Copper futures

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against NOK, AUD, NZD, SEK and CAD, in that order, while it was lower against JPY and GBP. The greenback was virtually unchanged against EUR and CHF.

Copper futures fell sharply on Thursday, as the commodity fraud at China’s Qingdao port hit bank financing of the metal, and as a result China, the world’s largest consumer of the metal, may have to cut its copper imports. On top of that, Wednesday’s unexpected drop in core US retail sales and the decline in the country’s PPI raised concerns whether the US recovery is on a stable path. The last time copper prices plunged with such strength was in March, amid fears about future demand from China. This time, investors are facing the possibility of lower demand in the US as well as in China. Since two of the main copper importers seems to encounter uncertain future demand for the metal, I would expect the price of the metal to decline even more.

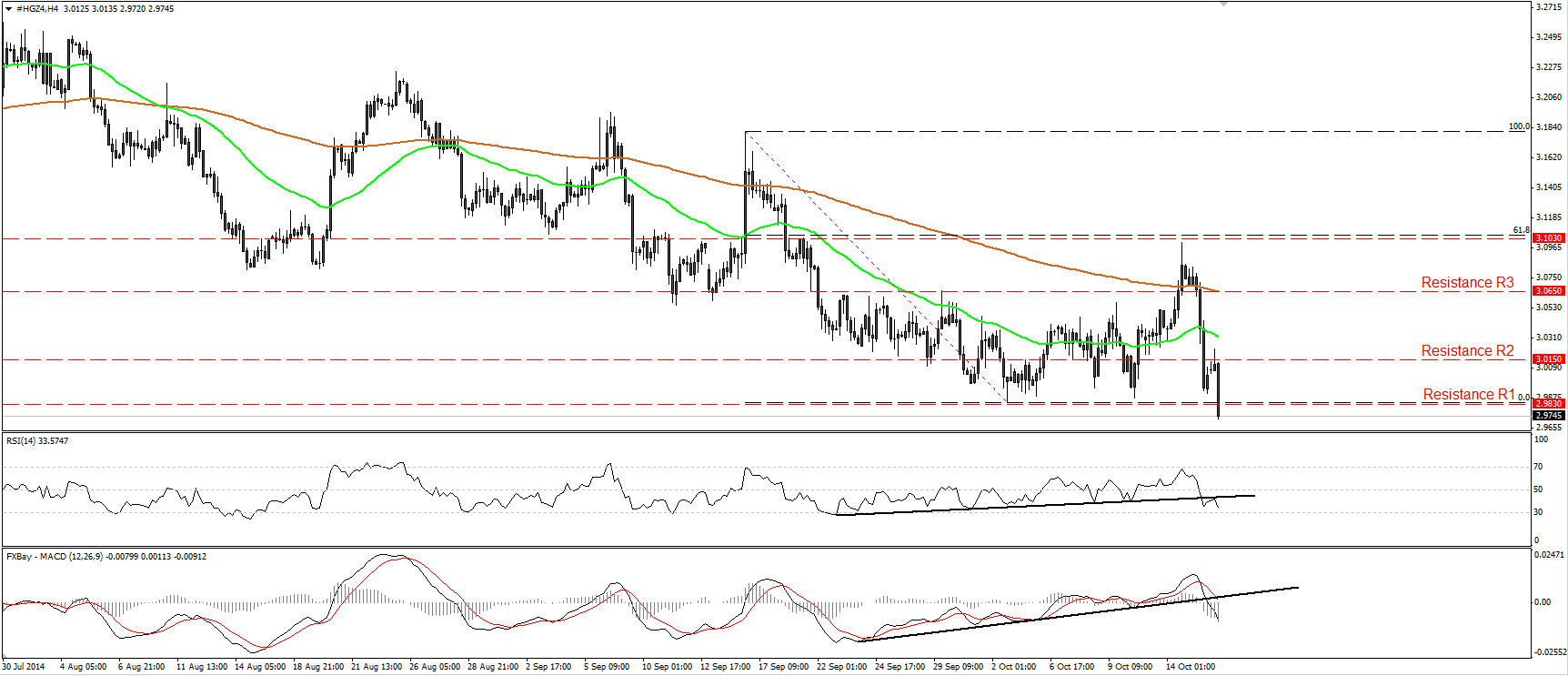

Copper futures started tumbling sharply after finding resistance near the 3.1030 line, which lies fractionally below the 61.8% retracement level of the 16th September – 2nd October decline. Today, during the European morning, the metal moved below the key support barrier (turned into resistance) of 2.9830 (R1). I would now expect the price to challenge the next hurdle, at 2.9600 (S1). Bearing in mind our short-term oscillators, I believe that the price has the necessary momentum to challenge that line. The RSI moved lower after finding resistance at its prior upside support line, while the MACD, already below its trigger, fell below its black support line and also obtained a negative sign. On the daily chart, the price structure suggests a downtrend, thus I would consider the overall picture of copper to be negative. Further declines, below the 2.9600 (S1) obstacle, are likely to see scope for larger bearish extensions, perhaps towards the 2.9200 (S2) area.

Support: 2.9600 (S1), 2.9200 (S2), 2.8750 (S3)

Resistance: 2.9830 (R1), 3.0150 (R2), 3.0650 (R3)

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.