USD/NOK

The dollar traded unchanged against most of its G10 peers during the European morning Friday, ahead of the US nonfarm payrolls for November. It was higher against NOK, JPY and SEK, in that order, while it was lower only against GBP.

The Swedish krona fell after the country’s industrial production fell short of expectations and disappointed the market. Sweden’s industrial production rose 0.2% mom in October, a turnaround from -1.1% mom in September, but below the forecast of a rise of 0.5% mom. USD/SEK surged approximately 0.30% to find resistance near the 7.560 area. On top of the Riksbank’s recent rate cut to zero and the high possibilities for further stimulus due to the weakening fundamentals, I would expect these to weigh on the currency and increase selling pressure on SEK.

Norway’s industrial production decelerated to +1.4% mom in October, from a downwardly revised +3.6% mom previously, weakening the Norwegian krone. USD/NOK firmed up approximately 1% in the first hour following the release, as it put some pressure on the Norges bank to take action in response to the falling oil prices. Since currently prevailing oil prices could weaken even more, I could see NOK to weaken further.

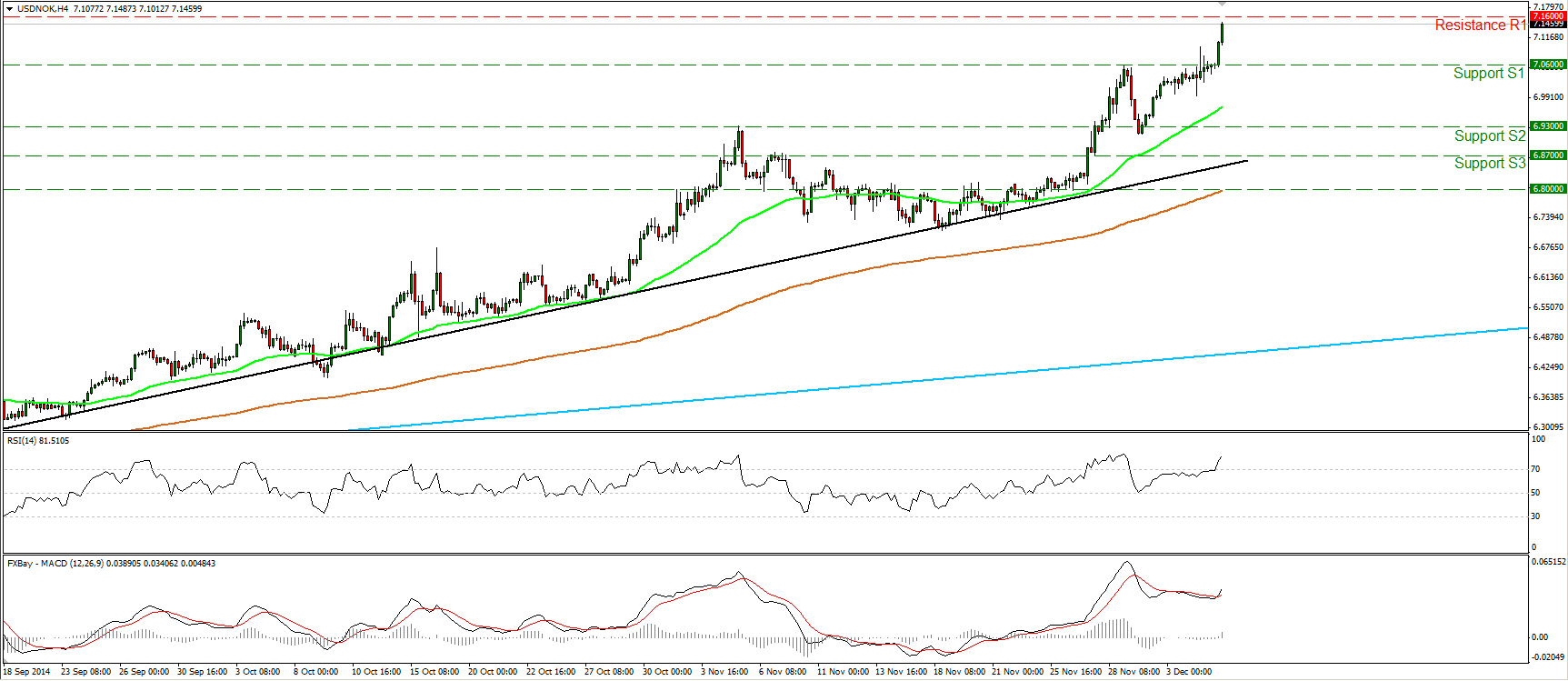

USD/NOK surged on Friday breaking above the resistance (turned into support line) of 7.0600 (S1). At midday in Europe, it is approaching the resistance hurdle of 7.1600 (R1), determined by the highs of the 9th and 10th of March 2009. Taking a look at our short-term momentum studies, I believe that the rate has the necessary momentum to breach that barrier. The RSI moved above its 70 line and is pointing up, while the MACD, already positive, crossed above its trigger line. These signs designate accelerating bullish momentum and enlarge the case for further rise in the close future, in my view. A clear move above the 7.1600 (R1) barrier is likely to pull the trigger for the well-tested zone of 7.3000 (R2). It is worth mentioning that the 7.3000 (R2) area offered strong resistance from October 2008 until March 2009. That area was tested 6 times during the aforementioned period. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I would consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 7.0600 (S1), 6.9300 (S2), 6.8700 (S3) .

Resistance: 7.1600 (R1), 7.3000 (R2), 7.4000 (R3).

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.