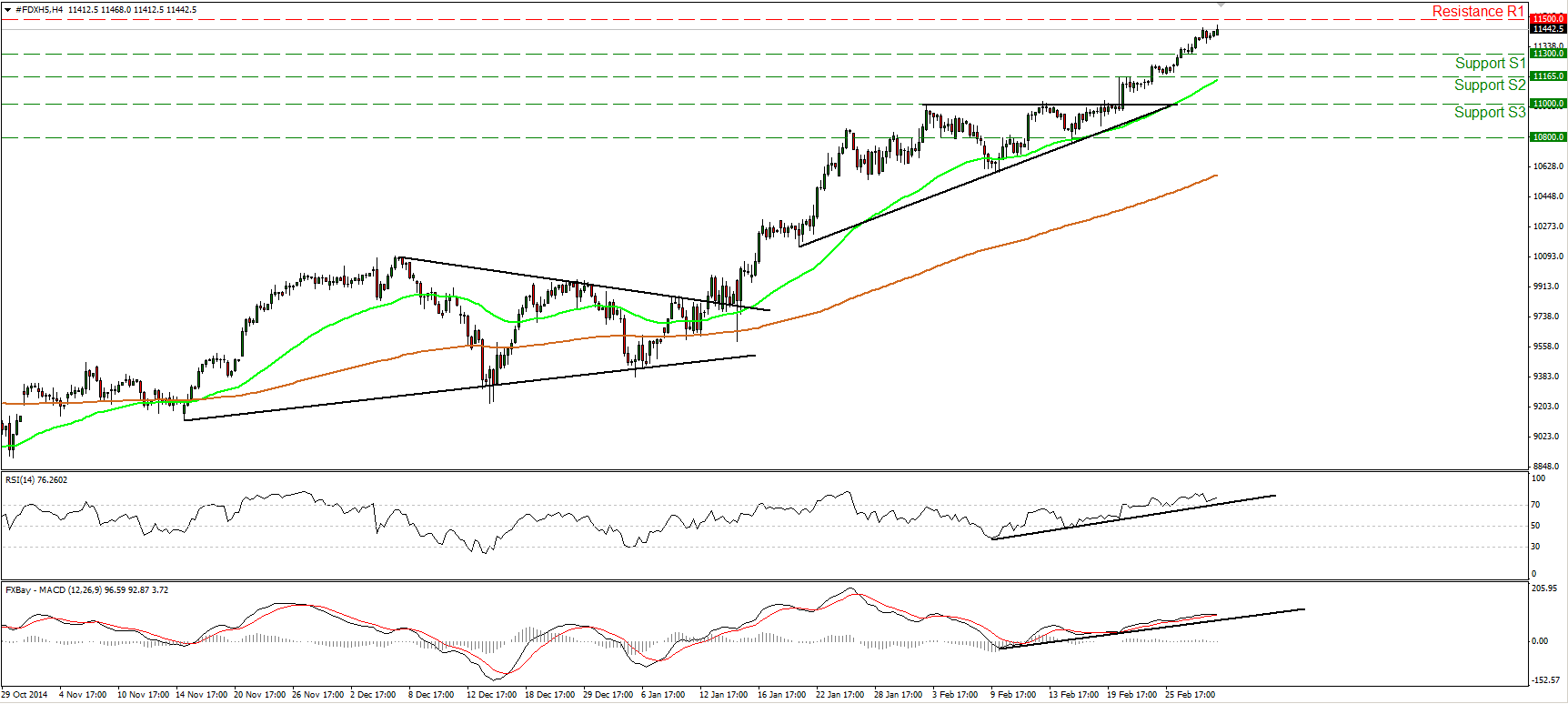

DAX futures

The dollar traded higher against most of its G10 peers during the European morning Tuesday. It was lower against SEK, while it remained unchanged against CAD, JPY and GBP.

The UK construction PMI rose to 60.1 in February, up from 59.1 in January, beating market expectations of a moderate decline to 59.0. As with manufacturing PMI released on Monday, the construction PMI seems to have started 2015 on solid ground and suggests that the UK economy is picking up momentum. If the service-sector PMI, to be released on Wednesday, confirms the improving momentum in Q1, this could strengthen GBP somewhat (particularly against EUR) in the anticipation of strong Q1 GDP growth. I still believe that if EUR/GBP breaks below 0.7230, this will pull the trigger for the 0.7100 zone.

German retail sales rose 2.9% mom in January, an acceleration from +0.6% mom in December, beating forecasts of a deceleration. This was one more piece of encouraging data showing a strong start to the year for German retailers. Low oil prices, the weak euro and low interest rates are among the factors that are likely to support this strength, while risks from Greece and the situation in Ukraine are the potential spoilers of Germany’s recovery. Even though the impact on EUR was limited, the strong German data lifted DAX to a new record level. The recent signs of recovery in the German economy also highlight the good timing of the ECB to announce the QE in January, as it would have faced more resistance inside and outside the Bank otherwise.

DAX futures continued to race higher during the European morning Tuesday to print a new record high at 11468, slightly below the psychological figure of 11500 (R1). The price structure still suggests an uptrend above both the 50- and 200- period moving averages. Both the moving averages are pointing north, adding to the trend’s health. The strength of the trend is also visible in our near-term momentum studies. The RSI stays above 70, pointing up, while the MACD continues higher in its positive field, above its trigger line. As a result, I would expect the index to keep rising and perhaps even break through the psychological barrier of 11500 (R1). Nevertheless, zooming on the 1-hour chart, I see negative divergence between both the hourly oscillators and the price action. This makes me cautious that a minor pull back may occur before the next shoot up.

Support: 11300 (S1), 11165 (S2), 11000 (S3).

Resistance: 11500 (R1) (psychological barrier above the record high).

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.