USD/CAD

The dollar traded mixed against its G10 counterparts during the European morning Wednesday. It was higher against CHF and SEK, in that order, while it was lower against CAD and GBP. The greenback remained unchanged vs JPY, NZD, EUR, AUD and NOK.

The minutes of the Swedish Riksbank September meeting revealed that a number of policy members emphasized that easier policy remains an option. Karolina Ekholm, one of six executive board members, said that as inflation remains low there are still reasons for attaching a higher probability to repo-rate cut than a repo-rate increase in the near term. The current rate path indicates a first increase towards the end of 2015. The Swedish krona strengthened slightly at the release but gave back all the gains and retreated even more in the following minutes. The dovish tone of the statement supports our view that SEK could weaken further in the near future.

The British pound weakened even though the minutes of the Bank of England latest policy meeting showed that the same two members voted for a second month for a 25bps rate increase despite the Scottish referendum. At the same time, the unemployment rate fell to 6.2% in July and although average weekly earnings accelerated, the real wages are still falling. But perhaps more important was that the several polls on Scottish independence released this morning showed a small lead for the “no” camp, albeit one generally within the margin of error. The bet makers are even more confident: “no” is now a 2-9 favorite, while a “yes” vote is 19-5. Net net, sterling kept above its early morning levels.

The Canadian dollar rallied after Bank of Canada Governor Stephen Poloz Tuesday said that they are cautiously optimistic about the future for exports and acknowledged early signs of recovery. He also repeated that the central bank does not try to manipulate the value of the Canadian currency. However, as the US economy appears to be back on track and the FOMC members are expected to revise their forecasts later in the day and discuss about the timing of the rate hike, USD/CAD could move up if the news proves USD-supportive.

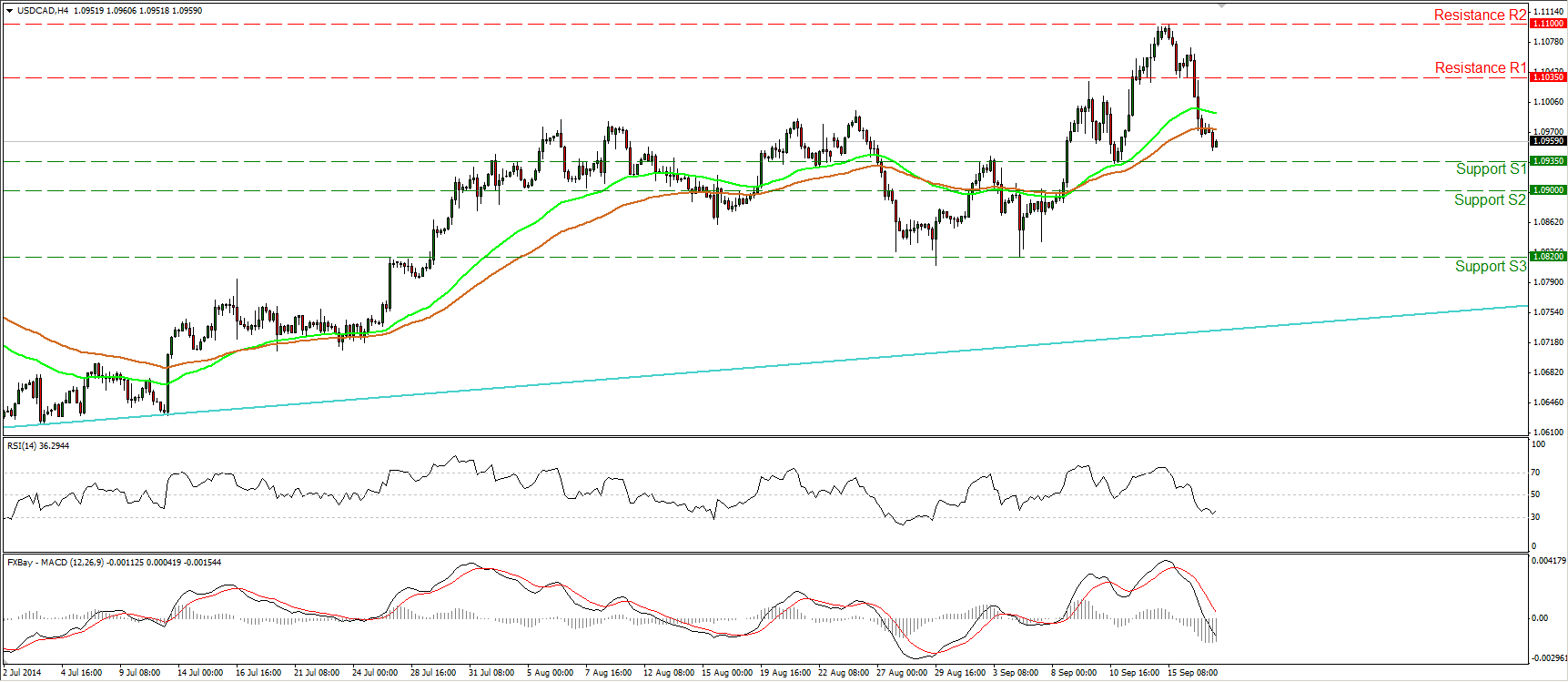

USD/CAD is now back below 1.1000, slightly above the support of 1.0935 (S1) determined by the low of the 11th of September. A further dip below that barrier is likely to challenge our next support line at 1.0900 (S2). On the daily chart I see a bearish harami candlestick pattern that favors the continuation of the down wave. However on the longer-term timeframes, I still see a major uptrend, marked by the light blue trend line, connecting the lows on the weekly chart from back the beginning of September 2012. As a result I would consider the recent declines as corrective move of the larger trend and I believe that any future setbacks are likely to provide renewed buying opportunities. Indeed, the fundamentals also support the notion, since the Fed has already started considering its first rate hike while the BoC remains neutral and seems to be waiting for more evidence to confirm that the recovery is sustainable.

Support: 1.0935 (S1), 1.0900 (S2), 1.0820 (S3).

Resistance: 1.1035 (R1), 1.1100 (R2), 1.1200 (R3).

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.