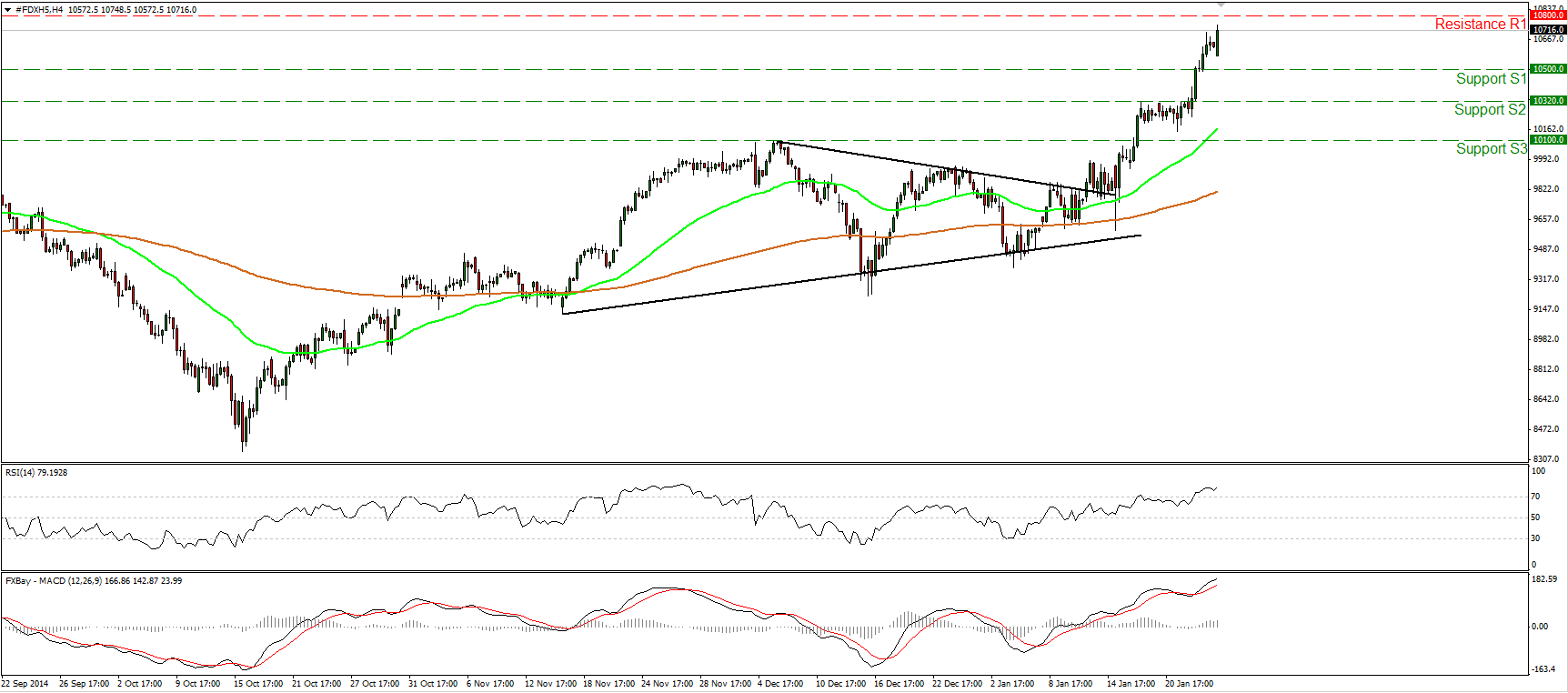

DAX futures

The dollar traded lower against most of its G10 peers during the European morning Monday. It was higher against CHF and JPY, in that order, while it was stable against CAD.

The German Ifo Business climate index rose for the third consecutive month in January, driven probably by low oil prices and anticipation of the ECB’s QE program. The expectations index also rose in line with the strong ZEW survey released last Wednesday. The overall increase in the Ifo indices suggest that German business investment could pick up in Q1 and lift optimism about an economic recovery. Today’s rise can be seen as an optimistic sign added to the recent encouraging German data, although the indices remain below last year’s level.

Greece’s SYRIZA party gained the backing they needed and formed a governing coalition with the right-wing party Greek Independents. The coalition will have a comfortable majority as SYRIZA with 149 MPs and ANEL (Independent Greeks) with 13 MPs have the majority in the 300-seat parliament. Although it is an alliance between two ideologically opposed parties who share only their opposition to the bailout, it boosted the stock market across the Europe as fears of a second election had disappeared. SYRIZA’s coalition with ANEL, which sits with the British Conservative Party in the European Parliament, also ameliorated somewhat the fears that their win would result in a lurch to the left throughout Europe – as symbolized by the presence of the leader of Spain’s Podemos Party, Pablo Iglesias, on the podium with SYRIZA’s Alexis Tsipras (see photo). The boost could also be attributed to investors’ hopes that a compromise over Greece’s bailout terms may be found at the regular Ecofin meeting later in the day. EUR/USD recovered a bit on these developments but stayed below our 1.1315 resistance line.

DAX futures continued to race higher during the European morning Monday, as Syriza’s victory in Greek elections failed to derail the surge in European stock markets (the only exception was FTSE 100) driven by ECB’s QE announcement. The index is trading well above the psychological area of 10500 (S1), and now appears able to challenge 10800 (R1), the 1st price objective of the triangle formation. As long as the price structure stays higher highs and higher lows, I would consider the near-term bias to remain positive and I would expect a clear move above 10800 (R1) to open the way for the next psychological area of 11000 (R2). Our daily momentum studies detect strong upside momentum and support the continuation of the uptrend. The 14-day RSI entered its overbought territory and is pointing up, while the MACD, already above both its zero and signal lines, accelerated higher.

Support: 10500 (S1), 10320 (S2), 10100 (S3).

Resistance: 10800 (R1) 11000 (R2).

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.