USD/CAD

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against EUR, CHF, SEK and GBP, in that order, while it was lower against AUD, NZD and CAD. The greenback was stable vs JPY and NOK.

“A stronger recovery is unlikely in the coming months” said ECB President Mario Draghi in an opening speech at the Frankfurt European Banking Congress. The ECB President stressed the importance to bring inflation back to target without delays as fast as possible. He also mentioned that monetary policy can and will do its part to achieve the inflation target and if its current policy is not effective enough or further risks to the inflation outlook materialize, the Bank will broaden the channels through which it intervenes by altering the size, pace and composition of their purchases. EUR/USD fell below 1.2500 at these comments and break below our support-turned-into-resistance of 1.2440. The move below that line could trigger further extensions towards the psychological line of 1.2400.

The People’s Bank of China cut its benchmark interest rates in response to a slowing domestic and global economy. The AUD and NZD that heavily depend on trade with China, surged approximately 1% each against the dollar. The Canadian dollar, also a commodity currency surged by the unexpected move due to expectations that the rate cut will spur demand and boost China’s economy.

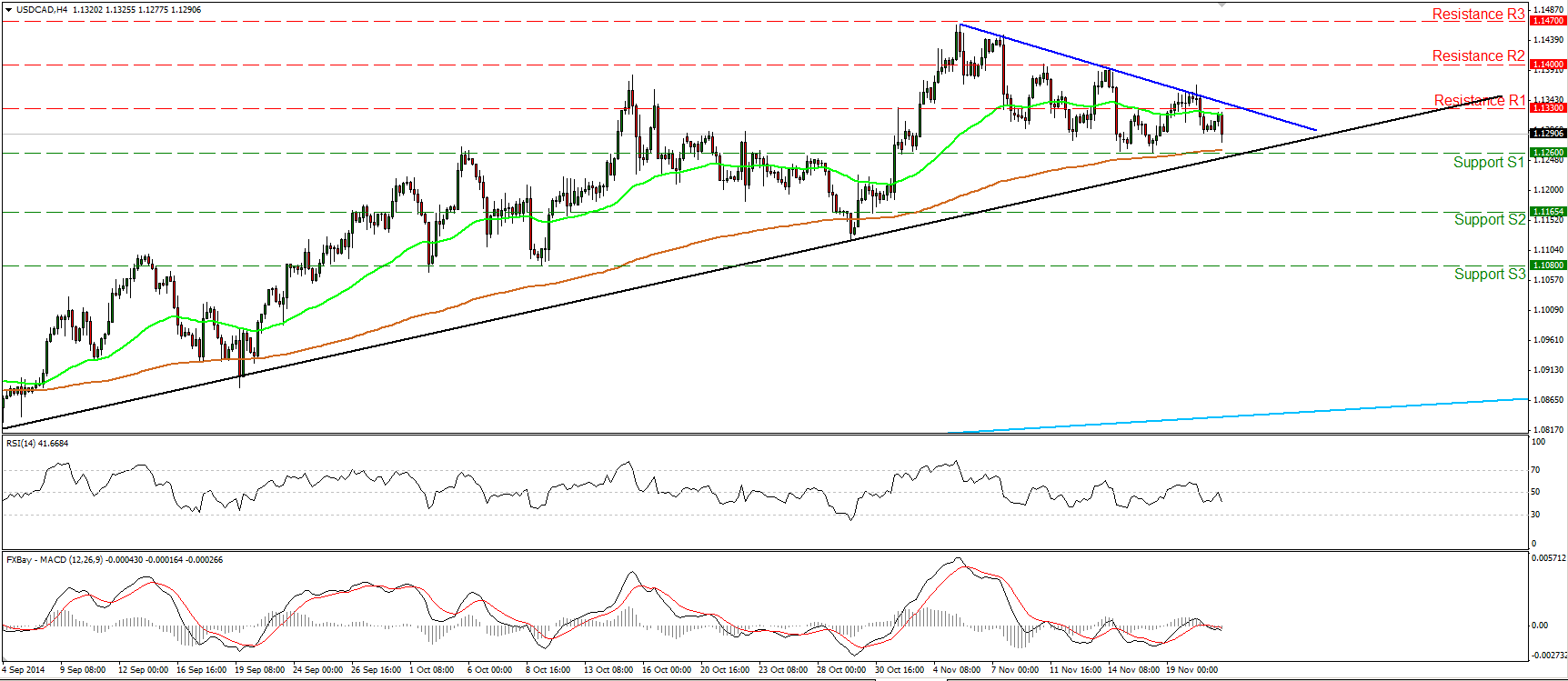

USD/CAD slid during the European morning Friday, after finding resistance near 1.1330 (R1). The pair is now approaching the 200-period moving average, which lies near the support barrier of 1.1260 (S1) and near the black uptrend line taken from back the low of the 4th of September. Later in the day we get Canada’s CPI rate for October which is expected to remain at 2%, the BoC’s target. This could push the pair below that critical support zone and perhaps open the way towards the next support line, at 1.1165 (S2). Our near-term momentum studies support the notion. The RSI moved lower after finding resistance at its 50 line, while the MACD has topped slightly above zero, turned negative and crossed below its trigger line. However, as far as the broader trend is concerned, USD/CAD is still printing higher highs and higher lows above the long-term light blue line taken from back at the lows of September 2012, As a result, I believe that the long-term path of this pair is still to the upside and I would see any near-tern declines as a corrective phase at the time being.

Support: 1.1260 (S1), 1.1165 (S2), 1.1080 (S3) .

Resistance: 1.1330 (R1), 1.1400 (R2), 1.1470 (R3) .

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.