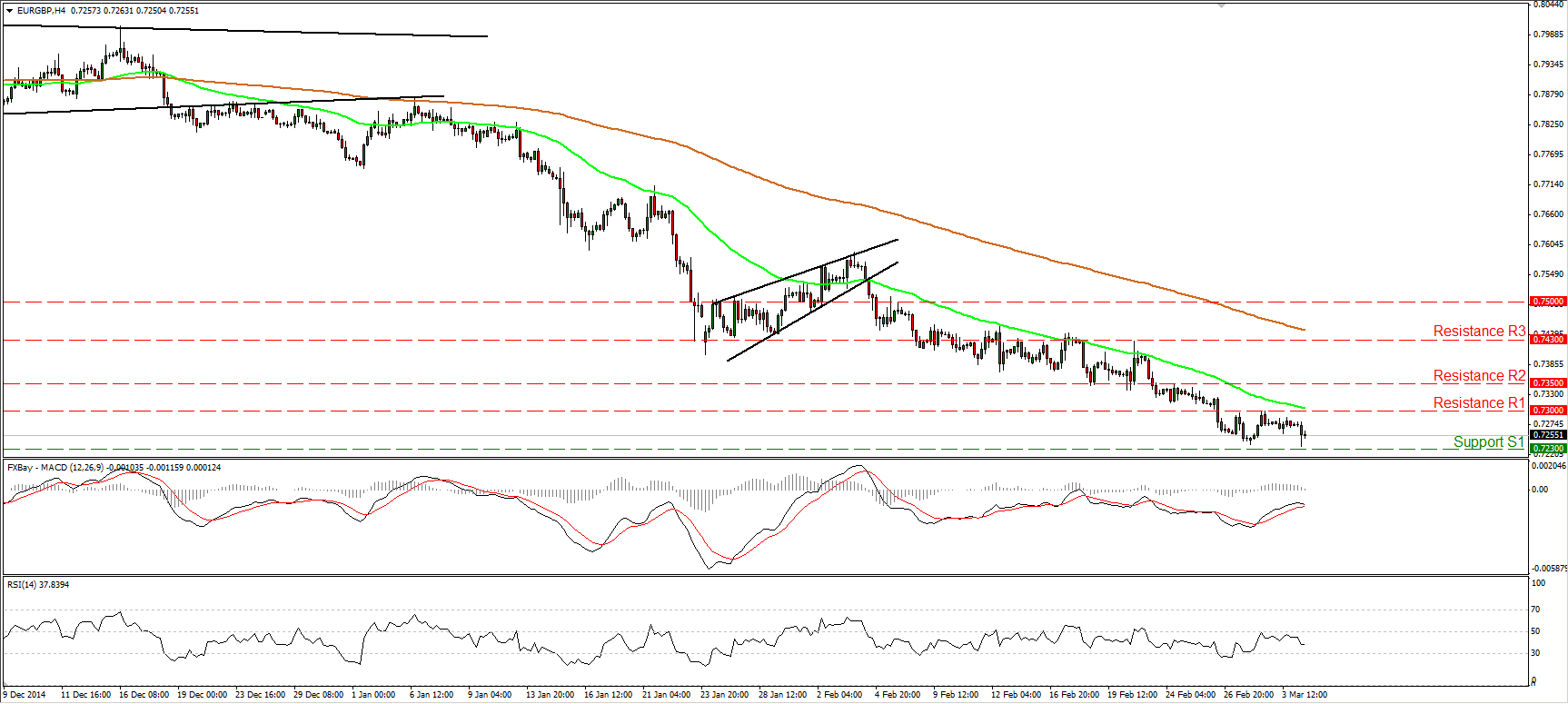

EUR/GBP traded lower after finding resistance at the 0.7300 (R1) line, but the slide was halted once again marginally above the 0.7230 (S1) line, a support defined by the high of the 7th of December 2007. On the 4-hour chart, the price structure still suggest a short-term downtrend, thus I would expect a clear break below the 0.7230 (S1) barrier to set the stage for extensions towards the 0.7100 (S2) territory, marked by the lows of the 3rd and 4th of December 2007. The short-term momentum studies corroborate my view. The RSI turned down after hitting resistance near its 50 line, while the MACD, already negative, shows signs of topping and could cross below its trigger line any time soon. As for the broader trend, the downside exit of the triangle pattern on the 18th of December signaled the continuation of the longer-term downtrend. Since then, the price structure has been lower peaks and lower troughs below both the 50- and the 200-day moving averages, thus I would stay bearish on the overall path of this exchange rate.

Support: 0.7230 (S1), 0.7100 (S2), 0.7025 (S3).

Resistance: 0.7300 (R1), 0.7350 (R2), 0.7430 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.