EUR/GBP

The dollar traded lower against almost all of its G10 peers during the European morning Tuesday. It was stable only vs JPY and CAD.

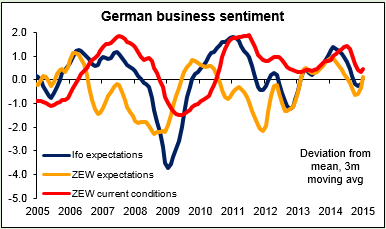

EUR/USD started strengthening well before the German ZEW survey for January, but in the event, lost much of the gains despite the strong reading, only to find some buy orders around 1.1590 that lifted it back up again. Both the current situation and expectation indices surged for the 3rd consecutive time, beating the market consensus. The expectations index rose to 48.4 from 31.8, while the current situation ticked up to 22.4 from 10.0. Even though this will not be enough to reverse the negative sentiment towards EUR, it could favor the continuation of the upside corrective wave, which could challenge the resistance of 1.1650 in the near future.

On Wednesday we get the minutes from the latest BoE meeting. The focus will be on the number and the names of the dissenters, especially following the fall in December’s CPI rate below 1% and the comments by the BoE Gov. Carney that lower oil prices are positive for the UK. On top of that, the UK unemployment rate is expected to have declined while average weekly earnings are anticipated to accelerate, suggesting less slack in the labor market. Overall this could be GBP-supportive and the better fundamentals compared to Eurozone could push EUR/GBP further down.

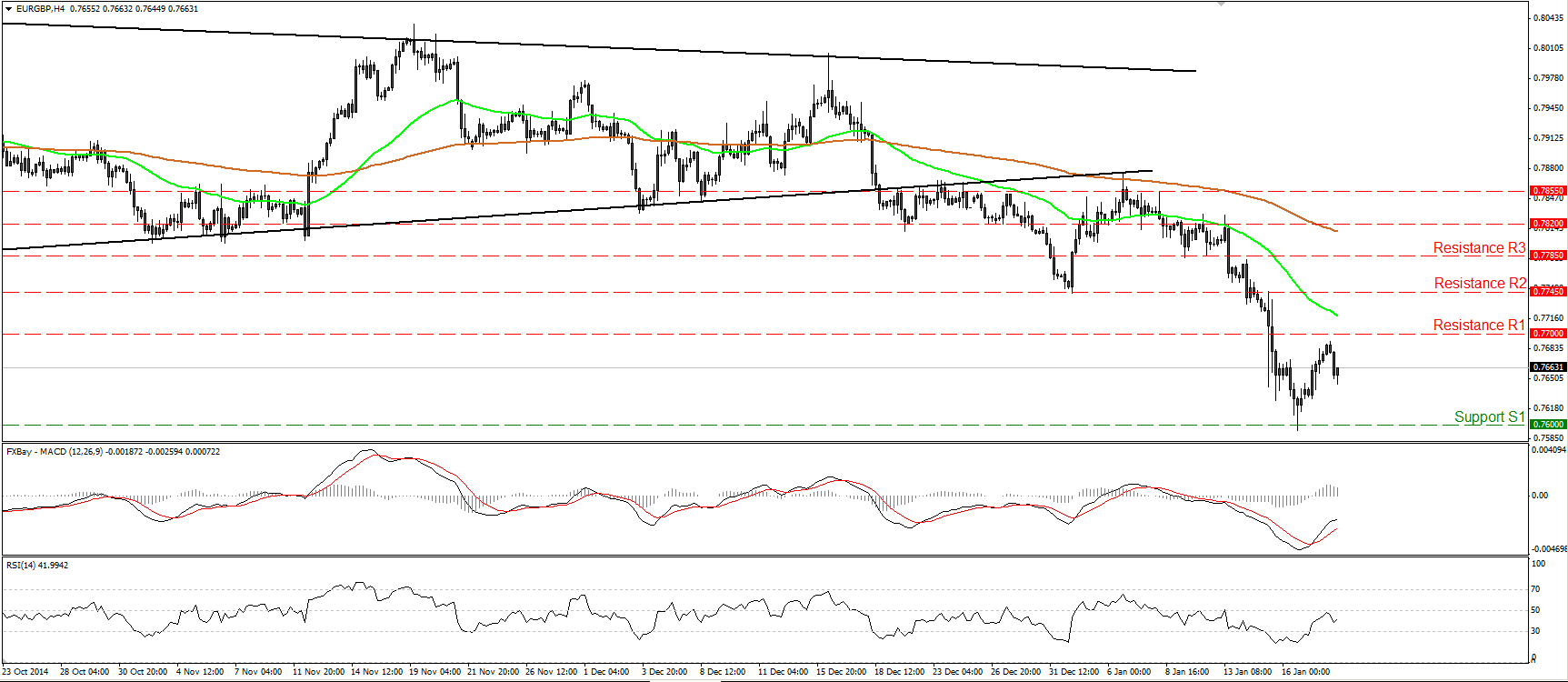

EUR/GBP slid during the European morning Tuesday after finding resistance slightly below the key line of 0.7700 (R1). That move confirmed a lower high on the 4-hour chart. Thus I would expect the decline to continue and perhaps challenge again the support zone of 0.7600 (S1). Our short-term momentum studies corroborate my view. The RSI moved lower after hitting resistance at its 50 line, while the MACD, already negative, shows signs of topping. This shows that the price could regain its downside momentum in the close future. As for the bigger picture, the downside exit of the triangle pattern on the 18th of December signaled the continuation of the longer-term downtrend, thus the overall outlook stays negative in my view.

Support: 0.7600 (S1), 0.7500 (S2), 0.7415 (S3).

Resistance: 0.7700 (R1), 0.7745 (R2), 0.7785 (R3).

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.