GBP/JPY

The dollar trade mixed against its major counterparts during the European morning Wednesday. It was higher against NZD, AUD and GBP, in that order, while it was lower against CHF, NOK, SEK and JPY. The greenback was stable vs EUR and CAD.

The Bank of England policy meeting minutes revealed that the policy makers are no longer divided over policy. The MPC members voted unanimously to keep rates on hold, after the two policymakers who since August had been voting for a rate hike dropped their call in the face of falling inflation. They switched their stance because they now believe there is a risk that below-target inflation may persist. The UK CPI rate declined to +0.5% yoy in December and could even turn negative in the coming months, pulled mainly by lower oil prices and also lower inflation feeding through to lower wage settlements, helping to depress price increases further. Even though the central bank saw no need for further stimulus and still plans to raise rates within the foreseeable future, expectations are getting pushed back even further, leaving GBP vulnerable, in our view.

At the same time, the UK unemployment rate declined to 5.8% in November from 6.0% previously and average weekly earnings including bonuses rose 1.7% yoy, up from +1.4% yoy in October. Wage growth outpaced inflation and suggested less slack in the labor market. Normally this would strengthen GBP, but given the switch in MPC votes, GBP/USD plunged to find buy orders near our 1.5075 support line, while EUR/GBP firmed up to find resistance near 0.7700. We could view the surge in EUR/GBP short-lived given the Eurozone’s weaker fundamentals, as for Cable we would wait for a break below 1.5000 to get confident for further declines.

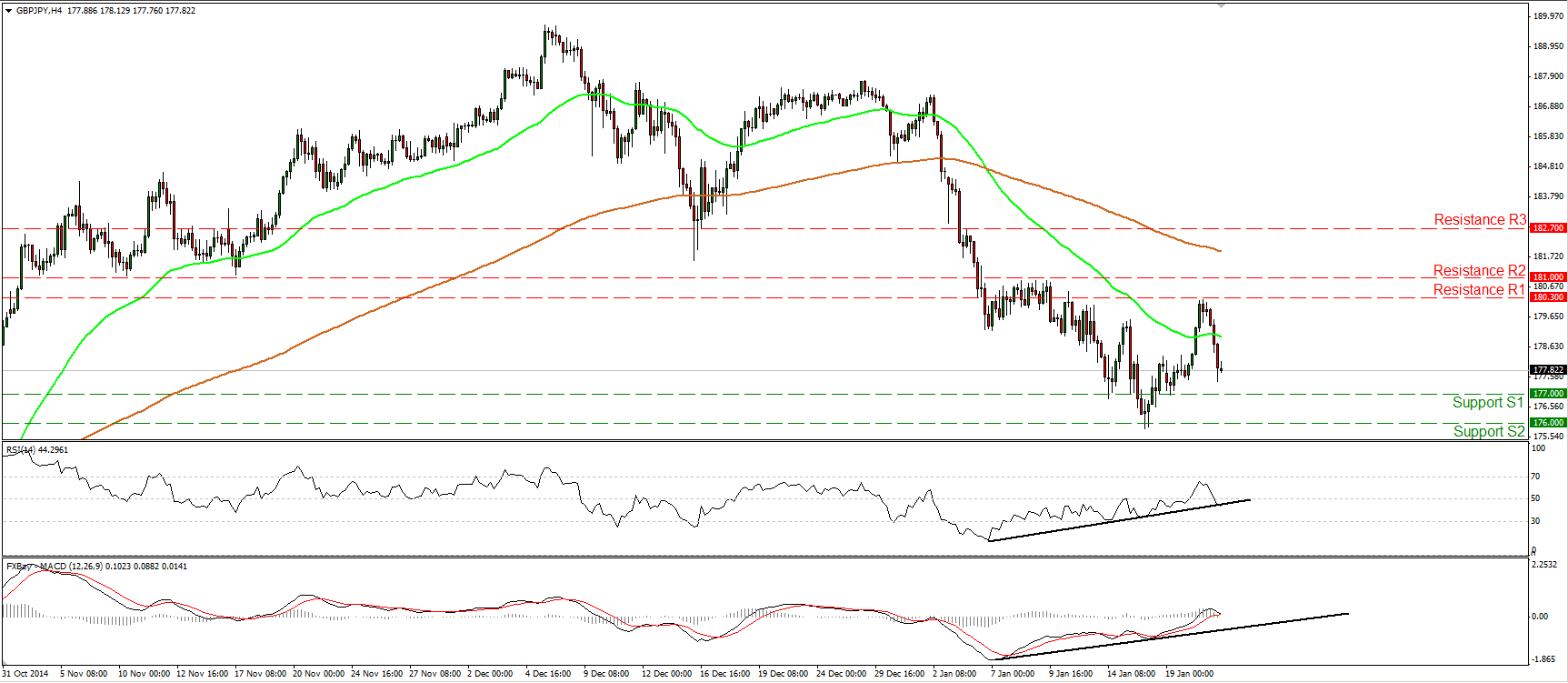

GBP/JPY fell sharply after hitting resistance around 180.30 (R1). At midday in Europe, the rate is heading towards our support barrier of 177.00 (S1), where a break could challenge again the 176.00 (S2) line. The RSI fell below its 50 line and could now move below its black upside support line, while the MACD has topped and could move below both its zero and signal lines any time soon. These signs confirm today’s negative momentum and support the case for further declines in the short term. On the daily chart, the picture stays cautiously negative. I would like to see a move below the 176.00 (S2) area and the 200-day moving average before trusting that medium term down path again. It is worth noting that the 176.00 (S2) area coincides with the 61.8% retracement level of the 15th of October – 5th of December rally and also with the 161.8% extension level of the width of a failure swing top completed on the 6th of January.

Support: 177.00 (S1), 176.00 (S2), 174.60 (S3)

Resistance: 180.30 (R1), 181.00 (R2), 182.70 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.