USD/NOK

The dollar traded unchanged against most of its G10 counterparts during the European morning Wednesday, except AUD and NOK, where it was higher.

The 2nd estimate of UK Q3 GDP came in as expected at 0.7% qoq, unchanged from the initial estimate. Growth in the service sector was revised up but industrial production was revised down, adding to evidence that the recovery was less balanced than previously thought. GBP strengthened ahead of the GDP release but weakened afterwards to trade unchanged against the dollar. The growth report was not so encouraging and is likely to leave GBP vulnerable, especially if the US data to be released later in the day beat expectations.

The Norwegian krone depreciated after the country’s AKU unemployment rate for September failed to decline as the official unemployment figure did for the same month. Another reason for the increased pressure on NOK is the cautious mood of investors before the OPEC meeting on Thursday. Since Norway is the largest oil producer and exporter in Western Europe, the country’s currency could weaken further if the meeting ends without a consensus to stabilize oil market.

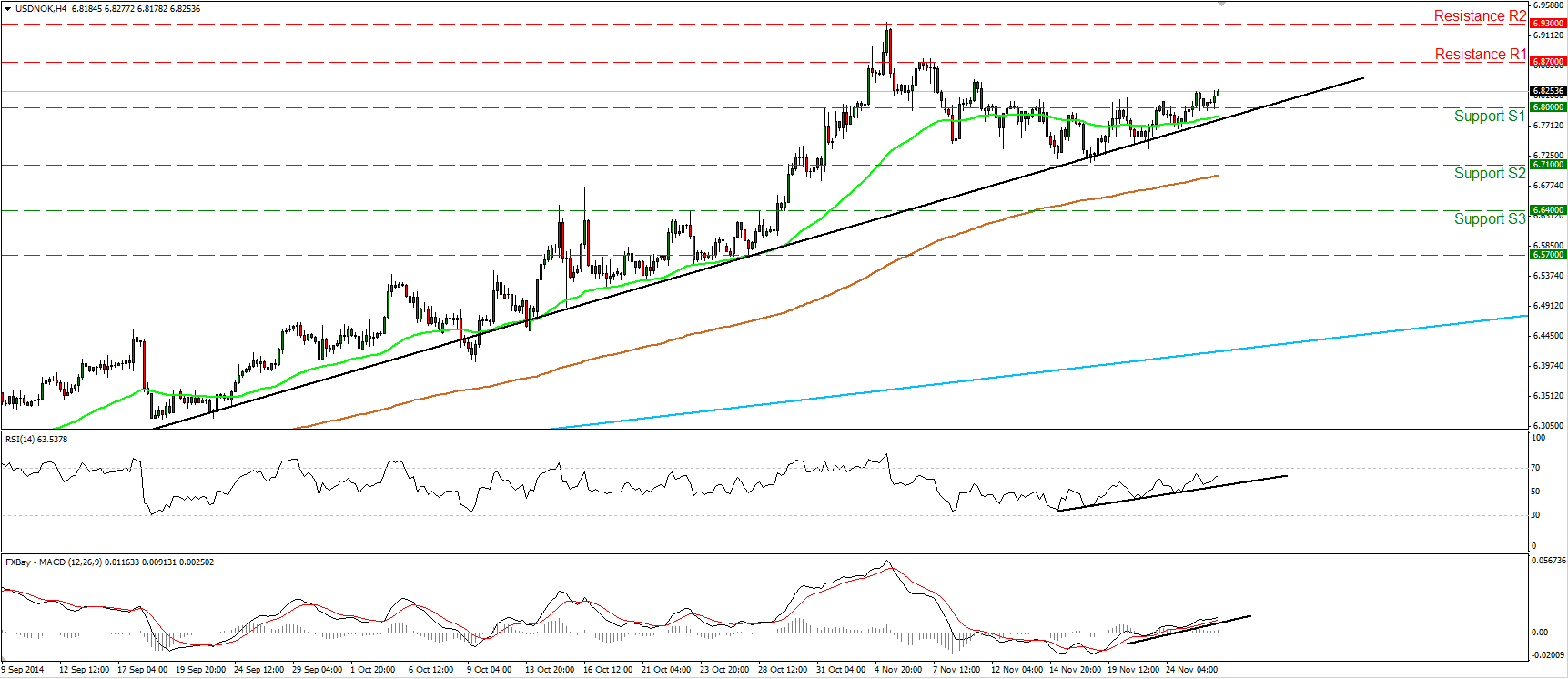

USD/NOK moved higher during the European morning after finding support near 6.8000 (S1). I would now expect the rebound to target the resistance zone of 6.8700 (R1). A clear break above that hurdle is likely to extend the bullish wave, perhaps towards the next resistance zone, at 6.9300 (R2), determined by the high of the 5th of November. Our short-term oscillators support this scenario. Both of them follow upside paths as marked by their upside support lines. Moreover, the RSI rebounded from slightly above its 50 line and edged higher, while the MACD stands above both its zero and signal lines. As long as the rate is trading above the black uptrend line drawn from the low of the 3rd of September, I consider the near-term picture to remain positive. On the daily chart, USD/NOK stands above the 50- and the 200-day moving averages and well above a longer-term uptrend line taken from back at the low of the 8th of March. This confirms that the overall outlook of the pair is to the upside.

Support: 6.8000 (S1), 6.7100 (S2), 6.6400 (S3) .

Resistance: 6.8700 (R1), 6.9300 (R2), 7.0000 (R3).

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.