USD/NOK

The dollar traded higher against almost all its G10 counterparts during the European morning Thursday. It was lower only against SEK, while it was virtually unchanged against CHF. The main losers were NOK, AUD and JPY in that order.

The Norwegian Krone collapsed after the Norges Bank unexpectedly decided to lower its key policy rate by 0.25bps to 1.25%. In the statement following the decision, the Bank noted that the growth prospects for the Norwegian economy have weakened and that the sharp fall in oil prices is likely to amplify this tendency. The Bank now sees its key rate at present or lower levels till the end of 2016.

Besides the Norges Bank, the Swiss National Bank held its policy meeting today as well. The SNB left its rate target range unchanged at 0.00-0.25% and maintained its minimum exchange rate of CHF 1.20 per EUR. In its statement, the Bank said that deflation risks have increased once again and that the Swiss franc is still high. Consequently, the SNB said that it will continue to enforce the EUR/CHF floor and repeated that for this purpose it is prepared to purchase foreign currencies in unlimited quantities and that it will take further measures if necessary. SNB’s Governor Jordan said that officials do not rule out the use of negative interest rates.

The results of ECB’s second TLTRO showed that the Bank allotted EUR 130bn, near the low end of analysts estimate range. This is likely to fuel the debate among ECB officials on whether current measures are enough, or if the Bank has to embark on large quantitative easing. EUR/USD declined about 25 pips on the announcement.

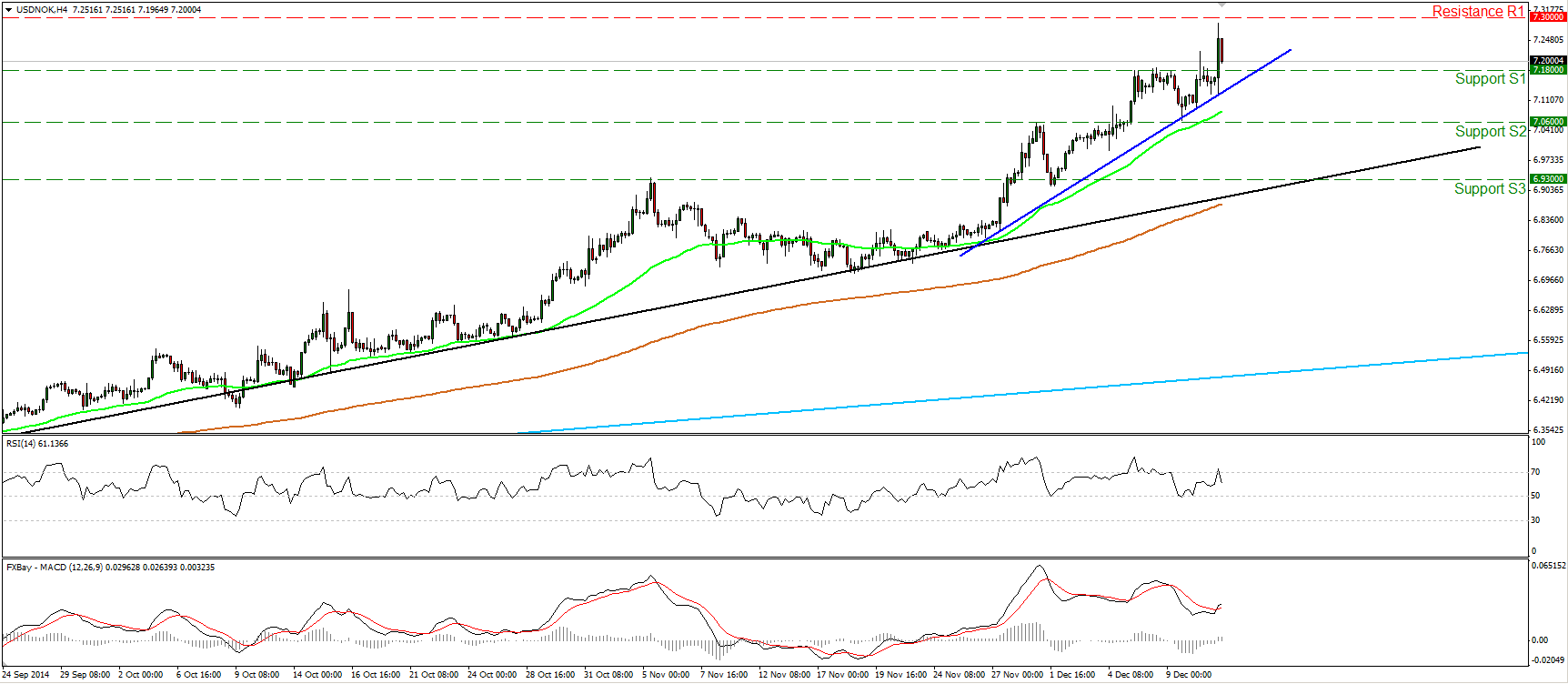

USD/NOK surged after the unexpected decision of the Norges Bank. The rate shot up but failed to reach the 7.3000 (R1) resistance area, which offered strong resistance to the pair from October 2008 until March 2009. However, on the daily chart the price structure still suggests an uptrend. Hence, although we may experience a pullback after the steep rally, I would expect the bulls to eventually reach the aforementioned key resistance zone. Our daily technical indicators complete the positive picture of USD/NOK. The 14-day RSI stays within its overbought zone and is pointing up, while the daily MACD stands above both its zero and trigger lines, also pointing north. A decisive close above the key hurdle area of 7.3000 (R1) is likely to set the stage for larger bullish extensions, perhaps towards the next resistance zone of 7.4250 (R2), defined by the highs of the 16th and 17th of September 2003.

Support: 7.1800 (S1), 7.0600 (S2), 6.9300 (S3)

Resistance: 7.3000 (R1), 7.4250 (R2), 7.4700 (R3)

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.