USD/NOK

The dollar traded higher against almost all of its G10 peers during the European morning Tuesday. It was lower only against NOK.

The euro plunged against the dollar after the Eurozone’s CPI slowed to +0.3% yoy in September, its lowest level since November 2009. Core CPI also slowed, showing that this was not due only to lower oil and other commodity prices. The unemployment rate remained unchanged in August as was broadly expected. With only two days before the ECB meeting, the data shows that the risk of deflation remains in the Eurozone. The impact of the recent measures from the ECB are yet to be reflected in the data and the economy will take more time to respond to them.

The Norwegian krone was the only gainer against the dollar after the country’s central bank announced that it will start selling foreign exchange equivalent to NOK 250 mln per day in October. Norway will start for the first time to convert some of the oil revenue it gets in foreign currency into NOK to cover increasing budget needs. On top of that, the nation’s retail sales excluding volatile items rebounded in August. Nevertheless, the need to convert oil revenues to cover budget needs raises concerns about the country’s finances.

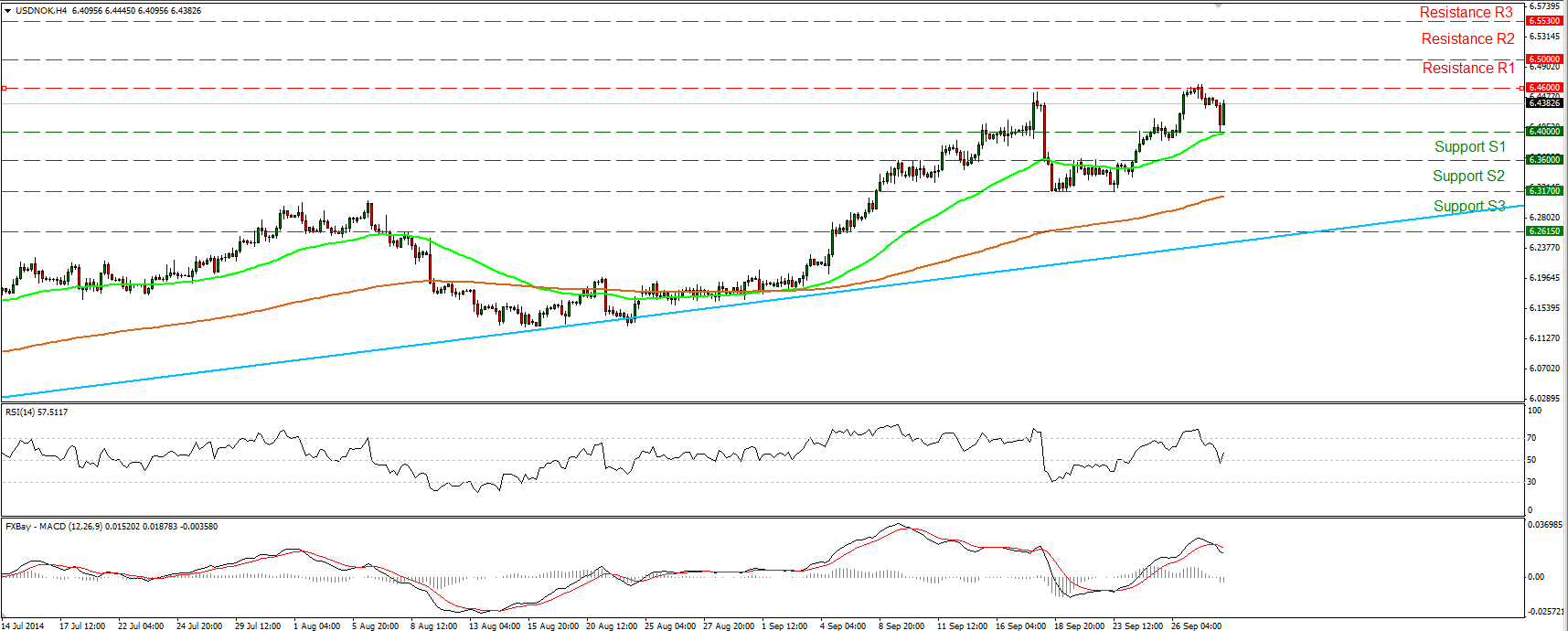

USD/NOK moved lower after it failed to break the 6.4600 (R1) resistance level but bounced back once it found support at the 6.4000 (S1) zone. A break above the 6.4600 (R1) level could trigger a bullish extension towards the psychological line of 6.5000 (R2), on the other hand, the failure once again to break up from this level raises some doubts. On the daily chart, I still see a longer-term uptrend from a technical view. The rate is printing higher highs and higher lows above the light blue uptrend line drawn from back at the low of the 8th of May.

Support: 6.4000 (S1), 6.3600 (S2), 6.3170 (S3) .

Resistance: 6.4600 (R1), 6.5000 (R2), 6.5530 (R3) .

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.